First Day of Listing 50,000 KRW → 16,000 KRW After One Month

100% of Top Range in Demand Forecast for January-February Used to Set IPO Price

Greater Discrepancy Between IPO Price and Stock Price Advises 'Cautious Investment'

As funds flood into the initial public offering (IPO) market, controversies over inflated offering prices continue unabated. Online home furnishing distributor Studio Samik recorded high competition rates in demand forecasting and public subscription, but its stock price has been hitting new lows day after day since its listing.

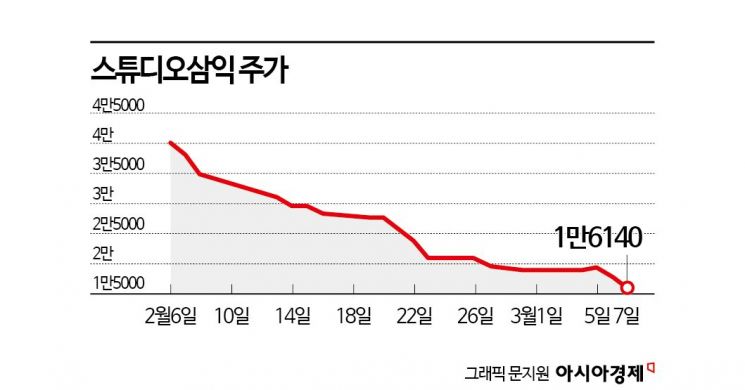

According to the financial investment industry on the 8th, Studio Samik's stock price fell 69.3% within a month compared to the all-time high of 52,600 KRW recorded on the first day of listing on the 6th of last month.

Founded in 2017, Studio Samik operates an online home furnishing distribution business that offers its own brand products to customers through various online platforms. It does not own separate manufacturing facilities but produces products through manufacturing partners. It possesses planning capabilities and production capacity that allow it to launch products within a month from planning to release. Through a direct-to-consumer (D2C) logistics system, it quickly delivers products to consumers and has grown rapidly. From 2018 to 2022, it recorded an average annual sales growth rate of 46.5%, surpassing the industry average growth rate of 3.1%.

During the demand forecasting conducted over five days from January 17 to 23 targeting institutional investors, it recorded a competition rate of 967 to 1. The offering price was set at 18,000 KRW, exceeding the expected range of 14,500 to 16,500 KRW. Nine out of ten institutional investors offered prices above 20,000 KRW.

A representative from DB Financial Investment, which underwrote the listing, said, "99% of the requested quantities were offered at prices above the upper limit of the expected range," adding, "We set the offering price at 18,000 KRW to lower the entry barrier for general investors with a market-friendly offering price."

The public subscription for general investors also continued to attract strong interest. The subscription competition rate reached 2,650 to 1, and subscription deposits amounted to 5 trillion KRW.

On the first day of listing, trading started at 52,000 KRW, 188.9% higher than the offering price. The stock price then rose to 52,600 KRW before closing at 39,900 KRW. While public offering investors may have achieved high returns, investors seeking short-term capital gains by taking advantage of the high volatility on the first day likely incurred losses.

Since then, no significant rebound has occurred, and the stock price has continued to decline daily. The previous day's stock price fell to 16,040 KRW, below the per-share valuation of 20,526 KRW calculated by the underwriter to propose the expected offering price range. The underwriter evaluated Studio Samik's appropriate corporate value at 90 billion KRW based on cumulative net profit up to the third quarter of last year. Three listed companies?Zinus, Sidiz, and Ohaim & Company?were selected as comparable companies, and an average price-earnings ratio (PER) of 28.9 times was applied.

A discount rate of 19.6% to 29.4% was applied to the valuation to propose the expected offering price range of 14,500 to 16,500 KRW, but the offering price rose following the demand forecasting results.

An investment banking (IB) industry official explained, "Since the expanded volatility on the first day of listing, funds have been pouring into the public subscription market," adding, "The higher the rate of offering prices confirmed above the expected range, the stronger the controversy over overvaluation becomes."

Looking at the offering price confirmation status after demand forecasting this year, 100% of the offering prices were confirmed above the upper limit. The average initial price return of newly listed companies that entered the market in January and February reached 183.5%. Speculative funds seeking short-term capital gains on the first day of listing create high initial prices and increase trading volume, but many newly listed companies see their stock prices converge toward the offering price afterward. A financial investment industry official said, "Investing in new stocks requires caution," adding, "The greater the gap with the offering price, the harder it is to gauge support levels when the stock price turns downward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.