Big 4, January Loss Ratio at 82.5%

Impact of Increased Vehicle Movement and Labor Costs

Loss Ratio Expected to Rise This Year, Turning to Deficit

The profitability of automobile insurance for the big four major non-life insurance companies has turned red. Last month, their auto insurance loss ratios exceeded the break-even point. Moreover, since the major non-life insurers recently lowered auto insurance premiums by around 3% as part of the government's 'win-win finance' initiative, concerns are rising that the auto insurance sector may incur losses this year.

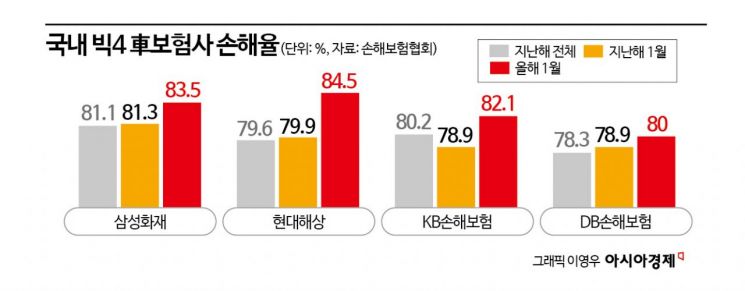

According to the General Insurance Association on the 21st, the auto insurance loss ratio of the big four?Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance?was 82.5% (simple average of the four companies) last month, up 2.8 percentage points from 79.7% in the same period last year. All four major insurers saw an increase in loss ratios: Samsung Fire & Marine Insurance (81.3% → 83.5%), Hyundai Marine & Fire Insurance (79.9% → 84.5%), DB Insurance (78.9% → 80%), and KB Insurance (78.9% → 82.1%). Their combined market share in the domestic auto insurance market is about 86%. Looking at all nine non-life insurers handling auto insurance, the loss ratio last month was 86.8%, up 5.9 percentage points from 80.9% in the same period last year.

The loss ratio is the proportion of insurance premiums received by the insurer that is paid out as claims to victims in the event of an accident. The higher the loss ratio, the lower the insurer’s profit and the greater the loss. The industry considers the break-even loss ratio for auto insurance to be between 78% and 80%. Typically, loss ratios are higher in January due to frequent car accidents caused by snowfall and increased minor breakdowns due to low temperatures. An industry insider said, "Last month, traffic volume increased compared to last year, leading to more accidents," and added, "The annual rise in vehicle repair costs and medical fees also contributed to the increase in loss ratios."

Despite considering market conditions and seasonal factors, the industry is concerned as the auto insurance loss ratio has exceeded the break-even point since January this year. Given that major insurers such as Samsung Fire & Marine Insurance (2.8%), Hyundai Marine & Fire Insurance (2.5%), DB Insurance (2.5%), KB Insurance (2.6%), and Meritz Fire & Marine Insurance (3%) recently lowered auto insurance premiums by 2.5?3%, there are worries that the auto insurance sector may turn to a deficit this year. Last year, the big four insurers recorded a profitable auto insurance loss ratio of 79.8%.

Some argue that the government's pressure to participate in 'win-win finance' at the end of last year was poorly timed. A representative from an insurance company said, "Typically, insurers review the auto insurance loss ratio in January and February to estimate the expected loss ratio for the year and then decide whether to raise or lower premiums," adding, "However, since the financial authorities pressured insurers to lower auto insurance premiums starting last fall, this aspect was not reflected at all this year."

Auto insurance has been unprofitable for insurers, causing about 9 trillion won in losses from 2010 to 2020. After turning a profit of 26.6 billion won for the first time in 2017, it immediately returned to losses. It only managed to return to profitability for a few years during the COVID-19 pandemic when vehicle accident rates declined.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.