"'Only One Outside Director Candidate Recommended' JB Financial's Claim Incomprehensible"

Align Partners Asset Management expressed regret, stating that "JB Financial Group disparages the independence of shareholder-proposed director candidates without any basis." On the 18th, Align Partners issued a rebuttal to JB Financial's statement on the 14th, saying, "We cannot understand JB Financial's claim that only one outside director candidate should be recommended."

Earlier, JB Financial stated, "Although Align Partners recommended candidate Lee Hee-seung as an outside director, Align Partners' additional recommendations of multiple directors could undermine the board's independence, fairness, and balance, and increase the risk of conflicts of interest."

On this day, Align Partners countered, "This is an inappropriate claim. Shareholder proposals for director candidates are a unique right guaranteed by law to shareholders," adding, "Regardless of who recommends the outside directors, the correct approach is for the board to be composed through fair competition among candidates with better expertise and independence, based on shareholder votes." They also stated, "The candidates are top-level independent experts in key areas necessary to enhance JB Financial's shareholder value."

Regarding JB Financial's claim that "last year, the total shareholder return ratio increased by 6.1 percentage points from the previous year to 33.1%, striving to maximize shareholder returns," Align Partners responded, "We did not criticize last year's performance or shareholder return ratio, nor did we immediately demand additional shareholder returns this year," emphasizing, "The core demand has consistently been the introduction of a mid- to long-term capital allocation and shareholder return policy aimed at enhancing shareholder value." This implies that JB Financial has shown no changes despite calls for a more predictable shareholder return policy.

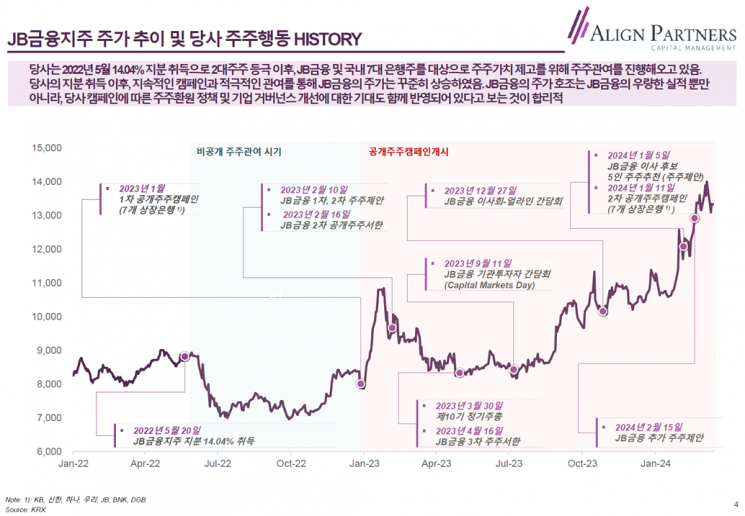

In response to JB Financial's claim that "the cumulative stock price increase rate and PBR (price-to-book ratio) over the past five years rank among the top in the industry," Align Partners stressed, "It is reasonable to view that JB Financial's stock price improvement also reflects expectations for shareholder return policies and corporate governance improvements following Align Partners' public campaign starting January 2 last year."

Furthermore, they explained, "JB Financial's PBR is around 0.57 times, ranking among the top domestic players alongside KB Financial, but its PER (price-to-earnings ratio) is 4.1 times, placing it fourth domestically," adding, "This indicates it is still significantly undervalued relative to its profitability, and compared to major overseas banks, there is still a long way to go."

Align Partners stated, "Passing shareholder proposals at the general meetings of large listed companies is never easy," but added, "We will do our best during the remaining period to create a constructive opportunity for JB Financial's attitude change and to ensure that at least one shareholder-proposed director candidate is elected to enhance shareholder value and improve corporate governance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.