BBB Rating, 30 Billion KRW Offering Increased by 45 Billion KRW

New Balance Growth in Focus... China’s Kids Brand 'Hwalhwang' Thriving

The sports brand 'New Balance' has emerged as a growth engine for E-Land by generating 1 trillion KRW in sales last year in South Korea and China. Conservative investors are paying close attention to New Balance's explosive growth in the South Korean and Chinese markets, which is also easing E-Land's financing constraints.

According to the distribution and securities industries on the 6th, E-Land (BBB) will issue 2-year corporate bonds worth 45 billion KRW. The initial target amount was 30 billion KRW, but during the demand forecast on the 26th of last month, orders totaling 43 billion KRW were received at an interest rate 20 basis points (1bp=0.01 percentage point) higher than the rate (7.72%) proposed by a private bond rating agency, leading to an increase in the issuance amount.

E-Land stated that it was willing to add up to 30 basis points more than the initially proposed interest rate, but the order amount was fully filled without exceeding that range. With the increased issuance, E-Land will be able to relieve debt repayment pressure for the time being. The 43 billion KRW issued this time will be used entirely for debt repayment according to the refinancing plan scheduled by June, as there are no large debt securities maturing except for the 50 billion KRW corporate bonds maturing in September.

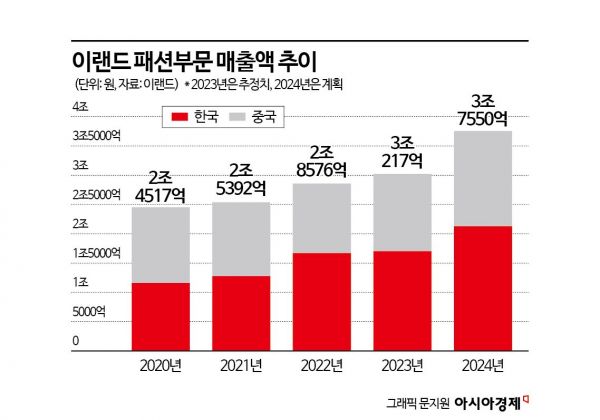

Six months ago, E-Land faced unsold bonds in the corporate bond market and was shunned by investors. Despite having the same credit rating, the 1.5-year bonds (60 billion KRW) and 2-year bonds (40 billion KRW) only received orders of 5 billion KRW and 21 billion KRW, respectively. Although issuance was barely achieved with the help of the Korea Development Bank, the offered interest rates were 7.8% and 8.3%, respectively. Half of E-Land's sales come from the fashion sector, and another 30% from NC Department Store and outlets. Institutional investors refrained from investing due to concerns that the company's financial structure would deteriorate amid weakened consumer sentiment caused by the economic downturn.

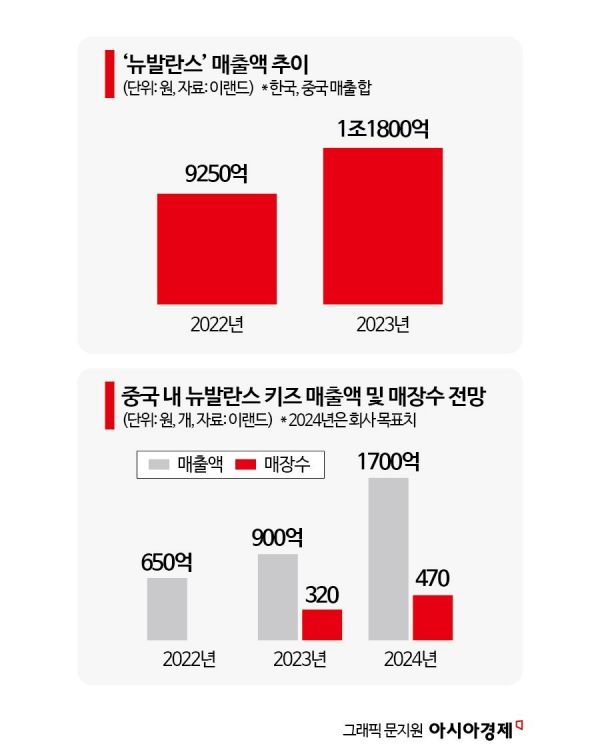

However, E-Land turned the previously negative investor sentiment positive within half a year by leveraging New Balance. E-Land holds the distribution rights for New Balance and New Balance Kids in South Korea and China. Last year, E-Land recorded sales of 1.2 trillion KRW in these two countries. Sales in the domestic market alone reached 900 billion KRW, and the fashion industry estimates that New Balance's sales have surpassed those of Adidas, the second-largest sports brand. The growth of New Balance has led to improved performance in the fashion sector. Despite weakened consumer sentiment and China's economic downturn, E-Land's fashion division posted sales exceeding 3 trillion KRW, a 6% increase compared to the previous year.

The star product is sneakers targeting the domestic MZ generation (Millennials + Generation Z). E-Land introduced products in collaboration with global luxury brands Miu Miu and Ganni, some of which were produced as limited editions and caused sell-out frenzies. E-Land has also worked to solidify New Balance's brand fandom. They opened a pop-up store at The Hyundai Seoul featuring a reinterpretation of the steady-selling sneaker model '574' and conducted marketing using influencers, which is believed to have triggered the MZ generation's "dito consumption" (purchasing products that appear on social networking services (SNS)).

The market is closely watching how much 'New Balance Kids' can grow in the Chinese market. Last year, New Balance Kids sales were overwhelmingly larger in the domestic market (200 billion KRW), but in terms of growth rate, China is far ahead at around 40%, compared to 11% domestically. This is due to a decrease in newborns in China and the economic leadership of young high-income groups who have increasing demand to buy good products for their children. According to Euromonitor, the Chinese children's clothing market size is expected to exceed 450 billion yuan by 2025, up from 370 billion yuan in 2023.

E-Land plans to absorb this demand by expanding New Balance Kids stores. Some stores will be directly operated as road shops locally in China, while others will be run in a "small owner" format, recruiting local agents responsible for individual stores and commercial districts. The expected sales this year are projected to grow 82% from last year to 170 billion KRW, with about 150 additional stores planned to open. An E-Land official explained, "If last year was a period to test market potential, this year is the stage for full-scale expansion." They added that recent events to check how much local agents would purchase received positive responses, so the brand's expansion speed is expected to accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)