The First Introduction by a Domestic Bank

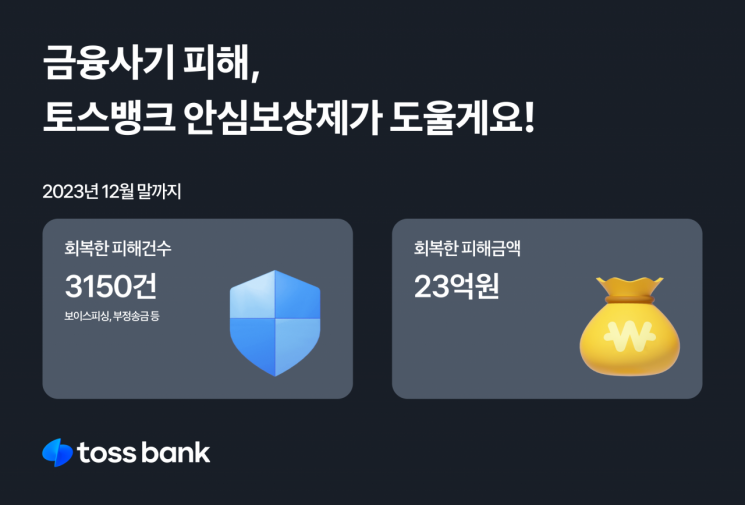

Toss Bank announced on the 19th that its Safe Compensation Program, which assists customers who have suffered financial fraud, has helped recover damages worth a total of 2.3 billion KRW over the past two years. Toss Bank is the first domestic bank to operate a compensation policy for customers affected by financial fraud such as voice phishing and unauthorized remittances.

From October 2021 to the end of December 2023, Toss Bank assisted in recovering damages for a total of 3,150 cases of financial fraud reported by customers, amounting to approximately 2.3 billion KRW. Among the damages experienced by customers, 83 cases involved financial fraud such as voice phishing, and 3,067 cases involved unauthorized remittances related to used goods transaction scams.

Specifically, the number of cases in 2023 was 2,081 (52 financial fraud cases and 2,029 used goods scams), which is about twice the 1,047 cases in 2022 (31 financial fraud cases and 1,016 used goods scams). The scale of damage support also nearly doubled, reaching 1.494 billion KRW in 2023 compared to 785 million KRW in 2022.

Toss Bank was the first domestic bank to introduce a compensation policy for customers affected by financial fraud in October 2021. Customers can apply for compensation if they suffered financial losses due to voice phishing crimes involving transfers from their Toss Bank accounts to other banks or if they were scammed during transactions on domestic online used goods platforms. If reported to the Toss Bank customer center within 15 days of the incident, customers can receive compensation after going through procedures such as submitting evidence of reports to investigative agencies.

A representative from Toss Bank stated, “The Safe Compensation Program, introduced as the first of its kind by a bank, has contributed to helping customers recover approximately 2.3 billion KRW in financial fraud damages over the past two years, and this value is spreading to other financial institutions as well. We will continue to fulfill our social responsibility actively to become a bank that all Toss Bank customers can trust and use with confidence.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)