"Stock Price Soars Then Declines on First Day of Listing"

"Speculative Funds Drive Trading Demand... Cautious Investment Needed"

The stock prices of newly listed rookie stocks this year have struggled to gain momentum except on their first day of listing. It appears that the so-called "Ddadouble" (400% compared to the public offering price) system, introduced last year, has had an impact. In the securities industry, there are opinions that a conservative approach is necessary when investing in rookie stocks.

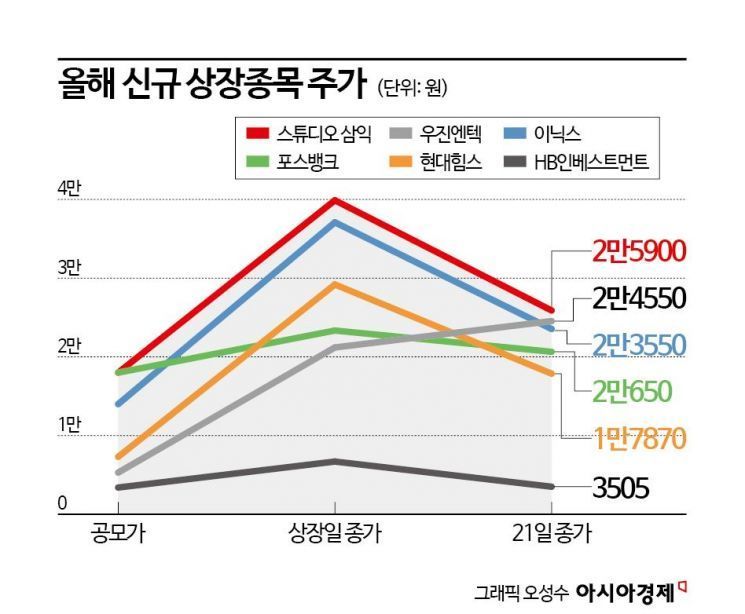

According to the Korea Exchange on the 22nd, the companies listed this year are six KOSDAQ firms: Woojin Entech, HB Investment, Hyundai Hims, POSBANK, Inix, and Studio Samik.

All these companies recorded high returns on their first day of listing compared to their public offering prices. Woojin Entech, which was listed on the 24th of last month, had a public offering price of 5,300 KRW but recorded 21,200 KRW on the first day of listing. This was a 300% increase compared to the public offering price. HB Investment also rose 97.06% from its public offering price of 3,400 KRW to 6,700 KRW, and Hyundai Hims recorded a 300% increase from 7,300 KRW to 29,200 KRW. Investors who sold on the day of listing likely earned significant profits.

This rise is due to the change in the price limit range on the first day of trading for newly listed stocks. The Korea Exchange expanded the price limit range on the first day of trading for listed companies last year to 60-400% of the public offering price. This was to improve the method of determining the reference price for newly listed stocks and to enhance the rapid price discovery function on the day of listing.

However, this goal has not been achieved. It is analyzed that speculative funds are pouring in as IPO stocks become themed stocks. Hwang Se-woon, senior researcher at the Korea Capital Market Institute, explained, "Stocks recording Ddadouble repeatedly are appearing. This is because IPO stocks are moving like theme stocks, and speculative funds are coming out as trading demand."

In particular, the returns decrease as time passes after listing. From the perspective of investors who traded on the first day of listing, this means losses. In the case of Inix, the closing price on the first day of listing was 37,100 KRW, but on the 21st, it was 23,550 KRW, a 36.52% drop. Studio Samik also fell 35.08%, from 39,900 KRW to 25,900 KRW. Although all other stocks still have prices higher than their public offering prices, they are recording losses compared to their peak prices.

As the enthusiasm for public offering stocks is expected to continue, advice is emerging to be cautious when investing in rookie stocks. Senior researcher Hwang advised, "When investing in companies, rather than focusing on profit realization, one should concentrate on the intrinsic value. From that perspective, it is necessary to approach investments carefully."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.