GIC Prefers Alternative Investments, Directly Invests in Korean Stock Market

K-Defense Leader 'LIG Nex1', Dental 3D Printing 'Ray'

Singapore Investment Corporation (GIC), the world's 6th largest sovereign wealth fund, has acquired more than 5% stakes in one company each listed on Korea's KOSPI and KOSDAQ markets. GIC, which manages the majority of Singapore government's financial assets, has primarily focused its investments in Korea on alternative assets such as real estate and private equity. Amid efforts by the Korean government and financial authorities to boost the domestic stock market through corporate value-up programs, interest is rising in the Korean listed companies included in GIC's investment portfolio.

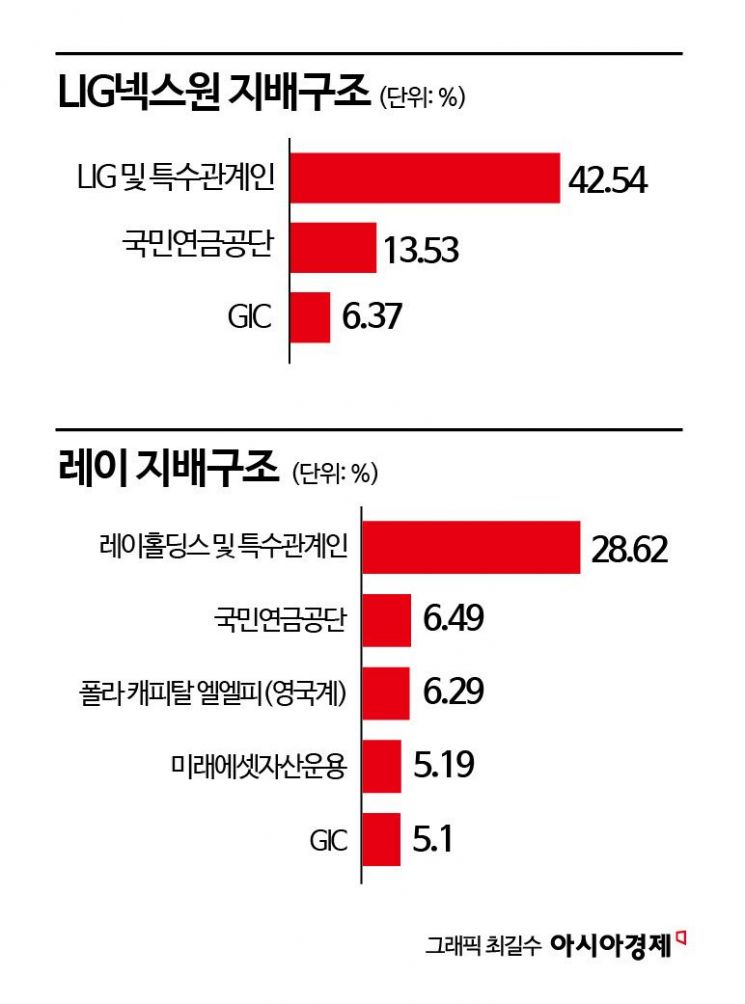

According to the Financial Supervisory Service's electronic disclosure system on the 12th, GIC recently disclosed holding a 6.37% stake in KOSPI-listed LIG Nex1 (as of March 7) and a 5.1% stake in KOSDAQ-listed Ray (as of February 26).

GIC is the world's 6th largest sovereign wealth fund with assets under management totaling $770 billion (approximately 1,016 trillion KRW). Singapore Prime Minister Lee Hsien Loong serves as its chairman. Domestically, GIC is well known for investing in the Seoul office market, including Seoul Finance Center (SFC) in Jung-gu, Gangnam Finance Center (GFC) in Gangnam-gu, and Shinhan Financial Investment in Yeouido. The companies in which GIC has directly invested in the Korean stock market, LIG Nex1 and Ray, are Korean firms distinguished by their global technological competitiveness. The K-defense industry and 3D oral solutions sectors are areas where Korean companies have recently gained notable attention in the global market.

The stake GIC holds in LIG Nex1 is the third largest after the largest shareholder LIG and its affiliates (42.54%) and the second largest shareholder, the National Pension Service (13.53%). GIC has specified its holding purpose as "simple investment." When the holding ratio exceeds 5%, a new reporting obligation arises. GIC began purchasing large volumes of LIG Nex1 shares starting from February 28. The investment industry interprets GIC's large-scale investment in LIG Nex1 as a response to analyses predicting increased orders for guided missiles worldwide due to international geopolitical instability. Securities firms forecast that LIG Nex1's order backlog will exceed 15 trillion KRW by the end of this year. Foreign investors have consecutively net purchased LIG Nex1 shares for nine trading days since February 26, with a significant portion presumed to be GIC's purchases.

In addition to LIG Nex1, GIC has also made a large-scale equity investment in Ray, a KOSDAQ company. As of February 26, GIC holds a 5.1% stake in Ray. Ray specializes in dental diagnostic equipment. Since launching its dental 3D printing solution in 2017, the company's growth has been driven by its digital treatment solutions segment. The industry regards Ray as having established a one-stop total solution covering everything from dental diagnosis to treatment. Ray was listed on the KOSDAQ market on August 8, 2019. Prior to GIC, several institutional investors had shown interest in the company. Besides the controlling shareholder Ray Holdings, major institutional investors holding over 5% stakes include the National Pension Service (6.49%), UK-based investment firm Polar Capital (6.29%), and Mirae Asset Global Investments (5.19%). Ray's revenue has rapidly grown, with 55.2 billion KRW in 2020, 90.3 billion KRW in 2021, 129 billion KRW in 2022, and an estimated 148.6 billion KRW in 2023 (according to securities firms). Ji-eun Kim, a researcher at DB Financial Investment, stated, "Additional top-line growth is expected this year through new contracts with U.S. retailers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)