PKG Group Sells All Yeonwoo Shares Through Public Tender Offer

Gives Up 2% Stake in Kolmar, Recovers 30 Billion KRW Investment

Warning Signal for US Market Entry via PKG Sales Network

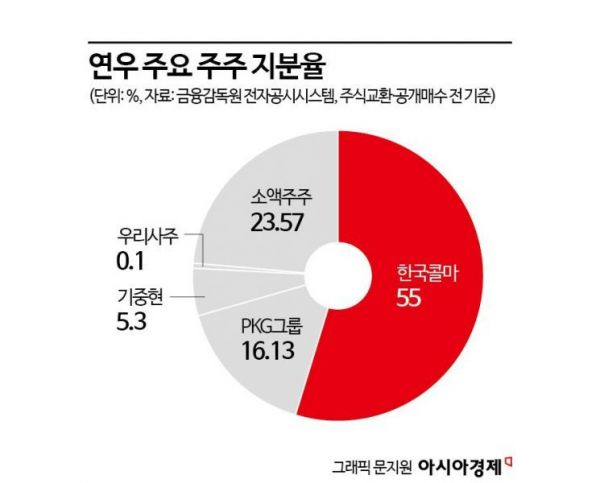

PKG Group, a US company and the second-largest shareholder of Yeonwoo, a cosmetics packaging container manufacturer and subsidiary of Korea Kolmar, exercised its stock purchase rights and disposed of its entire stake. Korea Kolmar is in the process of delisting Yeonwoo by making it a 100% subsidiary. Initially, Korea Kolmar planned to exchange Yeonwoo shares held by PKG Group for Korea Kolmar shares, but PKG Group recovered its investment through stock sales. This move is expected to hinder Korea Kolmar's plan to fully enter the US market through PKG Group this year.

According to the cosmetics and securities industries on the 22nd, US cosmetics container company PKG Group exercised its stock purchase rights on July 7 for 1,999,386 shares (16.13%) of Yeonwoo stock it held. The disposal price was 15,775 KRW per share, totaling approximately 31.4 billion KRW. Ki Joong-hyun, the founder of Yeonwoo and the third-largest shareholder, also disposed of 657,280 shares (5.30%) through exercising stock purchase rights. The stock purchase right is a system where the issuing company buys back shares at a certain price. PKG Group reportedly informed Yeonwoo of its intention to dispose of shares in early last month.

Korea Kolmar Secures 100% Stake in Yeonwoo... Moves to Delist

In October last year, Korea Kolmar announced it would increase its stake in subsidiary Yeonwoo from 55% to 100%, making it a wholly owned subsidiary. The method chosen was a comprehensive stock exchange. For each Yeonwoo share, Korea Kolmar offered 0.29 shares of its own stock, meaning that holding 4 Yeonwoo shares would entitle the shareholder to approximately 1 Korea Kolmar share. For shareholders wishing to sell publicly, shares were purchased at 15,775 KRW each.

When Korea Kolmar first acquired a 55% stake from Yeonwoo’s largest shareholder in 2022, Ki Joong-hyun, it applied a 48% management premium (around 40,000 KRW per share), spending 280 billion KRW in cash. This time, however, Korea Kolmar used its own shares for the transaction.

PKG Group has been a long-standing partner of Yeonwoo. About 20% of Yeonwoo’s sales are generated through PKG Group. The group has also invested significantly. When Yeonwoo was listed on the KOSDAQ market in 2015, PKG Group invested in a 6.83% stake and steadily increased its holdings over more than a decade. Because of this, the industry expected PKG Group to continue investing in Korea Kolmar.

However, PKG Group is known to have deliberated for a long time between exchanging Yeonwoo shares for Korea Kolmar shares and public stock purchases. PKG Group stated that its action was for "investment capital recovery."

'Investment Capital Recovery' by PKG Group May Disrupt Korea Kolmar's North American Business

By utilizing the stock purchase rights to dispose of Yeonwoo shares, PKG Group’s financial burden has increased. Yeonwoo needed about 48.8 billion KRW for this public purchase and borrowed 50 billion KRW from financial institutions last month to cover it. This deviated from the company’s intention to minimize cash outflow and maximize the improvement of Korea Kolmar’s financial structure.

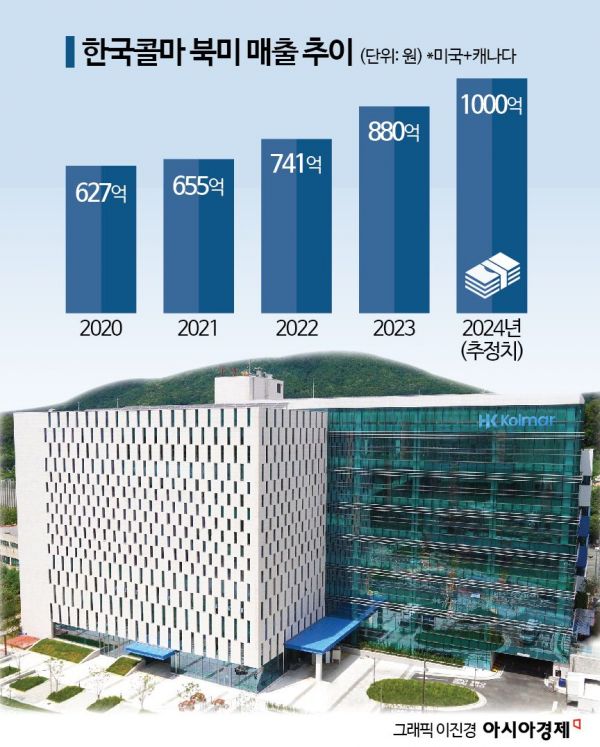

Korea Kolmar’s North American business strategy is also expected to face setbacks. Korea Kolmar had planned to use Yeonwoo’s US market sales network as a foothold to aggressively target the North American market. The strategy was to expand the client base of partner domestic indie brands and secure local customers. Although Korea Kolmar already has a US corporation (Kolmar USA) and a Canadian corporation (Kolmar Canada) in the North American market, these are production-focused, so a sales network foothold was needed to expand.

However, the company dismissed concerns that transactions with PKG Group would shrink. A company official explained, "PKG Group only exercised its rights as a shareholder from an investment perspective," adding, "Besides Kolmar USA, we will establish a second factory in the North American market and continue the container business, so we will maintain a good relationship with PKG Group."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.