Secured Emergency Operating Funds with Parent Company Support

CDS Has No Disclosure Obligation... Kolon Also Does Not Disclose

Did They Aim to Reduce Apparent Financial Burden?

Kolon Global secured 200 billion KRW in operating funds with the indirect support of Kolon. After struggling to secure funds due to concerns over project financing (PF) defaults, Kolon stepped in, enabling the company to quickly obtain urgent liquidity. However, there are criticisms that Kolon used an unconventional method to conceal contingent liability burdens by providing credit enhancement through credit default swaps (CDS) instead of a typical debt guarantee.

Credit Enhancement via CDS...Credit Derivatives Similar to Guarantees

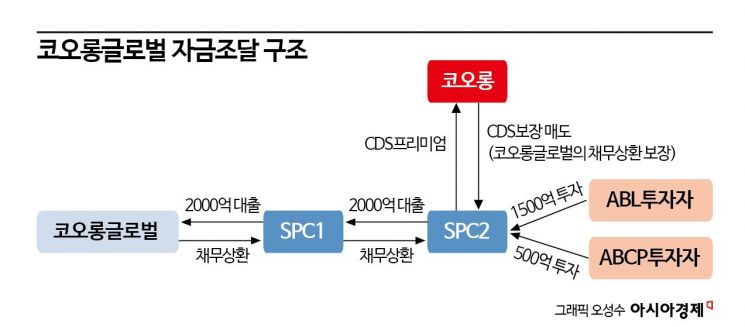

According to the investment banking (IB) industry on the 21st, Kolon Global raised 200 billion KRW from a special purpose company (SPC) organized by Hana Bank. This SPC borrowed 200 billion KRW from another securitization-purpose SPC and then lent it to Kolon Global. The securitization-purpose SPC, in turn, borrowed 150 billion KRW through asset-backed loans (ABL) from a lending group composed of financial institutions and issued 50 billion KRW worth of asset-backed commercial paper (ABCP) to fund the loan. Thus, the loan funds originated from ABL and ABCP investors. Investors will receive their principal and interest back when Kolon Global repays the loan principal and interest in the future.

Kolon, the parent company and group holding company, provided side support for Kolon Global’s fund raising. Kolon Global is assessed to be in a difficult position to secure funds independently due to concerns over PF defaults. Since issuing 68 billion KRW worth of private bonds at a high interest rate of 8.30% in August last year, it has been unable to raise market-based funds. As a result, Kolon provided credit enhancement by taking responsibility for Kolon Global’s debt repayment.

To strengthen Kolon Global’s credit, Kolon entered into CDS contracts with ABL and ABCP investors. Kolon agreed to take responsibility if Kolon Global encounters difficulties in repaying its debt and, in return, receives CDS contract premiums (a type of fee). This is equivalent to Kolon providing guarantees to its construction subsidiary and receiving guarantee fees.

However, the guarantee method using CDS differs from typical guarantees such as joint guarantees, funding supplementation agreements, or debt assumption. A bond market official explained, “CDS is a ‘credit derivative’ that pays a fee to the protection buyer to compensate for losses due to the debtor’s credit deterioration, which differs from typical guarantee obligations,” but added, “In economic substance, it is not much different from a debt guarantee.”

‘Evasive Guarantee’ to Avoid Disclosure of Contingent Liability Burdens(?)

Kolon’s support for its subsidiary through this method is interpreted as a way to avoid increasing financial burdens such as contingent liabilities. Kolon Global is in a difficult situation due to PF default concerns, and the parent company Kolon is not in a particularly strong financial position either, due to support for affiliates.

In particular, financial burdens have increased recently as Kolon participated in a paid-in capital increase for its affiliate bio company Kolon TissueGene. From 2021 to last year, it directly supported 104.1 billion KRW in three rounds of funding to conduct Phase 3 clinical trials of ‘Invossa’ in the United States.

Borrowings have increased, and short-term repayment burdens have become quite significant. As of the end of the third quarter last year, out of total borrowings of 825.8 billion KRW, short-term borrowings and long-term current liabilities due within one year amounted to about 570 billion KRW. Cash equivalents available to meet debt maturities stood at only 6.5 billion KRW, and cumulative operating cash flow (OCF) until the third quarter last year was about 16 billion KRW.

Under these circumstances, it is not easy for Kolon to increase guarantee liabilities by 200 billion KRW. In fact, Kolon did not disclose the CDS contracts as contingent liabilities such as debt guarantees. An IB industry official said, “Debt guarantees for affiliates must be disclosed, but CDS contracts are different from guarantees and are often not disclosed,” adding, “However, it is hard to say that financial burdens have not increased due to support for affiliates.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.