Kim Wholesale Price Up 46% Compared to a Year Ago

Increased Overseas Market Demand and Decreased Domestic Supply

Reduced Harvest Due to Abnormal Weather... Price Rising Trend

Possible Additional Increase in Gimbap Prices

The price of gim, one of the most popular seafood products among Koreans, is rising sharply. The increased popularity of K-food has led to record-high export performance, which in turn has reduced the supply in the domestic market and driven prices up. On top of that, abnormal weather conditions have also reduced the harvest volume, leading to expectations that the price increase trend will continue for the time being.

Gim Prices Surge Amid K-Food Craze

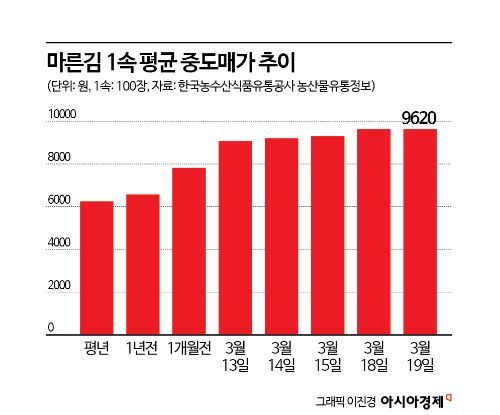

According to the Agricultural Products Distribution Information (KAMIS) of the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 21st, the wholesale price of dried gim (medium grade) per bundle (100 sheets) was 9,620 won as of the 19th, which is 46.4% higher than the same period last year (6,572 won). This price is 53.9% higher than the average price (6,249 won) and has increased by 23.1% compared to a month ago (7,813 won). As wholesale prices rise, retail prices are also on the rise. As of the 19th, the consumer price for 10 sheets of dried gim was 1,136 won, up 13.9% from the same period last year (997 won) and 17.0% higher than the average price (971 won).

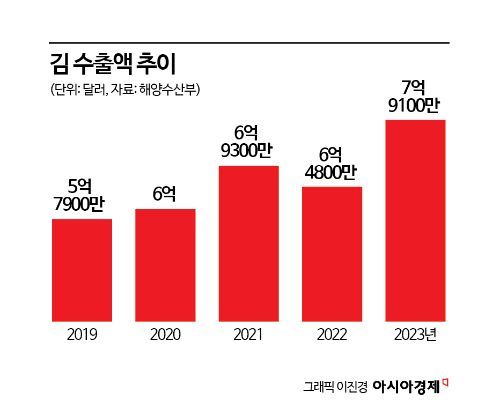

The recent sharp rise in gim prices is due to increased demand not only domestically but also from overseas markets. In recent years, gim has set new export records annually, becoming a key product. Last year, gim exports amounted to $791 million (approximately 1.06 trillion won), a 22.2% increase from the previous year ($648 million). Korea’s gim accounts for 70% of the global gim market and has been the top seafood export item since 2019.

The Dual Reality of the Gim Market: Strong Exports and Domestic Shortage

While gim is mainly consumed as a side dish with rice in Korea and Japan, it is gaining popularity overseas as a low-calorie healthy snack, replacing potato chips and popcorn. Additionally, the frozen gim-bap craze that started in the U.S. last year has also contributed to expanding gim demand. The American grocery retailer Trader Joe’s began selling frozen gim-bap in August last year, and the initial shipment of 2.5 million tons?equivalent to millions of gim-bap rolls?sold out in less than a month, gaining huge popularity. Furthermore, Korean dramas featuring gim-bap frequently have helped increase gim’s recognition.

As gim has become a key export product, domestic supply has relatively decreased. With rising export demand, the volume brought into wholesale markets has declined, naturally pushing prices up. In February, the wholesale price of gim for gim-bap was 7,400 won per bundle, up 38.9%, and the price of wild gim also rose 40.5% to 10,790 won during the same period. The significant increase in gim prices raises the possibility of gim-bap price hikes. According to the Korea Consumer Agency’s Price Information, the average price of one gim-bap roll in Seoul last month was 3,323 won, up 7.2% from the same period last year (3,100 won) and 18.3% from March 2022 (2,808 won).

Price Increase Due to Declining Gim Production and Government Response Strategies

While demand is increasing, production is actually decreasing. Last month, gim production was 30.76 million bundles, down 9.8% from January (34.1 million bundles) and 2.6% lower than the same period last year. Due to abnormal climate conditions over recent years, rising water temperatures have spread pests and diseases, reducing the harvest volume of raw gim (unprocessed gim). Recently, frequent swells have caused many gim leaves to fall off, and strong winds and heavy rains have reduced harvesting opportunities, further impacting production.

There are forecasts that the price increase will accelerate next month when products are made from the more expensive raw gim. Gim is typically harvested from December to April, and food companies purchase a year’s worth of raw gim at once during this period to produce products. According to the Korea Maritime Institute, earlier-than-usual water temperature rises are expected, so production in April is also predicted to be low. April gim production is expected to be about 8.2 million bundles, approximately 38% less than the same period last year, and wholesale prices are expected to be higher this month and compared to last year due to reduced production.

As gim price increases are expected to accelerate, the government is also taking steps to stabilize prices. On the 19th, the Ministry of Oceans and Fisheries decided to include dried gim in this month’s seafood discount event as part of price stabilization efforts. Additionally, in the mid to long term, the government plans to develop 2,000 hectares of new aquaculture farms?equivalent to 2,800 soccer fields?from July to stably increase gim production, which is expected to raise production by about 3%. The government also plans to minimize production instability by developing superior gim seeds resistant to high temperatures and diseases, as well as land-based gim aquaculture technology.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)