From the 26th, Step 1 Mortgage Loan Additional Interest Rate '+0.38%'... Gradual Increase

Next Year, Stress Interest Rate '100%' Applied Uniformly to All Financial Sector Loan Products

Existing DSR + Additional Interest Rate... 'Stress Interest Rate' Calculated Twice a Year

'Annual Income 50 Million Won' 329 Million Won → 315 Million Won... 278 Million Won Next Year

'Periodic and Fixed Types' Have Reduced Additional Interest Rates Compared to Variable Type

A customer is receiving consultation at the bank loan consultation desk. Photo by Jinhyung Kang aymsdream@

A customer is receiving consultation at the bank loan consultation desk. Photo by Jinhyung Kang aymsdream@

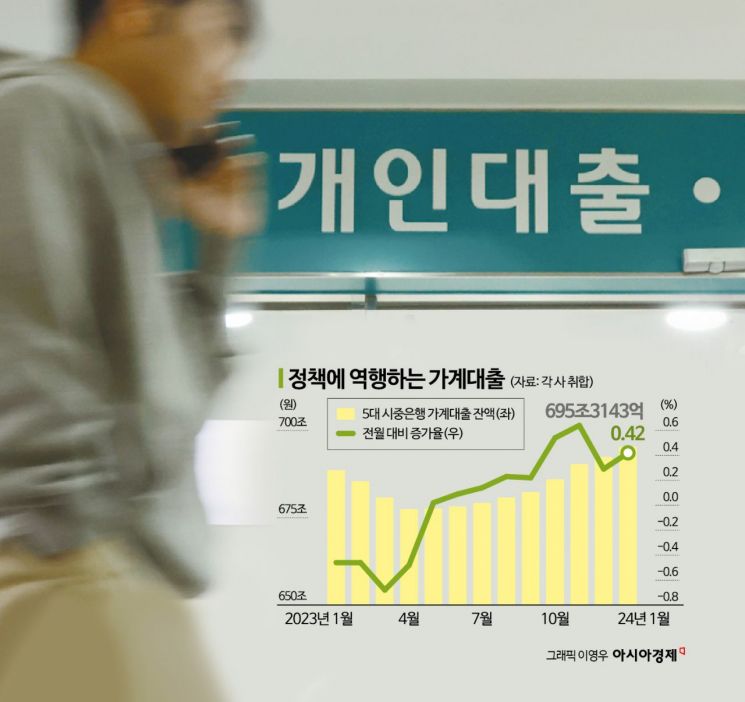

Starting today (the 26th), the amount of mortgage loans available from major commercial banks will decrease according to the newly applied 'Stress Debt Service Ratio (DSR)'. For an annual income of 50 million KRW, the previous variable-rate loan limit (30-year maturity with installment repayment) was up to 329 million KRW, but it will now decrease by 14 million KRW to 315 million KRW, and next year it will further drop by 51 million KRW to 278 million KRW. Since the government plans to gradually strengthen the application of the 'Stress DSR' this year and expand its scope, it is expected to curb the rising trend of household loans, which have ballooned to 1,886 trillion KRW.

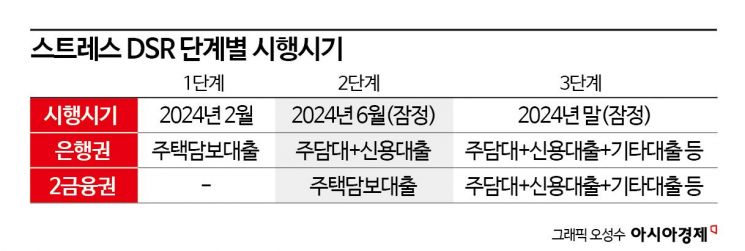

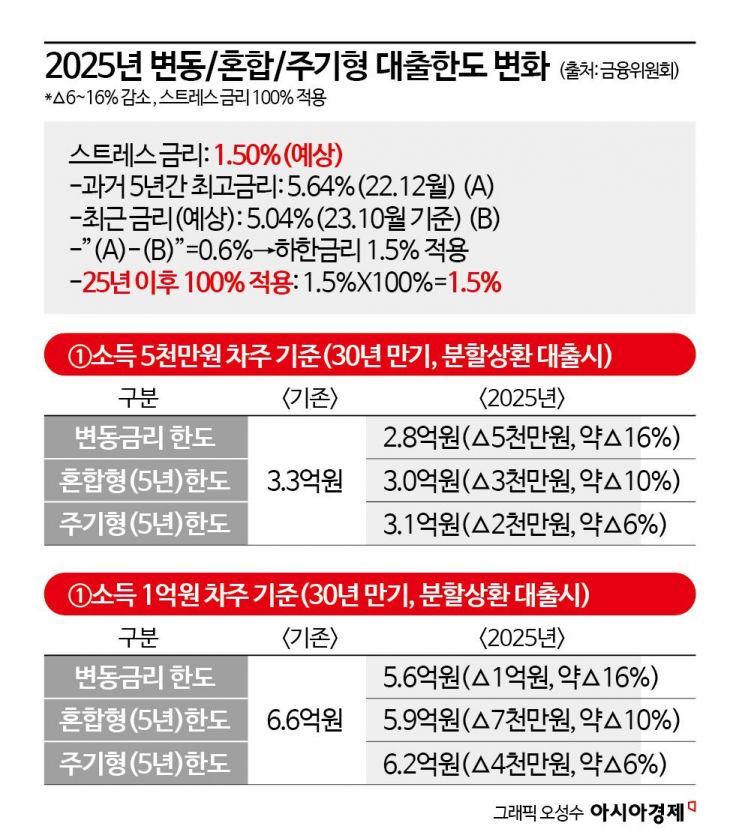

The 'Stress DSR' implemented by financial authorities and banks from today adds a stress (additional) interest rate of 1.5% to the existing DSR regulation. The stress interest rate applied from the 26th to June 30 is 0.38%, and the authorities will initially add 25% of the stress interest rate to mortgage loans by banks, increasing it to 50% in the second half of the year. Next year, the full calculated stress interest rate will be reflected. This is a phased measure to mitigate the policy's impact.

The stress interest rate is calculated every June and December by reflecting the difference between the highest interest rate in the past five years and the current rate. However, the lower and upper limits are set at 1.5% and 3.0%, respectively, to compensate for underestimation and overestimation during interest rate fluctuations, and more lenient standards are applied to mixed and periodic products compared to variable-rate loans. For a mortgage loan with a variable interest rate of 5% per annum, the loan limit is determined by adding 0.38% (rounded to the third decimal place), which is 25% of the 1.5% stress interest rate. In the second half of the year, the loan amount will be calculated based on adding 0.75%, and next year, the full 1.5% will be applied.

Due to the application of the stress interest rate, the mortgage loan limits per borrower in the first half of this year are expected to decrease by about 2-4% depending on the loan type?variable, mixed, or periodic. For a salaried worker with an annual income of 100 million KRW taking a variable-rate mortgage loan, the loan amount will decrease by up to 100 million KRW next year. In the first half, the loan amount will reduce from 660 million KRW to 630 million KRW, then to 600 million KRW in the second half, and finally to 560 million KRW next year, a decrease of 100 million KRW.

The loan limit is somewhat higher for periodic loans. If a salaried worker with an annual income of 100 million KRW chooses a 30-year maturity, 5-year periodic product, the loan amount will be 650 million KRW in the first half, 640 million KRW in the second half, and 620 million KRW next year. This is 60 million KRW higher than the variable-rate loan limit next year. For a salaried worker with an annual income of 50 million KRW borrowing with a 5-year periodic loan, the loan limit decreases from the previous 329 million KRW to 325 million KRW in the first half, a reduction of 5 million KRW. In the second half, it decreases by 9 million KRW to 320 million KRW, and next year, it further decreases by 17 million KRW to 312 million KRW.

Going forward, the authorities will gradually increase the reflection ratio of the stress interest rate and expand the scope of application. From June, the Stress DSR will also apply to bank credit loans exceeding 100 million KRW with maturities under 5 years. The same Stress DSR will be applied to mortgage loans from secondary financial institutions such as savings banks and mutual finance companies. Starting next year, a 100% additional interest rate will be applied to all loans across the entire financial sector, including other loans.

However, some loans are either not immediately subject to the stress interest rate or are exempt. Group loans with a move-in announcement issued by the 25th and general mortgage loans with real estate sales contracts signed are exempt from the stress interest rate. Especially, if the loan amount is not increased and the loan is refinanced or renewed with the same bank, the stress interest rate will not be applied until the end of this year. Financial products for low-income households, small loans, installment loans, as well as savings and deposit collateral loans, insurance contract loans, and jeonse (key money deposit) loans will also remain exempt, applying the existing DSR standards.

As the application of the stress interest rate intensifies mainly for variable-rate loans, borrowers who want larger loan amounts are increasingly likely to switch to periodic or fixed-rate loans. Some major commercial banks are reportedly considering strengthening their periodic or fixed-rate loan products.

The focus going forward is on the effectiveness of household debt management following the application of the Stress DSR and how much the authorities will reduce the categories exempt from DSR. Since the authorities are determined to firmly establish the principle of managing household debt within the repayment capacity under the Stress DSR, all 'other loans' in both the banking sector and secondary financial sector will be included starting next year.

Kim So-young, Vice Chairman of the Financial Services Commission, stated, "We will closely monitor the loan trends by type and purpose of individual financial companies and discuss self-management plans with financial institutions where loan growth is excessive." She emphasized, "Although there are challenges such as increased loan demand due to expectations of interest rate cuts and concerns about excessive competition in the financial sector, we will manage this strictly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.