PF ABSTB Repayment Failure... Downgraded to Default Rating 'D'

KRW 200 Billion Loan Cross Default

Taeyoung Construction "Negotiating Site Self-Help Plan with Major Lenders"

Taeyoung Construction's project company ‘Samgye Development,’ established to carry out a large-scale urban development project in Gimhae City, Gyeongnam Province, has fallen into a default situation. This is because it failed to repay a loan of 8.4 billion KRW that matured last week. Taeyoung Construction, which guaranteed (assumed the debt of) the loan, is also currently undergoing a workout (corporate financial restructuring) process and is unable to immediately fulfill repayment obligations for the ‘contingent liabilities.’ As a result, loans amounting to several hundred billion KRW lent by financial institutions to Samgye Development have also entered default.

According to the investment banking (IB) industry on the 20th, Samgye Development failed to repay the loan that matured on the 15th. Among the loans borrowed from the special purpose company (SPC) ‘Biggate Jeilcha,’ the repayment of 8.4 billion KRW that matured last week was not completed. It is also reported that there is a high possibility that the 41.6 billion KRW loan maturing early next month will not be repaid. The total loan borrowed by Samgye Development from the SPC amounts to 50 billion KRW.

Taeyoung Construction provided a capital supplementation and debt assumption agreement to the SPC during Samgye Development’s borrowing process. The agreement stipulates that if Samgye Development lacks the liquidity to repay the loan, Taeyoung Construction will support the necessary funds for repayment, and if that is still insufficient, it will assume the debt and take responsibility for principal and interest repayment on behalf of Samgye Development. However, Taeyoung Construction is currently undergoing a workout procedure and is unable to immediately repay loans for specific projects.

Accordingly, credit rating agencies plan to downgrade the credit rating of the asset-backed securities (PF ABSTB) issued based on the loans lent by the SPC to Samgye Development from the existing ‘C’ to ‘D (Default).’ The D rating is typically assigned to companies that have entered court receivership due to default and is the lowest credit rating. A credit rating agency official explained, "Samgye Development’s debt cannot be considered deferred repayment due to the workout, so it was downgraded to a rating equivalent to default."

According to the creditor group, due to the default on some loans, approximately 200 billion KRW in loans lent by financial companies to Samgye Development have entered a cross-default situation. Cross-default means that if a borrower fails to repay some matured debts, all other loans borrowed by the borrower are considered in default. In such cases, measures such as suspension of current accounts are imposed.

According to the IB industry, the financial creditor group lending funds to Samgye Development includes financial companies such as IBK Investment & Securities (30 billion KRW), IBK Capital (15 billion KRW), IBK Savings Bank (10 billion KRW), BNK Investment & Securities (30 billion KRW), as well as affiliates of the Taeyoung Group including Taeyoung Construction. A creditor group official stated, "As Samgye Development failed to repay the matured loan, all of Samgye Development’s loans automatically entered cross-default."

Taeyoung Construction established Samgye Development to carry out a large-scale urban development project on the site at San 288, Samgye-dong, Gimhae City, Gyeongnam Province. This is a project directly invested in by Taeyoung Construction. It is currently estimated that Taeyoung Construction and A-One Aviation each hold 50% of the shares.

Samgye Development plans to operate a quarry business on the land until June 2026 and then obtain urban development permits to build apartments and other facilities. In this process, Samgye Development received a bridge loan of 165 billion KRW for land acquisition, and Taeyoung Construction also lent 29 billion KRW to Samgye Development as project funds.

Taeyoung’s side intends to find a self-rescue plan for the project site in consultation with the creditor group of Samgye Development. Regarding this, a Taeyoung Construction official said about the Gwangmyeong Station area development project, which also faced a default situation, "In the case of the project company’s loan, we decided to repay the loan by selling project facilities," and added, "Regarding Samgye Development, we are currently discussing self-rescue plans (such as project site sales) with the creditor group and are making every effort to normalize the project site."

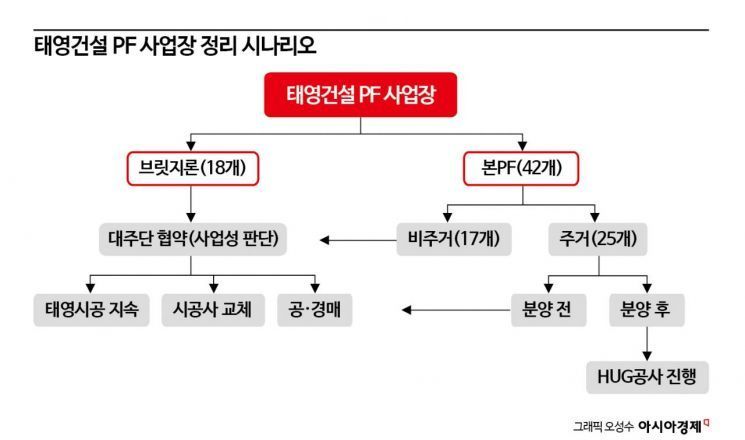

An IB industry official said, "During the due diligence process for Taeyoung Construction’s project financing (PF) sites, some project companies are falling into default," and predicted, "The creditor group will decide whether to inject additional funds or restructure the project based on the business feasibility of each project site."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.