Foreigners Net Buy Over 12 Trillion Won This Year

Low PBR Stocks Lead Price Rise

'Price Merit' Samsung Electronics May Gain Momentum for Further Rebound

The KOSPI has recovered to the 2700 level for the first time in 23 months. Foreign investors, who have purchased over 12 trillion won this year, led the upward momentum. The strength of low price-to-book ratio (PBR) stocks, driven by expectations for corporate value-up programs, also pushed the index higher. However, it remains to be seen whether the KOSPI's upward trend will continue. Next week, the U.S. Federal Open Market Committee (FOMC) meeting scheduled for March could act as a variable influencing the stock market. Attention should also be paid to whether Samsung Electronics, which had been somewhat sidelined amid the market rally, will provide additional support for the rebound.

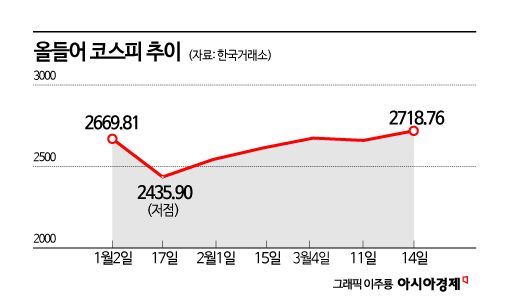

According to the Korea Exchange on the 15th, the KOSPI closed at 2,718.76, up 0.94% from the previous session. It maintained its upward trend for three consecutive days, regaining the 2700 level. The last time the KOSPI closed above 2700 was on April 22, 2022, 23 months ago. Following an intraday touch of 2700 on the 13th, the closing price also surpassed 2700 just one day later.

Although the U.S. and Japanese stock markets, which had been hitting record highs, recently showed signs of hesitation, and semiconductor stocks centered on Nvidia took a breather, raising concerns that the KOSPI's rise might be constrained, it succeeded in reaching the 2700 mark. Lee Kyung-min, a researcher at Daishin Securities, analyzed, "The KOSPI's rebound process was not smooth. As the advanced markets such as the U.S., Europe, and Japan, which had been on a record-breaking streak, wavered, the momentum of the KOSPI's rebound was also controlled. Last weekend, despite bond yields and the dollar weakening, semiconductor-related stocks that had been leading the U.S. market rally sharply reversed, triggering investor anxiety."

Despite unfavorable surrounding conditions, foreign investors and low PBR stocks played a significant role in the KOSPI's recovery to the 2700 level. Foreigners have net purchased 12.2044 trillion won in the KOSPI market this year up to the previous day. In particular, last month, they net bought 7.375 trillion won in the domestic stock market, marking the largest scale in 11 years since September 2013.

The strength of low PBR stocks, driven by expectations for corporate value-up programs, also supported the KOSPI's rise. Recently, financial stocks have led the index's increase by consecutively hitting 52-week highs. Among the stocks that recorded 52-week highs the previous day were many financial stocks including KB Financial Group, Shinhan Financial Group, Hana Financial Group, Woori Financial Group, BNK Financial Group, IBK Industrial Bank, NH Investment & Securities, Kiwoom Securities, Daishin Securities, and Samsung Card. KB Financial's stock price jumped from the 63,000 won range at the end of last month to the 78,000 won range. NH Investment & Securities rose 11.24% this month.

Kim Ji-hyun, a researcher at Kiwoom Securities, analyzed, "Although the KOSPI remains in a box range compared to the bullish U.S. and Japanese markets, it is positive that the index's lower bound has been rising since the beginning of the year. Foreign net buying in banking and securities sectors continues, supporting the bottom of low PBR stocks, and the simultaneous strength of high-value sectors such as internet and medical devices shows that risk asset preference sentiment remains valid."

However, it is uncertain whether the KOSPI's bullish trend will continue. The upcoming March FOMC meeting is expected to act as a factor increasing market volatility. Lee said, "The possibility that the KOSPI's breakthrough of 2700 will lead to a move toward 2800 is still low. While investor sentiment is overheated, macro risk indicators are at the peak of risk-on signals, and the U.S. volatility index (VIX) is at historic lows, suggesting that a risk-off signal and increased volatility may occur soon." He added, "The stock price trend in late March will be determined by the release of China's February real economy indicators on the 18th and the results of the March FOMC."

Attention is also focused on whether Samsung Electronics, which had shown somewhat sluggish movement, will contribute to an additional rebound. Thanks to the Nvidia-driven tailwind, AI semiconductor stocks continued their strength, and SK Hynix showed a remarkable price increase, but Samsung Electronics appeared sidelined. Lee said, "Since last weekend, cracks have appeared in the rapid rise of AI semiconductor companies, and it is necessary to consider the possibility of entering a phase of overheating relief and volume digestion for the time being. Even if SK Hynix, which surpassed 170,000 won last week, suffers from sharp volatility expansion, if Samsung Electronics' stock price holds, further level-up of the KOSPI can be expected depending on the situation." SK Hynix accounts for 5.32% of the KOSPI's total market capitalization, while Samsung Electronics accounts for 20.03%. Lee added, "One of the main reasons for the KOSPI's relative underperformance since the beginning of the year was Samsung Electronics' sluggish stock price movement. For the time being, Samsung Electronics' price merit will be a solid support for the KOSPI or provide strength for additional rebound attempts." Labor-gil, a researcher at Shinhan Investment Corp., said, "Valuation is a favorable factor for Samsung Electronics. The relative 12-month forward PBR of Samsung Electronics compared to SK Hynix is currently 0.74 times, while the average since 2010 is 1.04 times. It is closer to the historical low (0.55 times) than the average, which means the possibility of relative valuation recovery can be considered higher."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.