Alrine: "Exactly Coupang's Success Equation"

Coupang Chooses "Regional Expansion Instead of Success Equation"

3 trillion won vs 1.5 trillion won.

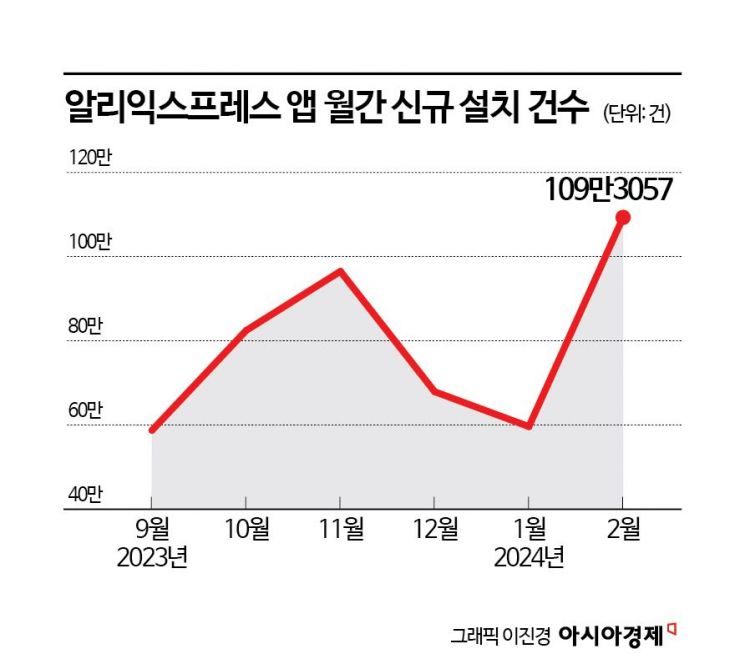

Coupang and the Chinese direct purchase app AliExpress have entered a large-scale investment battle over the next three years, competing for dominance in the domestic e-commerce market. It appears that the domestic retail giant Coupang is countering the massive capital of the Chinese companies, represented by AliExpress, with aggressive investments.

Although both sides are making large-scale investments, they are adopting different strategies in detail. The Chinese companies are investing in shortening delivery times in the metropolitan area by leveraging low prices as their weapon. Coupang plans to expand same-day delivery areas nationwide by utilizing its existing competitive edge, drawing the attention of the distribution industry to the outcome of this competition.

According to Statistics Korea on the 27th, the size of the domestic e-commerce market last year was around 227 trillion won. JP Morgan predicted that the domestic e-commerce market will grow to the 300 trillion won range by 2026. The solid growth of the domestic market is the reason for the entry of Chinese e-commerce operators into Korea.

According to the Ministry of Trade, Industry and Energy's 'Sales Composition Ratio by Business Type' data, the share of online distribution in the domestic retail market was 49.7% as of January last year, but grew 16.8% year-on-year to 53.6% in January this year. Online sales surpassed the combined sales of large supermarkets, department stores, convenience stores, and SSMs (46.3%). On the other hand, domestic e-commerce companies, except for Coupang, are recording losses, so the success or failure is likely to be determined by who gains more market share.

Ali Follows Coupang's Strategy from 10 Years Ago

The Chinese companies' strategy for penetrating the domestic market is similar to Coupang's approach 10 years ago. The first is price. Most consumer goods sold domestically are made in China, which affects pricing. For example, if a fashion item priced at 5,000 won in China is sold on a domestic open market, the price inevitably exceeds 5,000 won considering the middle margin.

The second is delivery. Coupang rapidly captured the domestic market based on fast delivery. Ali has shortened delivery times to an average of 3 to 5 days through a logistics route dedicated to Korea. They stock frequently sought-after products by Koreans in a warehouse in Weihai, Shandong Province, China, and ship immediately upon order. They have also significantly improved the previously complicated return and refund processes.

Additionally, referring to Coupang's success case, they plan to further shorten delivery times. Ali's parent company, China's Alibaba Group, recently submitted a business plan to the Korean government to invest $200 million (about 270 billion won) this year to build a fulfillment center (FC, integrated logistics center) of 180,000㎡ (about 54,450 pyeong) in the metropolitan area. The plan is to establish an FC about the size of 25 soccer fields to create a rapid delivery system comparable to Coupang's Rocket Delivery. If an FC is installed domestically, fresh food delivery in the metropolitan area will also be possible. The strategy is to compete with low prices and fast delivery.

Coupang Announces "Free Nationwide Delivery"... Expanding Logistics Centers

In response to the offensive from C-commerce companies, Coupang has pulled out the "free nationwide delivery" card for 'Wow Membership' members. Having already secured competitiveness in the metropolitan area, the core strategy is to aggressively expand logistics infrastructure with twice the investment of Ali to make the entire country a ‘Cusegwon’ (areas where Coupang Rocket Delivery is available).

Coupang's strategy lies in expanding its business area through already proven methods. Coupang has dominated the domestic online distribution market by growing its logistics infrastructure through aggressive investments. Since Rocket Delivery started in 2014, Coupang has invested over 6 trillion won in domestic logistics. Through this, Coupang has established more than 100 logistics centers in 30 regions nationwide, increasing the number of Cusegwon areas. According to a report submitted by Coupang to the U.S. Securities and Exchange Commission (SEC), as of the end of last year, Coupang's domestic and overseas logistics and fulfillment-related real estate area reached 5.11 million ㎡ (about 1.55 million pyeong). This is larger than the combined size of 700 soccer fields and incomparable to Ali.

Moreover, Coupang plans to further expand FCs and dominate provincial areas as well. Coupang plans to invest more than 3 trillion won by 2026 to initiate new construction and equipment investment for new FC operations in more than eight locations including Gimcheon in Gyeongsangbuk-do, Jecheon in Chungcheongbuk-do, Busan, Icheon in Gyeonggi-do, Cheonan in Chungcheongnam-do, Daejeon, Gwangju, and Ulsan.

The second strategy is expanding loyal customers. This is a 'lock-in' strategy that confines customers to Coupang based on the 'Wow Membership.' Previously, consumers in areas where Coupang delivery was unavailable only had benefits such as Coupang Play when joining Wow Membership. However, by expanding delivery nationwide, Coupang aims to increase loyal customers based on these benefits.

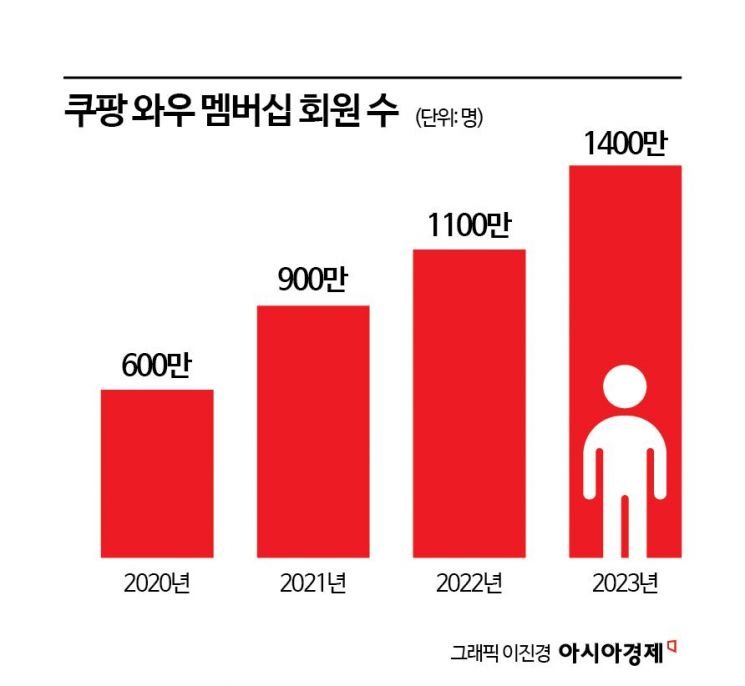

As of the end of last year, Coupang Wow Membership had 14 million members, a 27% increase from the previous year. Wow Membership is a service that provides five free services including free Coupang delivery, delivery, returns, direct purchase, and free viewing of Coupang Play for a monthly fee of 4,990 won. To strengthen the lock-in effect, Coupang also introduced a service that offers unlimited free delivery through Coupang Eats for Wow members.

This year, Coupang Play plans to showcase various original works such as ‘SNL Korea,’ ‘Hyde,’ ‘Things That Come After Love,’ and ‘Family Plan.’ The ‘Coupang Play Series,’ which invites Bayern Munich, a German Bundesliga club featuring soccer player Kim Min-jae, will also be launched this summer. As of February this year, Coupang considers over 50 million out of Korea’s 51.3 million population as Wow members.

The distribution industry is closely watching this competition. The winner of this large-scale investment battle will determine the future dominant player in the rapidly growing domestic e-commerce market. An industry insider said, "The domestic e-commerce market has a successful model in Coupang, and based on this, Chinese companies and Coupang have entered large-scale investments early. It is also noteworthy what strategies existing retail giants will adopt in response to their competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.