Loan Application Yongin>Suwon>Seongnam Order

It was found that 7 out of 10 applicants for refinancing mortgage loans are users in the Seoul metropolitan area.

Finda, a fintech (finance + technology) company specializing in loan brokerage and management, released the "National Mortgage Loan Refinancing Map" containing data of users of the mortgage loan refinancing service on the 26th. This is the result of analyzing user data from the Finda application (app) from the government's introduction of mortgage refinancing on the 9th of last month until the 21st.

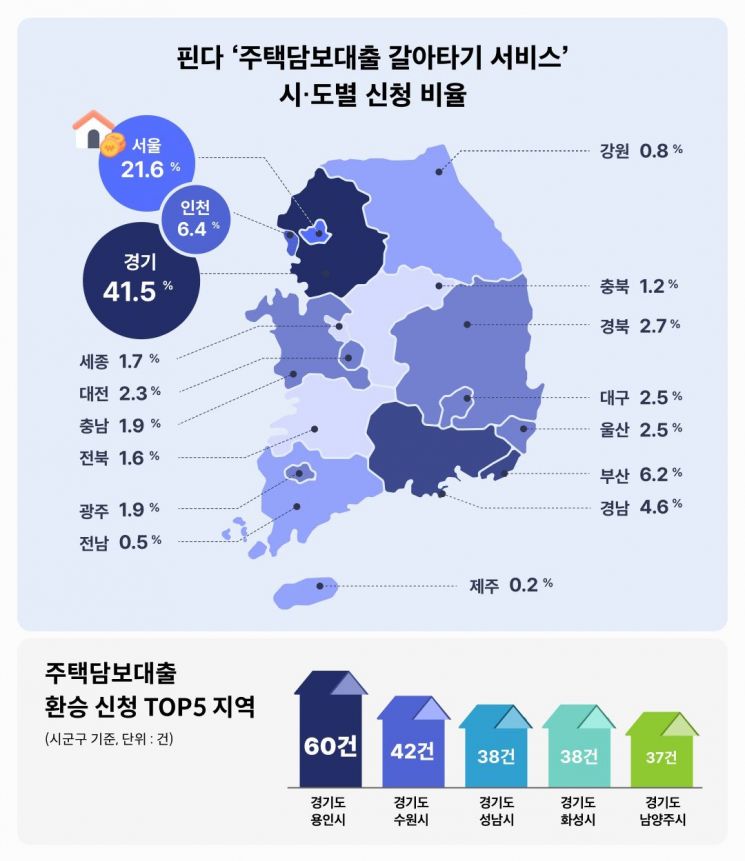

Looking at the application rates by city and province nationwide, the Seoul metropolitan area accounted for 70%. The city/province with the highest number of applications was Gyeonggi (41.5%), which was about twice as high as Seoul (21.6%). The third place was Incheon (6.4%), with all top three regions located in the Seoul metropolitan area. Following were Busan (6.2%), Gyeongnam (4.6%), Gyeongbuk (2.7%), Ulsan (2.5%), Daegu (2.5%), Daejeon (2.3%), Gwangju (1.9%), Chungnam (1.9%), Sejong (1.7%), Jeonbuk (1.6%), Chungbuk (1.2%), Gangwon (0.8%), Jeonnam (0.5%), and Jeju (0.2%) in order of high application rates.

At the city/county/district level, the area with the highest number of loan applications was Yongin (60 cases). Suwon (42 cases), Seongnam (38 cases), Hwaseong (38 cases), and Namyangju (37 cases) followed, with all top five regions concentrated in Gyeonggi Province.

The average loan application amount was 169.57 million KRW, and if the contract is successful, the loan interest rate is expected to be reduced by an average of 1.56 percentage points. The expected interest rate reduction was lower in the Seoul metropolitan area (-1.53 percentage points) than in non-metropolitan areas (-1.63 percentage points). However, the loan amount applied for in the Seoul metropolitan area (184.52 million KRW) was about 36% higher than in non-metropolitan areas (135.57 million KRW), indicating that the interest burden in the metropolitan area is relatively high.

Among users who applied for loans, males (79.2%) were about four times more than females (20.8%). By age group, those in their 50s (40.6%) and 40s (38.7%) combined accounted for nearly 80%, followed by those in their 60s (12.9%), 30s (7.7%), and 20s (0.2%).

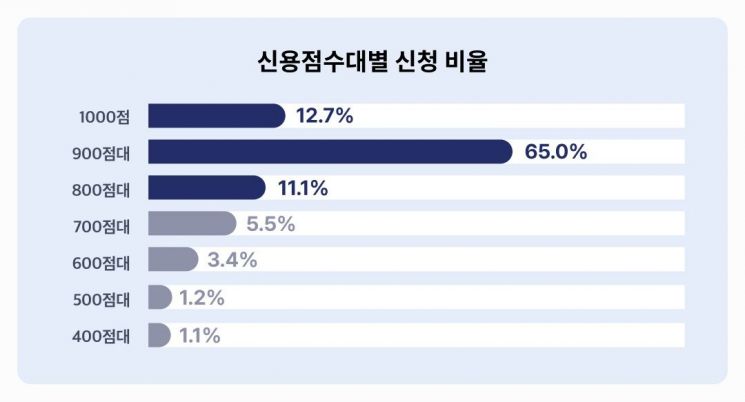

By credit score range, users with scores in the 900s accounted for 65%, and users with a perfect score of 1000 accounted for 12.7%, making the proportion of high-credit users with scores above 900 nearly 80%. The proportion of thin filers, such as housewives and freelancers with insufficient financial history, was 26.9%.

Lee Hyemin, co-CEO of Finda, said, “Interest in the mortgage loan refinancing service is higher than ever, with loan limit inquiries tripling immediately after the service was launched,” adding, “We will continue to partner with many affiliates to introduce products with favorable conditions to reduce the interest burden.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)