Growing Concerns Over North America-Originated Commercial Real Estate Crisis

Investments Across the Globe Including US, UK, Germany, France

Over 400 Billion Won Equity Investment Fully Written Off

Cases of 80-90% Valuation Loss Also Confirmed

As the value of overseas commercial real estate declines mainly in North America, spreading a sense of crisis, it has been confirmed that some overseas real estate investment projects funded by the equity capital of major domestic financial groups have been fully written off. Before the COVID-19 pandemic, investments were made in commercial real estate worldwide, including the United States, Canada, the United Kingdom, Germany, France, Ireland, and India, but it was found that many investments suffered valuation losses of 80-90%.

According to a full survey on overseas real estate investments obtained by Asia Economy on the 23rd through the office of Yang Kyung-sook, a member of the National Assembly's Political Affairs Committee (Democratic Party), 14 overseas real estate investments by the five major financial groups (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) were either fully written off or recognized as mostly losses. The principal amount invested by the five major financial groups amounted to 415.96 billion KRW.

The major financial groups aggressively engaged in overseas real estate investments using their equity capital (general accounts and PI) based on a low-interest-rate environment and abundant market liquidity. During the investment period, they expected rental income and eventual capital gains from sales as part of alternative investments. However, due to the impact of the COVID-19 pandemic, the value of investment properties in the U.S., Canada, the U.K., Germany, and other regions declined, and with global benchmark interest rates continuing to rise, it became difficult not only to earn investment returns but even to preserve the principal.

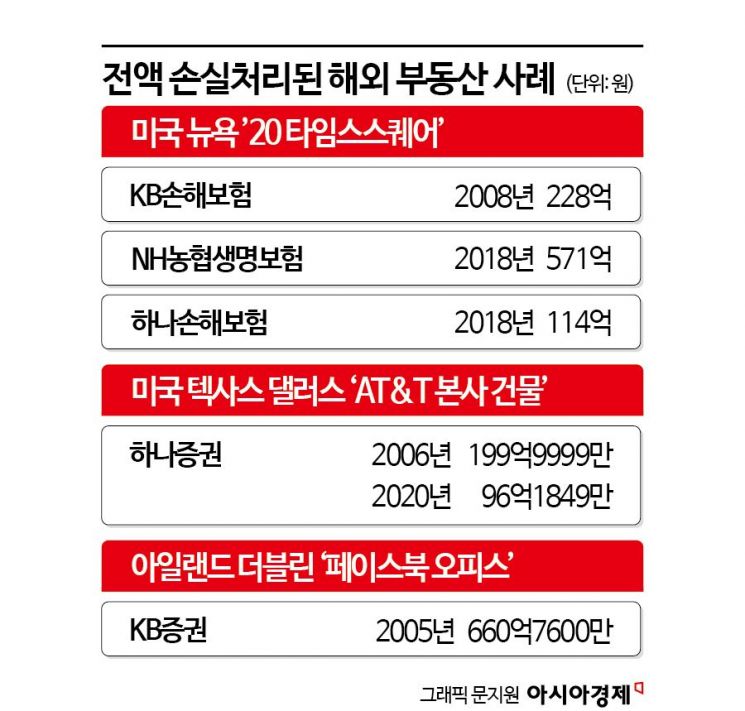

For example, Hana Securities invested 30 billion KRW in the headquarters building of the global telecommunications company AT&T located in Dallas, Texas, but fully wrote off the investment. Hana Securities initially invested 19.99999 billion KRW in August 2006 in the form of beneficiary certificates and attempted a turnaround by investing an additional 9.61849 billion KRW in March 2020, about 14 years later, but currently values the investment at "0 KRW," effectively recognizing a full loss. Hana Life Insurance also recognized a full loss on its 26.3 billion KRW investment in real estate located in the City of London at the end of 2018.

There are also cases where investments in the same overseas real estate were fully written off. KB Insurance, along with Nonghyup Life Insurance and Hana Insurance, invested a total of 91.3 billion KRW in the "20 Times Square" building located in Times Square, New York, at different times?22.8 billion KRW, 57.1 billion KRW, and 11.4 billion KRW respectively. They invested in mezzanine loan bonds through a private equity fund managed by Aegis Asset Management, but contrary to expectations, hotel completion was delayed and the COVID-19 pandemic struck, resulting in an almost total loss of the principal.

Many investments also suffered losses of 80-90%. Shinhan Investment Corp. invested 21.8872 billion KRW in a portfolio of 30 hotels across the U.S. in August 2020, but the current valuation has shrunk to 1.67 billion KRW. The loss rate over 3 years and 2 months was calculated at 92.3%. KB Securities' investment of 17.968 billion KRW in the DSM Building in New Jersey, U.S., is currently valued at only 1.075 billion KRW. Even considering cumulative dividends of 9.711 billion KRW, it falls short of the principal. Woori Bank invested 16.8599 billion KRW in German real estate through the Aegis Global Specialized Private Equity Fund, but the current value has dropped to 2.71265 billion KRW, representing a simple valuation loss of 83%. Cumulative dividends also did not reach 2 billion KRW.

The financial authorities believe that the fully written-off overseas real estate investments are unlikely to immediately escalate into a major crisis. However, there is also a view that the prolonged adverse conditions surrounding the overseas real estate market could expand exposure (risk exposure amount). The Financial Supervisory Service has identified 28 projects where loss of benefit of time (EOD) occurred, with three additional cases since the third quarter of last year. The total investment scale of these 28 projects was estimated at 2.46 trillion KRW.

Kim Byung-chil, Deputy Director of the Financial Supervisory Service, stated, "The scale of overseas real estate investments by domestic financial companies is less than 1% of total assets, and considering the sound capital ratios and loss absorption capacity of financial companies, the impact of investment losses on the financial system is limited." He added, "However, we will encourage appropriate loss recognition and sufficient enhancement of loss absorption capacity in preparation for the possibility of further deterioration in the overseas real estate market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.