Regular Shareholders' Meeting of Hanmi Science Held on the 28th

Mother and Daughter vs. Brothers Divided, Owner Family Conflict Erupts

Vote Swings Back and Forth Ahead of Meeting, Support Consolidates

Regardless of Winner, Challenges Remain

In January, the Hanmi Pharmaceutical Group's sudden announcement of a merger with OCI Group triggered a management rights dispute within the Hanmi Pharmaceutical Group's ownership family, which has finally reached its final chapter. The conflict between the mother-daughter side (Song Young-sook and Lim Joo-hyun) and the brothers side (Lim Jong-yoon and Jong-hoon) that has been engaged in intense legal battles and vote consolidation for two months is expected to be resolved at the Hanmi Science shareholders' meeting held on the 28th.

The owners of Hanmi Pharmaceutical Group, who are engaged in fierce conflict over the merger between Hanmi Pharmaceutical Group and OCI Group. Song Young-sook, Chairwoman of Hanmi Pharmaceutical Group (top left in the photo, clockwise), Lim Joo-hyun, Vice Chairman of Hanmi Pharmaceutical Group, Lim Jong-hoon, former President of Hanmi Pharmaceutical, and Lim Jong-yoon, Chairman of Cori Group.

The owners of Hanmi Pharmaceutical Group, who are engaged in fierce conflict over the merger between Hanmi Pharmaceutical Group and OCI Group. Song Young-sook, Chairwoman of Hanmi Pharmaceutical Group (top left in the photo, clockwise), Lim Joo-hyun, Vice Chairman of Hanmi Pharmaceutical Group, Lim Jong-hoon, former President of Hanmi Pharmaceutical, and Lim Jong-yoon, Chairman of Cori Group. [Image source=Hanmi Science and Chairman Lim Jong-yoon's side]

Hanmi Science, the holding company of Hanmi Pharmaceutical Group, will hold its regular shareholders' meeting on the 28th at the Ravideul Hotel in Hwaseong, Gyeonggi Province. In previous years, the meeting was held at the headquarters building in Songpa-gu, Seoul, but this year, shareholders will be welcomed near the Hwaseong Paltan factory, the 'legal headquarters.' This reflects the company's determination not to cause any legal issues during the shareholders' meeting amid the management rights dispute.

The Hanmi Pharmaceutical Group ownership family is currently divided into two opposing factions: the mother-daughter duo of Song Young-sook, Chairwoman of Hanmi Pharmaceutical Group, and Vice Chairwoman Lim Joo-hyun, and the brothers Lim Jong-yoon, Chairman of Kori Group, and Lim Jong-hoon, former President of Hanmi Pharmaceutical. In January, the mother-daughter side announced a merger plan in which Hanmi Science would become an intermediate holding company for OCI Group's pharmaceutical and bio-business. The plan includes a package deal involving third-party new share issuance by Hanmi Science to OCI Holdings, stock sales by the mother-daughter side, in-kind contributions of Hanmi Science shares to OCI Holdings by the mother-daughter side, and a third-party allotment rights offering by OCI Holdings to the mother-daughter side, aiming to bring stable OCI funds into Hanmi Pharmaceutical Group.

However, the brothers side opposed the plan, arguing that since the funds are largely intended to resolve the 540 billion KRW inheritance tax burden borne by the Hanmi Pharmaceutical Group ownership family after the death of founder Lim Sung-gi, the merger is a 'self-serving merger.' They have continuously raised issues, including filing injunctions to prohibit third-party new share issuance.

Regarding this shareholders' meeting, both sides have been engaged in fierce conflict over the agenda for director appointments. Currently, the Hanmi Science board of directors consists of four members from the mother-daughter side only. The brothers side has submitted a shareholder proposal to appoint a total of five directors, including themselves, at this meeting. The mother-daughter side responded by proposing to appoint six additional directors, the maximum allowed by the articles of incorporation. The controlling faction of the board will change depending on who wins at the shareholders' meeting.

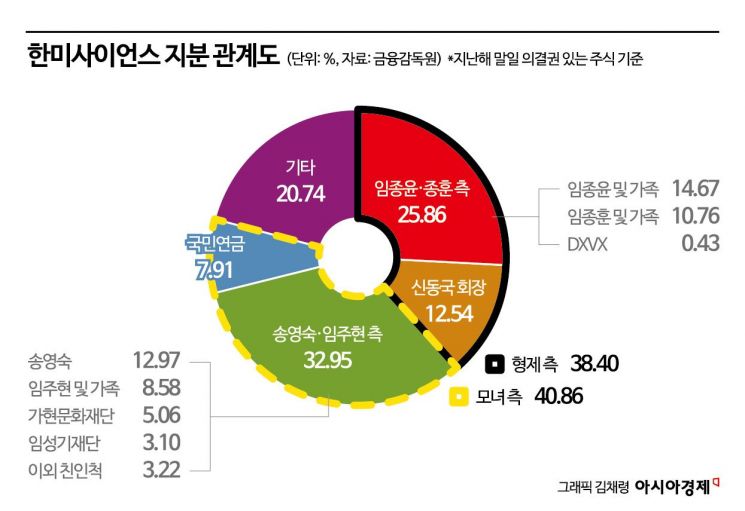

Until now, the mother-daughter side (32.95%) has held an advantage over the brothers side (25.86%) based on voting shares with voting rights. However, on the 23rd, Shin Dong-guk, the largest individual shareholder and Chairman of Hanyang Precision, unexpectedly sided with the brothers side, boosting their stake to 38.4% and gaining the upper hand. But on the 26th, the National Pension Service supported the mother-daughter side, stating that their plan better aligns with long-term shareholder value enhancement, restoring the mother-daughter side's stake to 40.86% and reclaiming the lead.

Additionally, when combining the 1.40% stake of minority shareholders affiliated with the shareholder action platform 'ACT,' who publicly declared support for the brothers side and submitted proxy votes, and the 0.3% stake of Hanmi Alumni Association, which declared support for the mother-daughter side, a fierce competition for minority shareholders' votes is underway at about a 1 percentage point level. Both sides reportedly have been meeting minority shareholders one-on-one through agencies until the day before to consolidate their final votes intensely.

However, regardless of which side wins this shareholders' meeting, challenges remain. If the mother-daughter side wins, even if the package deal is fully realized, OCI Holdings' stake in Hanmi Science will be only 27.03%, which is problematic. OCI Holdings must own more than 30% of shares to have Hanmi Science, a listed company, as its holding company. Additional share acquisitions through public tender offers or block deals will be necessary. Moreover, if Chairman Shin continues to support the brothers side after the meeting, an adversarial largest shareholder faction holding 28.8% exceeding the controlling shareholder's stake will remain an issue.

Conversely, if the brothers side wins, securing funding will be critical. The mother-daughter side is confident that selling existing shares to OCI Holdings can resolve the inheritance tax in one go, whereas the brothers side has not clearly presented the source of funds for the inheritance tax resolution. Chairman Lim Jong-yoon previously explained, "There are rumors that we lack funds, but you have to look at net assets," adding, "We are personally handling the tax issue well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.