Unlike Japan, Companies 'Themselves'

Drive Corporate Value Through Incentives

Board of Directors as Main Agent of Value Enhancement

Avoid 'Short-Term Boons'... Emphasize Mid- to Long-Term Policies

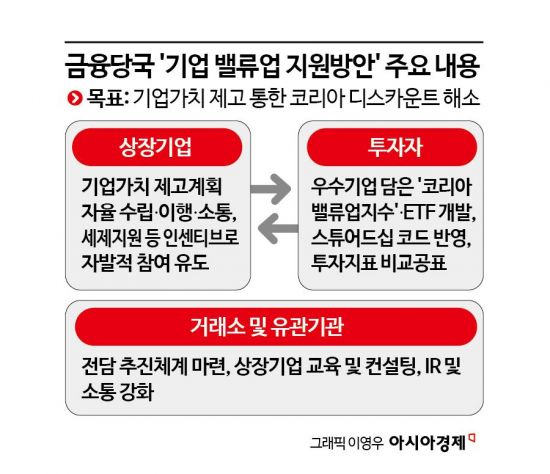

The core content of the 'Corporate Value-Up Program' is that the board of directors of listed companies takes the initiative to voluntarily prepare and disclose plans to enhance corporate value. Unlike Japan's value-up program, which is essentially mandatory, our government plans to encourage voluntary participation by companies through incentives such as tax support.

Five Types of Tax Support Not Found in Japan... Incentives for Voluntary Corporate Participation

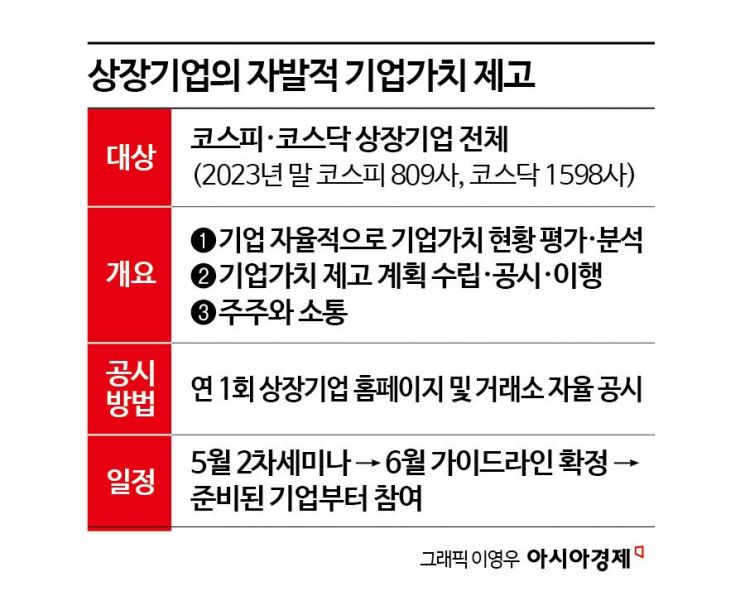

From now on, all corporations listed on KOSPI and KOSDAQ must analyze their current corporate value and disclose a 'Corporate Value Enhancement Plan' once a year on their website and to the stock exchange. The Financial Services Commission plans to establish guidelines for the corporate value enhancement plan in June and revise the enforcement rules related to disclosure regulations. To this end, it will gather opinions from companies and the market again in May to finalize the details.

The corporate value enhancement plan must include four essential elements: ① Current status diagnosis, ② Goal setting, ③ Plan establishment, and ④ Implementation evaluation and communication. During the current status diagnosis, companies must assess their own capital costs, capital profitability, governance, and other factors to evaluate whether their current corporate value is at an appropriate level.

Based on this, mid- to long-term goals are set to improve capital efficiency and other factors. The Financial Services Commission has suggested a minimum goal period of three years or more. A Financial Services Commission official emphasized, "It is not enough to look for short-term favorable factors; it is important to continuously present corporate value enhancement measures and communicate with investors."

The plan must not only set goals but also include specific management strategies and implementation schedules. From the second year of disclosure, the achievement and evaluation of goals must be reflected. The evaluation will also include whether communication with not only institutional investors but also general investors has been strengthened.

In particular, the role of the board of directors is emphasized in preparing corporate value enhancement measures. The role of the board will be specified in the guidelines to be announced in June.

Namwoo Lee, Chairman of the Korea Corporate Governance Forum, said, "The corporate value-up program should be developed centered on the board of directors," and evaluated it as "a balanced policy in that companies themselves prepare corporate value enhancement measures rather than government coercion."

Five Types of Tax Support Not Found in Japan... Incentives for Voluntary Corporate Participation

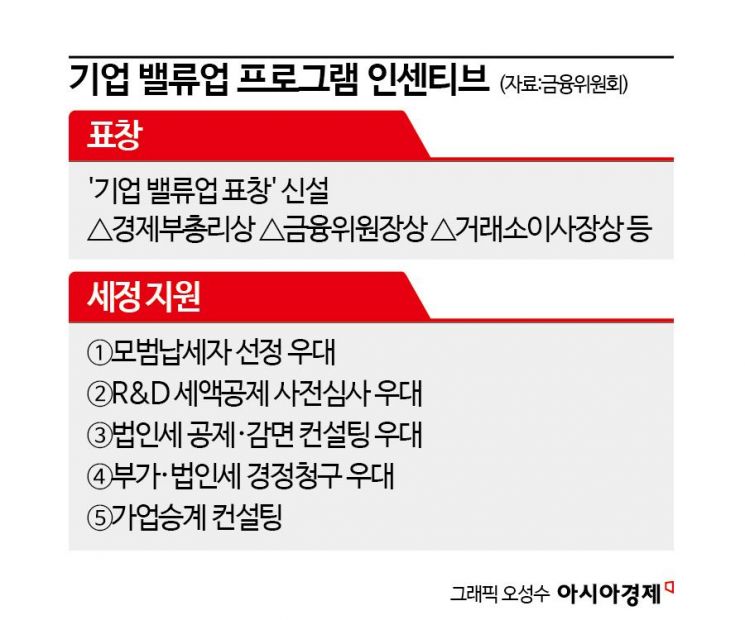

The financial authorities have prepared incentives such as tax support and awards to encourage companies to voluntarily prepare corporate value enhancement measures. This is the biggest difference from Japan's value-up program.

Government-level 'Corporate Value-Up Awards' such as the Deputy Prime Minister Award, Financial Services Commission Chairman Award, and Stock Exchange Chairman Award will be newly established. About 10 listed companies will be awarded every May based on a comprehensive evaluation of the completeness, implementation, and shareholder communication of their corporate value enhancement plans.

The approximately 10 awarded listed companies will receive tax support. Practical benefits include △ preferential selection as exemplary taxpayers △ preferential pre-review for research and development (R&D) tax credits △ preferential consulting for corporate tax credits and exemptions △ preferential claims for value-added and corporate tax adjustments △ consulting for business succession.

Companies that actively present corporate value enhancement measures will also receive preferential treatment. Since companies voluntarily disclose, those that participate actively will be selected as excellent disclosure companies by the stock exchange. Being selected as an excellent disclosure company can provide benefits such as exemption from listing fees and deferral of designation as a non-compliant disclosure company. Additionally, they will receive bonus points when selected for the KOSDAQ Association's KOSDAQ Awards.

However, contrary to companies' expectations, preferential inheritance tax rates were excluded from the incentive discussions. Under the current Inheritance and Gift Tax Act, the maximum tax rate is 50%. For large corporations, an additional tax on control premiums applies, raising the maximum rate to 60%. This is among the highest levels compared to OECD member countries. From the owner's perspective, undervaluation of the company's stock price is advantageous for succession. Due to this, there have been ongoing claims, especially from listed companies, that lowering inheritance tax rates should be considered to encourage active shareholder returns. A government official explained, "The government’s position is that the inheritance tax issue should be decided carefully."

Development of Korea Value-Up Index... Attracting Institutional and Foreign Investors

Financial Services Commission Chairman Kim Ju-hyun is speaking about support measures for corporate value-up at the Emergency Economic Ministers' Meeting held at the Government Seoul Office in Jongno-gu, Seoul on the 26th. Photo by Jo Yong-jun jun21@

Financial Services Commission Chairman Kim Ju-hyun is speaking about support measures for corporate value-up at the Emergency Economic Ministers' Meeting held at the Government Seoul Office in Jongno-gu, Seoul on the 26th. Photo by Jo Yong-jun jun21@

To ensure that corporate value enhancement measures are reflected in stock prices, an Exchange-Traded Fund (ETF) related to the 'Korea Value-Up Index' will also be developed. The Financial Services Commission plans to develop the index by September this year by gathering opinions from asset management companies, institutional investors, and experts, and launch the related ETF in the fourth quarter.

The composition of the Korea Value-Up Index has not yet been finalized. However, it will comprehensively consider key investment indicators such as price-to-book ratio (PBR), price-to-earnings ratio (PER), return on equity (ROE), payout ratio, dividend yield, and cash flow. Furthermore, companies that have received the Corporate Value-Up Award will also be included in the index.

In Japan, the 'JPX Prime 150 Index' was launched in July last year. It consists of 150 companies listed on the Prime Market with high capital efficiency and sustainability. Relatedly, Daiwa Asset Management has launched the 'ifree JPX prime 150 ETF' product.

Once the Korea Value-Up Index is developed, it can be used for the launch of financial products such as ETFs and funds, and institutional investors like pension funds are expected to use it as a benchmark indicator.

Furthermore, the Financial Services Commission plans to specify in the guidelines that institutional investors such as pension funds should reflect corporate value enhancement efforts in their investment decisions through the Stewardship Code (active exercise of voting rights by institutional investors). This means creating a virtuous cycle where efforts by listed companies to enhance corporate value lead to investments by institutions and foreigners.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)