The Start Date for Proxy Solicitation Delayed but Early Shareholder Contact Made

"Late Notification to Proxy Firms"... Resubmission of Shareholder Proposal Agenda

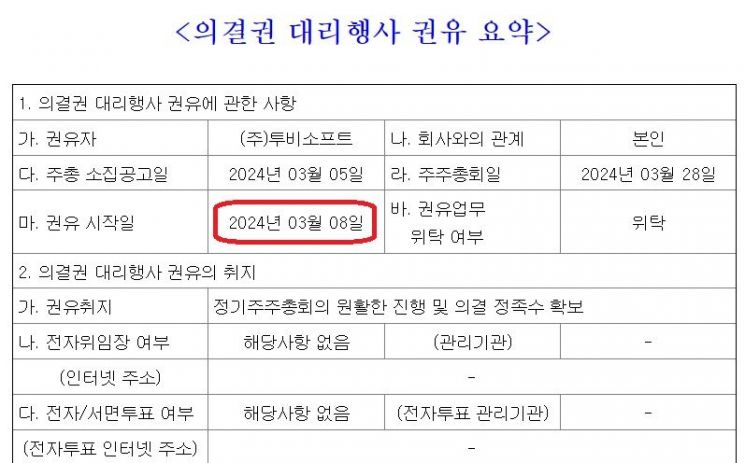

Summary Disclosure of Proxy Solicitation for Voting Rights by ToBeSoft. /Photo by Financial Supervisory Service Electronic Disclosure Capture

Summary Disclosure of Proxy Solicitation for Voting Rights by ToBeSoft. /Photo by Financial Supervisory Service Electronic Disclosure Capture

The management of ToBeSoft, a KOSDAQ-listed company currently embroiled in a management rights dispute, has been found to have contacted shareholders and gathered voting rights even before the official start date for proxy voting solicitation, sparking controversy.

According to the Financial Supervisory Service's electronic disclosure on the 13th, ToBeSoft made a disclosure related to proxy voting solicitation ahead of its regular shareholders' meeting scheduled for the 28th. The initial disclosure was made on the 29th of last month, stating that the start date for proxy voting solicitation would be March 6.

Companies disclose a "Reference Document for Proxy Voting Solicitation" before shareholders' meetings. They specify the start date for proxy voting solicitation and begin contacting shareholders from that day. This is to ensure fair exercise of voting rights by all shareholders.

ToBeSoft changed the disclosure on the 5th, one day before the initially announced start date for proxy voting solicitation, because they added an agenda item for amending the articles of incorporation requested by shareholders.

Previously, shareholders had demanded the company remove the "golden parachute" clause, which would allow the current management to receive large retirement payouts. Recently, there have been opinions in the market that golden parachute clauses may harm the rights of minority shareholders. In fact, companies with golden parachute clauses are known to receive deductions in ESG (Environmental, Social, and Governance) evaluations.

While adding the disclosure, ToBeSoft postponed the solicitation start date from the 6th to the 8th. However, according to the proxy solicitation agency, ToBeSoft began soliciting voting rights from the 6th. Despite the disclosure change, solicitation started two days earlier than the announced date.

Moreover, at that time, the agenda item for the election of directors proposed by shareholders was not included. Shareholders filed a provisional injunction against the agenda submission, and litigation is ongoing. Nevertheless, the company proceeded with proxy voting solicitation based on incomplete shareholders' meeting agenda items.

One shareholder said, "When the proxy agency came to collect the proxy voting forms, I did not even know there was a shareholder-proposed agenda item," adding, "After handing over the proxy form, I realized the situation and requested to have the proxy form returned."

There are opinions that soliciting proxy voting rights in advance with incomplete shareholders' meeting agenda items could be considered illegal.

According to legal experts, "If voting rights are delegated in violation of proxy voting solicitation regulations, various issues may arise, such as whether the voting rights can be restricted or what the validity is if the proxy exercises voting rights contrary to the explicit intentions of the shareholder."

In response, ToBeSoft stated, "We made a corrected disclosure late in the afternoon after the market closed on the 5th, but due to time constraints, the proxy agency was notified late," adding, "Therefore, the proxy agency had no choice but to accept the delegation."

Meanwhile, ToBeSoft made a corrected disclosure stating that it added the shareholder-proposed new director election agenda item and will start proxy voting solicitation from the 14th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)