4516 Businesses Required to Submit 'Special Collection Statement'... Seoul City Leads

Notice Letters Produced and Mailed by 29th to Encourage Submission

Enhancing Taxpayer Convenience and Tax Transparency through Efficient Tax Administration

Yeongdeungpo-gu (District Mayor Choi Ho-kwon) announced that it will create and send a notice for the submission of the ‘Special Withholding Tax Statement’ to corporate local income tax withholding agents to enhance taxpayer convenience and transparency in tax administration.

There are 4,516 businesses subject to submitting the ‘Special Withholding Tax Statement’ located in Yeongdeungpo-gu, which is the highest number within Seoul.

‘Corporate local income tax withholding agents’ refer to those who withhold 10% of the corporate tax withholding amount as local income tax special withholding when paying interest or dividend income to domestic corporations and foreign corporations with business establishments in Korea. To ensure accurate refunds and settlements of corporate local income tax later, the ‘special withholding agents’ must submit the ‘Special Withholding Tax Statement’ detailing the previous year’s special withholding by the end of February each year to the local government.

As this system is designed to facilitate the local income tax reporting and refund process for corporate taxpayers, the district office will send notices encouraging the submission of the ‘Special Withholding Tax Statement’ online by the 29th.

Additionally, for corporations that do not submit or fail to submit by the deadline, phone calls or visits will be conducted to provide guidance.

The ‘Special Withholding Tax Statement’ will be used as verification material for accurate deduction of prepaid tax amounts and refund amounts during the final corporate local income tax filing. Therefore, submitting it within the deadline can reduce the hassle of having to submit additional documents during corporate local income tax refunds and settlements.

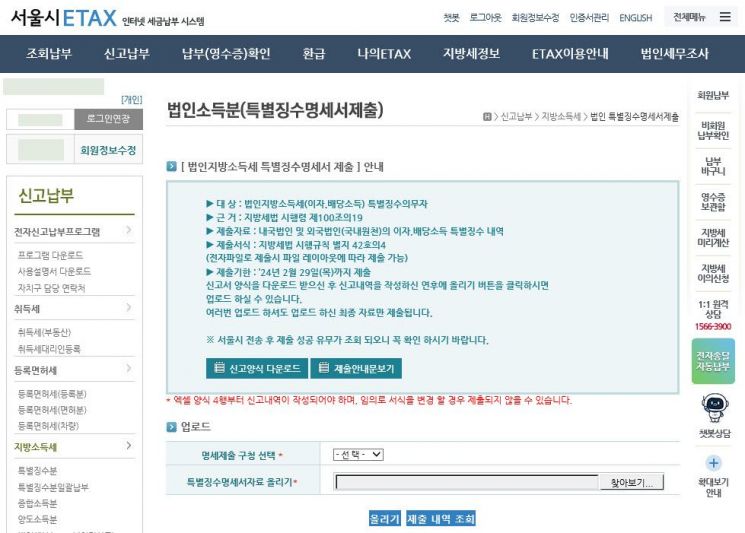

Submission can be made by accessing the Wetax or Seoul eTax websites and uploading the electronic file. If online submission is difficult, it can be submitted via email, visit, or mail to the district office staff.

Choi Ho-kwon, Mayor of Yeongdeungpo-gu, stated, “Submitting the Special Withholding Tax Statement within the deadline makes the settlement of corporate taxpayers’ reported tax amounts much more accurate and convenient,” and added, “We will continue to enhance taxpayer convenience and transparency through efficient tax administration tailored to taxpayers’ perspectives.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.