Key Points of the Vote Battle at the March 15 General Meeting

Management Dispute Between 'Daol Investment & Securities Alliance' and CEO Kim Gisu

Minority Shareholders' Consent Excluding Major Shareholders as a 'Variable'

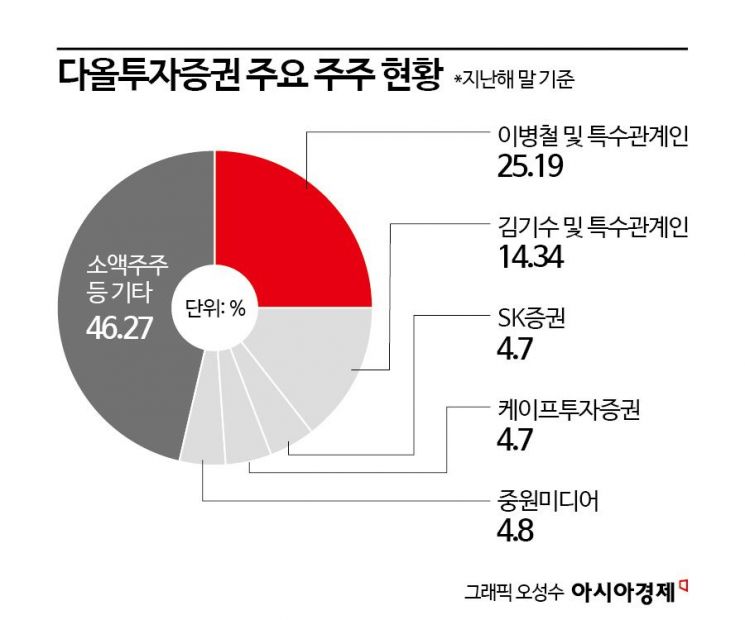

With the Daol Investment & Securities shareholders' meeting scheduled for the 15th, market attention is focused on the management rights dispute between Lee Byung-chul, chairman of Daol Financial Group, and Kim Ki-su, CEO of Presto Investment Advisory and the second-largest shareholder. Since the difference in shareholding between the two sides is not significant, the direction of the management rights dispute is expected to hinge on the outcome of the shareholders' meeting.

According to the financial investment industry on the 12th, as of the end of last year, SK Securities and Cape Investment & Securities each held approximately 4.7% of Daol Investment & Securities shares. These two securities firms began purchasing shares after Kim Ki-su, CEO of Presto Investment Advisory, became the second-largest shareholder of Daol Investment & Securities in May last year. Their stock purchases continued until the shareholder registry closure date at the end of December last year.

Given that the stock trades were executed around the same time and the final number of shares held is identical, the industry views these two securities firms as likely to support Chairman Lee's side.

Jungwon Media is also presumed to be an ally of Chairman Lee. Jungwon Media reportedly holds a 4.8% stake in Daol Investment & Securities. It is understood that Jungwon Media increased its stake by participating in a block deal transaction of Daol Investment & Securities shares held by KB Asset Management at the end of last year.

SK Securities, Cape Investment & Securities, and Jungwon Media all acquired less than 5% stakes, thus avoiding the '5% rule' which mandates disclosure of shareholding changes. Combined, the three companies hold 14.2%. The gap between Chairman Lee's side (25.19%) and CEO Kim's side (14.34%) as of the shareholder registry closure date is only 10.85%. This is why the small shareholders' votes are expected to play a 'casting vote' role. CEO Kim's side is encouraging small shareholders to electronically delegate their voting rights through the activist platform service 'B-Side.' Depending on the response from small shareholders, the likelihood of checks on the current management will be determined.

Furthermore, Chairman Lee is at a disadvantage in the vote for appointing outside directors who will serve as audit committee members subject to the '3% rule.' The 3% rule limits the voting rights of major shareholders to a maximum of 3% when electing outside directors to serve as audit committee members. Currently, in the vote for audit committee appointments, CEO Kim's side holds a total voting right of 6.87%, surpassing Chairman Lee. Under the Commercial Act, listed companies with assets exceeding 2 trillion won must elect at least one audit committee member separately from directors. Therefore, Daol Investment & Securities has submitted a proposal to appoint Lee Sang-mu, CEO of SL Platform, as an outside director to serve as an audit committee member. In response, CEO Kim's side has proposed appointing Professor Kang Hyung-gu of Hanyang University's Department of Finance and Management as an outside director.

Meanwhile, CEO Kim is currently under suspicion of evading the preliminary review of major shareholder eligibility. The Financial Supervisory Service is investigating whether CEO Kim avoided the major shareholder eligibility review by dividing shares with special related parties such as relatives to keep the stake below 10% during the acquisition process of Daol Investment & Securities shares. Under the Commercial Act, if an individual, excluding special related parties, holds more than 10% of voting shares in a financial company, they are subject to the major shareholder eligibility review.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)