Last year, despite a slowdown in demand, the electric vehicle (EV) market showed growth of over 30%, but battery material companies recorded a decline due to falling battery prices and decreases in lithium and metal prices.

According to SNE Research on the 15th, last year’s EV sales reached 14.07 million units, growing by 33.5%, and EV battery usage also increased by 38.8%, from 503 GWh to 698 GWh. Compared to growth rates of 109% in 2021 and 57% in 2022, the market experienced a demand slowdown caused by economic recession due to high interest rates and a "Chasm" phenomenon (a temporary demand slowdown occurring near a penetration rate of 16%), but the overall growth trend was maintained.

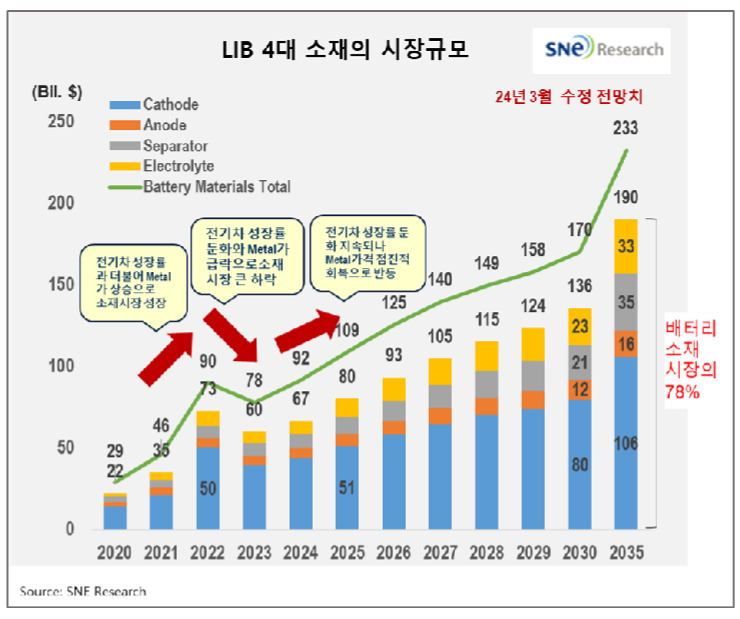

On the other hand, battery prices fell by about 13%, and the four major material markets, including cathode materials, also dropped by nearly 17%. Compared to the decline in battery prices, the price drops in materials, metals, and raw materials were even more pronounced, causing most material companies to record negative growth in the second half of last year and face difficulties. This trend is expected to continue into the first half of this year due to expanded inventory levels and a slowdown in market growth.

SNE Research stated, "Additionally, domestic companies are expected to survive the fierce competition for survival by overcoming the crisis through product competitiveness, achieved by diversifying supply sources to reduce dependence on China for raw materials, increasing the ratio of in-house production, securing technological gaps through research and development (M&A) and technology MOUs, and pioneering new next-generation technologies."

However, they added, "The recent bottoming out and nearly one-month upward trend in prices of lithium and nickel, key raw materials for batteries, raise expectations for a recovery in the performance of material companies. The production facility investment stance of Korea’s top three battery companies is also expected to be maintained, which should provide relief for material companies in securing sales volumes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.