Insurance Companies' Net Income Surpasses 10 Trillion Won for the First Time

Non-Life Insurance Leads Life Insurance in Profitability Indicators

Last year, the net profit of domestic insurance companies exceeded 13 trillion won, entering the 10 trillion won range for the first time in history.

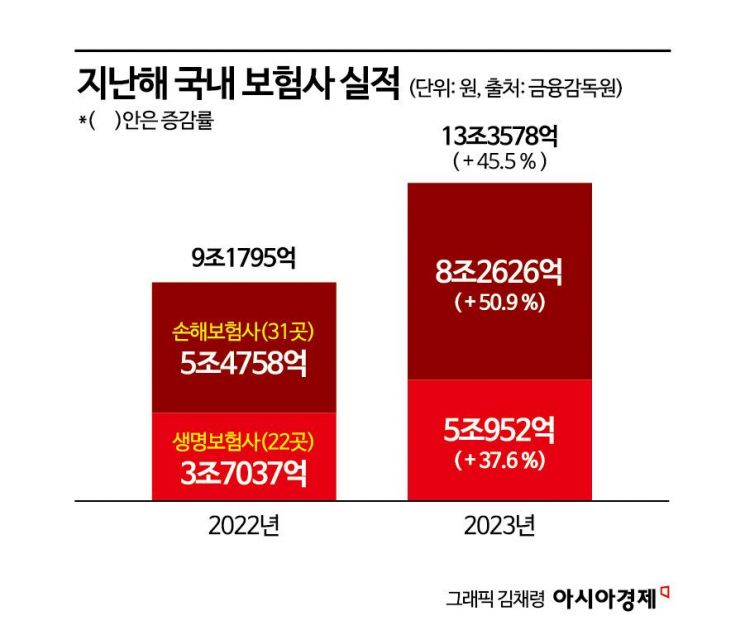

According to the Financial Supervisory Service on the 26th, the net profit of life and non-life insurance companies last year was 13.3578 trillion won, an increase of 4.1783 trillion won (45.5%) compared to the previous year (9.1795 trillion won). This is the first time that insurance companies' net profit has surpassed 10 trillion won.

Overall, non-life insurers performed better than life insurers. This is interpreted as a result of the worsening business conditions for life insurers due to demographic changes caused by low birth rates and aging. The net profit of life insurers (22 companies) was 5.0952 trillion won, an increase of 1.3915 trillion won (37.6%) compared to the previous year. Non-life insurers (31 companies) recorded 8.2626 trillion won, up 2.7868 trillion won (50.9%). A Financial Supervisory Service official explained, "Life insurers improved their performance due to increased sales of protection-type insurance, and non-life insurers due to increased sales of long-term insurance," adding, "The introduction of the new international accounting standard (IFRS17) last year also reduced costs by reclassifying interest expenses on insurance liabilities as investment income."

Insurance companies' premium income was 237.6092 trillion won, down 15.1832 trillion won (6%) from the previous year. Life insurers' premium income was 112.4075 trillion won, a decrease of 20.2761 trillion won (15.3%). This was due to a decline in premium income from savings-type insurance (-38%), retirement pensions (-14.7%), and variable insurance (-4%). However, premium income from protection-type insurance increased by 3.2% compared to the previous year. Non-life insurers' premium income was 125.2017 trillion won, up 5.0929 trillion won (4.2%) from the previous year. Premium income from general insurance (8.5%), retirement pensions (6.6%), long-term insurance (3.5%), and automobile insurance (1.4%) all increased steadily.

Profitability indicators such as Return on Assets (ROA) and Return on Equity (ROE) also favored non-life insurers. Last year, non-life insurers' ROA was 2.4%, up 0.92 percentage points from the previous year. Life insurers' ROA was 0.58%, up 0.2 percentage points. During the same period, non-life insurers' ROE increased by 0.33 percentage points to 13.07%, while life insurers' ROE decreased by 0.46 percentage points to 4.93%.

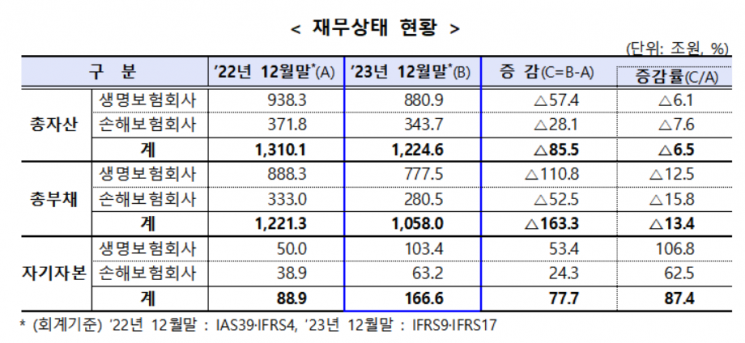

In financial indicators such as total assets and total liabilities, life insurers performed better. Total assets of life insurers were 880.9 trillion won, down 6.1% from the previous year, while non-life insurers' total assets were 343.7 trillion won, down 7.6%. Regarding total liabilities, life insurers recorded 777.5 trillion won, a decrease of 12.5%, and non-life insurers 280.5 trillion won, down 15.8%.

A Financial Supervisory Service official stated, "There are uncertainties related to interest rate and exchange rate fluctuations, and the increase in financial assets measured at fair value may expand volatility in future profits and capital," adding, "Insurance companies need to proactively manage financial soundness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.