Hyundai Glovis recruits capital market experts including former Mirae Asset Securities Chairman Choi Hyun-man

Expecting advisory on M&A and more

Strengthening investor communication... Initiating stock value-up efforts

Hyundai Motor Group is emerging as a key player in the 'Value-Up Project' aimed at resolving the Korea discount (the undervaluation of the Korean stock market) by recruiting Choi Hyun-man, former chairman of Mirae Asset Securities. As the government prepares to announce detailed plans for corporate value-up support measures on the 26th, expectations are rising that Hyundai Motor Group, a representative undervalued company, will strengthen shareholder returns.

Recently, Hyundai Motor Group has been replacing outside directors who were former public officials from institutions such as the Korea Exchange and the Fair Trade Commission with domestic capital market experts. Following Hyundai Glovis's move to recruit former chairman Choi, Kia has also selected Lee In-kyung, vice president (CFO) of MBK Partners, as a candidate for outside director.

The reason Hyundai Motor Group is actively recruiting investment banking (IB) experts is that they can provide direct investment advice on everything from fundraising to mergers and acquisitions (M&A) and governance, as well as increase touchpoints with investors. Former chairman Choi was a founding member of Mirae Asset Securities, the largest IB in Korea, and has been active in the domestic capital market for nearly 30 years. He is a heavyweight figure in the domestic investment industry with not only expertise but also a broad investor network.

Vice president Lee has been serving as a member of the investment review committee at the private equity firm MBK and has long overseen the management of more than 80 domestic and international investors (LPs). Kia expects that Lee’s joining will significantly strengthen its investor communication capabilities.

Hyundai Motor Group stocks, including Hyundai Motor and Kia, are considered representative undervalued stocks in the domestic stock market. As of last year, Hyundai Motor’s price-to-book ratio (PBR) was 0.6 times. Compared to major global automakers during the same period?General Motors (GM) at 0.7 times, Toyota at 0.9 times, and Ford at 1.1 times?Hyundai’s PBR is significantly lower.

The government plans to benchmark Japan’s case and introduce specific measures to raise the value of companies with a PBR below 1.0. Just the news of introducing such a program caused stocks related to automobiles, finance, and holding companies, which had been undervalued in the stock market, to surge sharply.

The government’s detailed plan is expected to include comprehensive measures such as support through tax reforms, strengthening board responsibilities, enhancing the substance of shareholder meetings, and developing indices and financial products for companies excelling in shareholder value enhancement. However, above all, the most important aspect is providing incentives that encourage companies to voluntarily increase shareholder return rates.

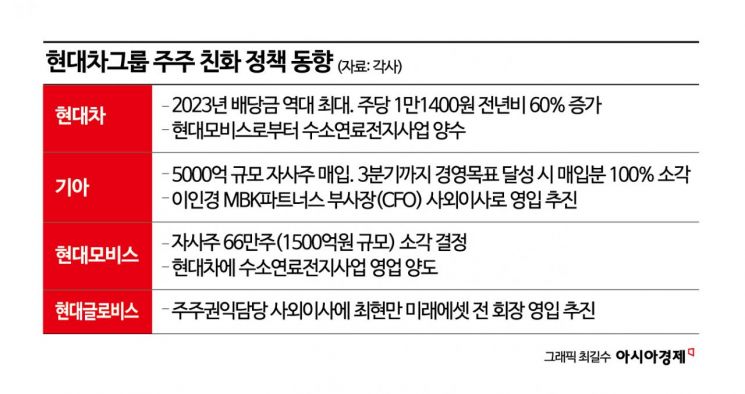

In line with this policy direction, Hyundai Motor Group has recently been strengthening shareholder returns. Hyundai Motor increased its dividend per share by more than 60% to 11,400 KRW last year, marking the highest annual dividend ever. Kia announced a bold treasury stock cancellation policy: after acquiring treasury shares within a limit of 50 billion KRW, half will be canceled, and the remaining half will be fully canceled if management targets are met based on cumulative results for the third quarter. Hyundai Mobis decided on a treasury stock cancellation worth 15 billion KRW, and Hyundai Glovis increased its year-end dividend by 10% compared to the previous year despite a decrease in operating profit last year. Recently, CEO Lee Gyu-bok also purchased 1,000 treasury shares as part of responsible management.

Kim Jun-sung, a researcher at Meritz Securities, said, "The key is the new shareholder value enhancement measures that Hyundai Motor and Kia will announce after the government finalizes the value-up program," adding, "The market is focusing on whether there will be further corporate value improvement through sharing the fruits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.