CIO Industry Dominated by Former Samsung Life Executives

KIC, Private School Pension Fund Stand Out with 'Internal Talent'

Strengths in Investment Continuity and Expertise Prevent Talent Drain

The number of internal personnel appointed to chief investment officer (CIO) positions at pension funds and mutual aid associations, which were previously dominated by former Samsung Life Insurance executives, is increasing. This is analyzed as a result of accumulated investment experience in managing pension and mutual aid funds, leading to the emergence of internally promoted professionals with expertise.

According to the investment banking (IB) industry on the 21st, the Police Mutual Aid Association, which manages a fund of 4 trillion won, is seriously considering internal promotion for the next CIO appointment for the first time in history. The current CIO position has been vacant for four months since former CIO Han Jong-seok retired in October last year. Industry insiders mention Ando-su, head of the Police Mutual Aid Association’s Investment Strategy Office, Cho Sung-yong, head of the Financial Investment Division, and Choi Young-bae, head of the Business Investment Division, as strong candidates.

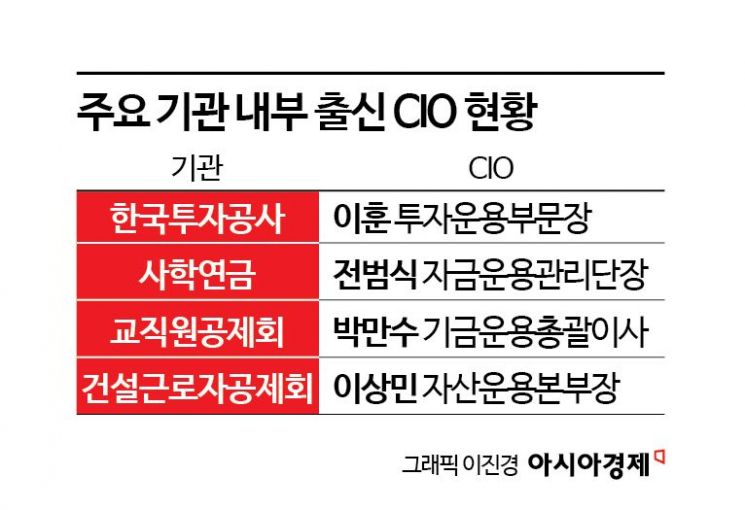

Recently, as internal CIO appointments have been made one after another, it is interpreted that the Police Mutual Aid Association is also reviewing this approach. Previously, the Construction Workers Mutual Aid Association appointed an internal candidate as head of asset management. This is Lee Sang-min, CIO, who has been with the Construction Workers Mutual Aid Association since 2011. He served as head of the securities management team, risk management team, and management strategy headquarters.

The CIOs of Korea Investment Corporation (KIC) and the Teachers’ Mutual Aid Association are also internal promotions. Lee Hoon, head of KIC’s Investment Management Division, joined KIC as an experienced hire when the Research Center was established in 2014. Over the past decade at KIC, he has successively served as head of the asset allocation team, head of the investment strategy headquarters, and head of the future strategy headquarters. Park Man-soo, chief fund management officer of the Teachers’ Mutual Aid Association, is also an internal staff member. He has held positions such as head of the development project division, overseas business team leader, alternative investment division head, and financial investment division head.

The Private School Teachers’ Pension Corporation (Sahak Yeongeum) also appointed an internal candidate as head of the fund management division. Jeon Beom-sik, who joined Sahak Yeongeum in 1991, built his career in the bond management team, investment analysis team, and alternative investment team. After leaving Sahak Yeongeum in 2012, he served as head of investment banking at Hyundai Securities, head of the PI division and representative of the alternative investment business unit at SK Securities, before returning to Sahak Yeongeum.

Over the past three years, CIOs of institutions have mainly been former Samsung Life Insurance personnel. The CIOs of the National Pension Service, the Korea Local Government Officials Mutual Aid Association, the Military Mutual Aid Association, and the Government Employees Pension Service are all from Samsung Life Insurance. Their experience managing assets at Samsung Life Insurance, which has total assets of 297 trillion won (as of the end of September 2023), is highly valued in the investment industry. The need for a financial network leading overseas investments, starting with the New York branch in 1986, was also significant.

Recently, the trend has shifted, and the rise of internal personnel is interpreted as a result of institutions accumulating operational experience and improving the expertise of internal talent. In the early stages of establishment, external hires were necessary due to a lack of internal capabilities, but over time, confidence has grown that the entire asset portfolio can be stably managed by internal personnel. Additionally, internal promotion is preferred for securing investment continuity and managing internal organizations.

Each institution generally sets asset allocation strategies to increase returns and executes investments expecting medium- to long-term performance. If an internal talent becomes CIO, there is an advantage in stable and long-term management compared to external hires who need to understand the organization and establish strategies anew. A CIO of institution A explained, "While CIOs with diverse external experience bring new perspectives and know-how, there are also advantages to internal personnel in terms of investment continuity and internal organization management," adding, "It can be a way to strengthen the organization to survive in a market environment with severe investment personnel turnover and uncertainty."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.