Domestic Insurers Use AI for Customer Service and Underwriting

AI's Role Grows in Claims Processing at Japanese Insurers

Accident and Disaster Loss Amounts Derived from Photos and Videos

As domestic insurance companies rush to utilize artificial intelligence (AI), it has been revealed that AI application in claims processing is still at a 'beginner' level. In contrast, the Japanese insurance industry is already using AI to analyze photos and videos of traffic accidents and natural disaster damages and to estimate loss amounts.

According to the insurance industry on the 27th, KB Financial Group has formed a generative AI task force (TF) together with its major subsidiaries. They selected 'insurance business' as the first case and completed a proof-of-concept test for the 'insurance assistant' technology. KB Financial's insurance subsidiaries are also accelerating the introduction of AI-based response services. KB Life Insurance is considering introducing a generative AI service within the year that automatically generates product guide documents and images and assists consultations. KB Insurance has piloted an 'AI business card service.' This service creates a virtual human resembling an insurance planner using one photo and 10 seconds of voice, delivering messages up to one minute long. The business card includes self-introduction, greetings, guidance for transferred customers, and contract customer management.

AI is also used in automating and simplifying the underwriting process, which ultimately decides whether to approve contracts for prospective policyholders. Samsung Fire & Marine Insurance developed a long-term insurance disease review system called 'Long-term U' and obtained a patent. It analyzes the medical history disclosed by the insurance consumer and insurance claim history using machine learning-based technology and informs the approval decision. The approval rate reaches 90%. DB Insurance obtained a patent for a pre-underwriting 'AI secretary system.' This system can simultaneously perform coverage analysis, customized design, and underwriting for each consumer using AI. Since introducing the AI secretary in sales fields in June last year, 6,000 planners have used it monthly, concluding contracts worth 300 million KRW with over 100,000 customers.

However, the insurance industry evaluates that AI-integrated tasks are limited to consumer response and contract underwriting review. AI utilization in claims processing remains at a very early stage. One insurance company's internal network has a system where AI calculates repair costs when photos of damaged vehicles are registered, but usage is low. A representative of the insurance company explained, "It only provides estimates based on external damage areas, so claims staff manually re-calculate each time."

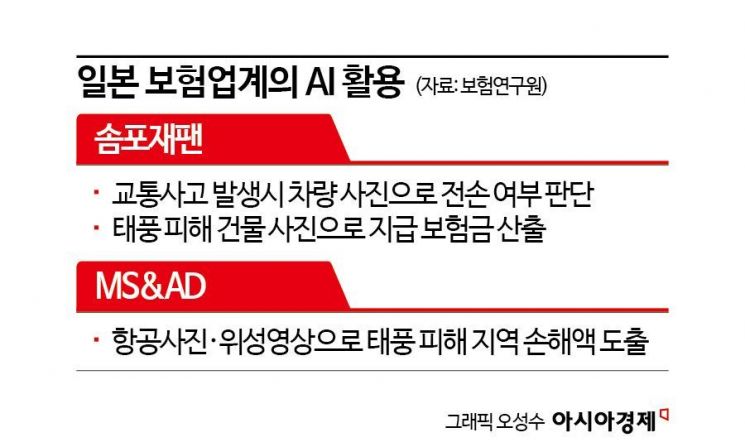

Meanwhile, Japanese insurers are using AI to calculate traffic accident loss amounts solely from photos and videos. Sompo Japan, Japan's first non-life insurer, introduced 'AI Estimate Check,' which determines whether a vehicle is a total loss from photos and pays insurance claims on the day of receipt. A total loss vehicle refers to a car that is completely damaged and cannot be repaired or whose damage amount exceeds the insured value. AI conducts detailed investigations only when it judges that 'human investigation is necessary.' Sompo Japan aims to delegate about 400,000 (40%) of 1 million traffic accident cases to AI by 2025.

In the Japanese insurance industry, AI is also responsible for assessing disaster and calamity loss amounts. Sompo Japan has a 'Smart Building Estimate' system. AI interprets photos of buildings damaged by natural disasters and calculates payable insurance amounts. This system was piloted during Typhoon No. 14 in September 2022 and has been fully implemented since August last year. Japan's major non-life insurer Mitsui Sumitomo & Aioi Nissay (MS&AD) added 'Building Damage AI Automatic Reading' technology last year when assessing typhoon damage scale. Using aerial photos and satellite images, it derives regional building loss amounts in as little as three days.

An insurance industry official explained, "Japan has a long history in the insurance industry, so there is inevitably a technological gap." He added, "Applying AI to claims processing allows insurers to reduce labor and operating costs, and insurance consumers can receive claims payments quickly, which benefits both parties. However, due to many potential disputes, most domestic insurers are likely still in internal review or development stages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.