Lack of Essential TSV Process Experience for 5th Gen HBM Production

Production Capacity and Yield Expected to Lag

"Samsung and SK Hynix Produce 120,000 to 130,000 Wafers Monthly"

There is a forecast that the production capacity of high-bandwidth memory (HBM) by US-based Micron will be limited to around 20,000 wafers per month. This is about half of the level previously expected by the related industry. The biggest reason cited is the lack of experience in the TSV (Through-Silicon Via) process, which is essential for next-generation HBM production.

On the 19th, Taiwanese market research firm TrendForce predicted this year’s wafer-based HBM production capacity to be 130,000 wafers per month for Samsung Electronics and 120,000 to 125,000 wafers per month for SK Hynix, while forecasting Micron’s capacity at around 20,000 wafers per month. It further analyzed that "Samsung and SK Hynix have the most aggressive HBM production plans until the end of this year." There was no separate mention of Micron.

Micron previously attracted attention by announcing it would skip the 4th generation (HBM3) and go straight to the 5th generation HBM (HBM3E). However, the industry views Micron’s production capacity as falling short of market expectations. Many securities firms had predicted that Micron would have a capacity of around 40,000 wafers per month by the end of this year.

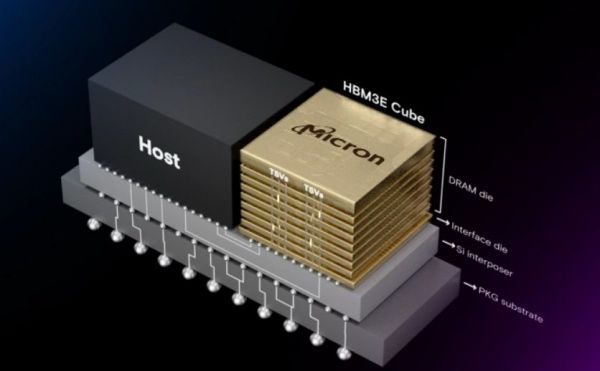

The industry points to the lack of experience in the TSV process as a key reason. The TSV process is an advanced packaging technology that involves thinning the chip and drilling hundreds of tiny holes to vertically connect electrodes through the holes of the upper and lower chips. Unlike general DRAM, HBM is characterized by stacking multiple chips, making TSV a technology that determines HBM’s competitiveness. The production capacity of HBM can depend on how many TSV lines are established. Micron has not introduced the TSV process up to HBM2.

On the other hand, Samsung Electronics and SK Hynix have been steadily investing to expand TSV lines. SK Hynix is prioritizing the expansion of TSV lines this year, doubling the process scale within its Cheongju plant compared to last year, while Samsung Electronics has set a goal to increase its volume by 2.5 times compared to the previous year.

TSV is also directly linked to yield. Since HBM requires discarding the entire package if even one of the stacked chips is defective, the yield is low. SK Hynix, the industry leader in HBM, is known to have yields in the 60% range. Micron’s yield is also said to be uncertain.

An industry insider said, "Given the characteristics of HBM, reducing costs and securing yield in the TSV process are crucial," adding, "Although Micron is accelerating investment in TSV equipment, it is questionable how quickly they can increase capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.