Last Year, Global Chocolate Market Reached 162 Trillion KRW, Up 9% YoY

Premium Products Gain Attention, Elevated to High-End Desserts

Functional Ingredients Transform Them into Healthy Snacks

The chocolate market continues its growth trend through a successful image transformation. While chocolate in the past was simply a sweet snack, it has recently been reborn as a premium dessert through small packaging, upgraded ingredients, and the inclusion of functional components.

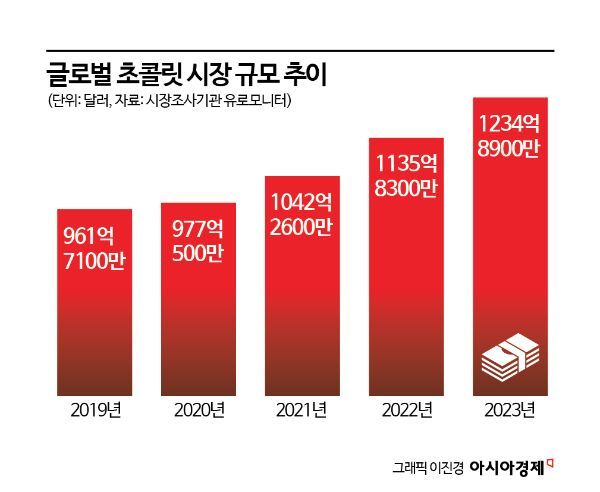

According to market research firm Euromonitor on the 12th, the global chocolate market size last year was $123.489 billion (approximately 162 trillion KRW), showing an 8.7% growth compared to the previous year ($113.583 billion). Chocolate consumption increased during the COVID-19 pandemic as it was recognized as a product that could provide psychological comfort. As a result, the chocolate market, which was at $96.171 billion (about 126 trillion KRW) in 2019, has shown an average annual growth rate of 6.5% over the past four years through last year.

Premium chocolate is currently driving demand in the chocolate market. As consumers’ tastes and standards have risen, consumption of high-end desserts has increased. In particular, the small luxury trend has spread mainly among young consumers, significantly boosting demand for handmade chocolates and gift-packaged chocolates. In the past, children and teenagers who enjoyed sweetness were considered the main consumers of chocolate. However, due to demographic changes reducing their proportion and a food consumption trend emphasizing health, sugar-free chocolates with alternative sweeteners that reduce calories are emerging, promoted as pairings with coffee and wine rather than high-sugar chocolates.

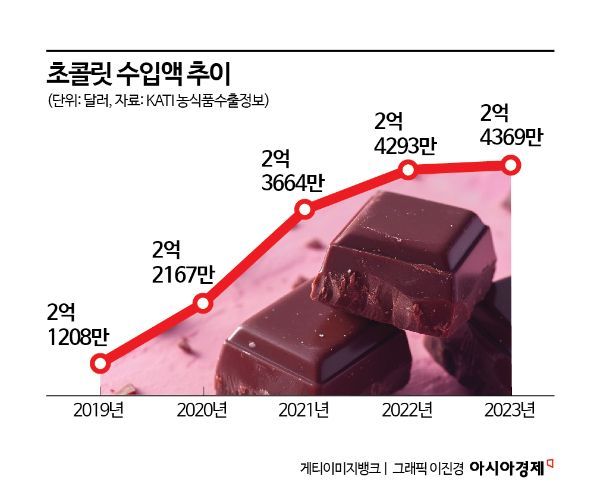

As demand for premium chocolate increases, chocolate import volumes are naturally rising as well. Last year, chocolate imports amounted to $243.69 million (about 320 billion KRW), showing an average annual growth rate of 3.5% since 2019. Imports are mainly from European countries such as Belgium (15.0%), famous for Godiva; Italy (11.4%), represented by Ferrero Rocher; and Germany (10.2%), which distributes Merci and Milka.

Domestic companies are also actively responding to these market changes. Lotte Wellfood, the leading domestic chocolate company, launched the premium chocolate brand "Premium Ghana," a higher-tier brand of the existing "Ghana," at the end of last December to meet the demand for premium chocolate. Premium Ghana is a dessert chocolate emphasizing deeper and richer flavors than existing products, made with carefully selected ingredients by professional chocolatiers. Lotte Wellfood is focusing on promoting the new brand through recent TV commercials and pop-up stores, aiming to give Premium Ghana a new image as a dessert and to renew the identity of the Ghana brand, which celebrated its 50th anniversary since its launch in 1975.

Along with premiumization, attention to chocolates that combine health benefits and nutrition is also increasing. In line with trends to reduce sugar intake and pursue healthy eating habits, chocolates sweetened with alternative sweeteners or fruit sugars instead of sugar, and containing functional ingredients such as prebiotics, magnesium, and protein instead of artificial flavors, synthetic colors, or gluten, are gaining popularity. Functional chocolates are praised for allowing consumers to intake specific nutrients or health supplements conveniently in the form of a regular snack without the hassle of taking separate supplements.

In Korea, Daesang recently launched a new functional food brand called "Pikitaka" and released five types of chocolates as its first products. These products contain ingredients such as red ginseng, known to help boost immunity, and indigestible maltodextrin, known to aid bowel movements. Daesang plans to actively target the related market as a new form of healthy snack by focusing on the changed eating habits of modern people.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)