Proposal to Cancel Treasury Shares and Appoint One Independent Audit Committee Member

Completely Unrelated to Management Rights Dispute, "For Minority Shareholders"

IB Industry Sees Another Attempt at Management Takeover

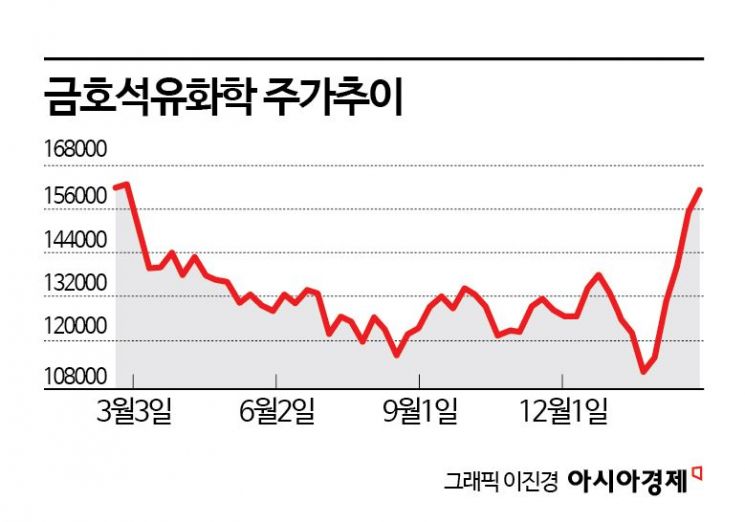

Chapartners Asset Management, which has taken shareholder action against Kumho Petrochemical, expressed confidence that it will succeed in appointing an independent audit committee member through a vote battle at next month's shareholders' meeting. However, it drew a clear line by stating that the current shareholder proposals, including the demand for treasury stock cancellation, are typical shareholder actions and unrelated to any management rights dispute.

Kim Hyung-gyun, Head of the Special Situations Division (Executive Director) at Chapartners Asset Management, who oversees the shareholder actions against Kumho Petrochemical, said in a recent interview with Asia Economy, "We proposed the cancellation of treasury stock and the appointment of one independent audit committee member to Kumho Petrochemical," adding, "Chapartners, which has the know-how to successfully demand the appointment of independent audit committee members from three companies since the year before last, will strive to achieve positive results this time as well."

Chapartners is an activist fund entrusted with shareholder proposal rights by Park Cheol-wan, former Executive Director and the largest individual shareholder of Kumho Petrochemical as well as nephew of Park Chan-gu, Chairman of Kumho Petrochemical. Since the year before last, this fund has utilized the '3% rule' at shareholders' meetings of companies such as Tobis, Sajo Oyang, and Namyang Dairy Products, gaining the support of minority shareholders to consecutively secure the appointment of independent auditors. The 3% rule is a regulation that requires listed companies to elect at least one audit committee member separately from directors, and limits the voting rights of controlling shareholders to a maximum of 3% regardless of their shareholding ratio during this election.

Kim emphasized, "However, when former Executive Director Park made shareholder proposals in the past, the angle of management rights disputes was stronger, but looking at this proposal, it is completely unrelated to management rights disputes and is a proposal made by an activist fund as a minority shareholder."

Chapartners proposed the following agenda items for the upcoming regular shareholders' meeting scheduled for next month: △ Amendment of the articles of incorporation regarding treasury stock cancellation △ Cancellation of treasury stock △ Appointment of an outside director as a member of the audit committee.

He explained, "Looking at the current shareholder composition, Chairman Park Chan-gu's side holds only 20%, and the remaining 80% are shares held by shareholders excluding the controlling shareholder," adding, "Simply put, if the board has a total of ten director seats, it is proportionate for Chairman Park's side to hold two seats, and the remaining eight seats should be occupied by representatives of other minority shareholders."

He added, "We intend to secure just one seat that we, as minority shareholders, can use to check and balance, and considering the shareholding structure, this is not an unreasonable demand," and "We will recommend a candidate for the audit committee who has the capability to monitor the board."

IB Industry Views: Management Rights Takeover vs. Pursuit of Efficient Exit

Earlier, Park Cheol-wan, former Executive Director and nephew of Chairman Park Chan-gu as well as eldest son of the late Park Jung-gu, former Chairman of Kumho Group, disclosed that a special relationship was formed as a joint holder of Kumho Petrochemical shares with Chapartners. Park Cheol-wan is the largest individual shareholder holding 9.1% of Kumho Petrochemical shares. Including related parties such as Chapartners (0.03%), the total shareholding ratio is 10.88%.

The investment banking (IB) industry offers two interpretations regarding Park Cheol-wan's collaboration with Chapartners to make shareholder proposals. One view is that through treasury stock cancellation, which has a certain management rights defense function, and the appointment of audit committee members who monitor management, they are aiming once again for a management rights takeover. The other interpretation is that they are pursuing an efficient exit (capital recovery). In the latter case, there is a possibility of a new direction, such as private equity funds acquiring Park Cheol-wan's shares. So far, Park Cheol-wan's official position is that the shareholder proposals are for improving management transparency and enhancing shareholder value.

In a statement released after the disclosure, Park Cheol-wan said, "Kumho Petrochemical's un-cancelled treasury stock accounts for 18% of the total shares, and these treasury shares may infringe on the rights of minority shareholders and be used unfairly. We recognized and reached a consensus with Chapartners on the problem that Kumho Petrochemical is undervalued due to a board composition lacking independence and failing to perform its role."

He added, "As the largest individual shareholder of Kumho Petrochemical, I have decided to delegate the necessary authority to Chapartners to improve corporate governance, protect minority shareholder rights, and monitor and check management," and "As a shareholder, I hope Chapartners will continuously strive to improve Kumho Petrochemical's corporate governance, strengthen management transparency, and maximize overall shareholder value including minority shareholders."

Park Cheol-wan was excluded from management after the 2010 Kumho Asiana Group workout (corporate restructuring) but later joined Chairman Park Chan-gu's side. Subsequently, a succession structure was established centered on Park Jun-kyung, then Executive Director and son of Chairman Park Chan-gu, leading Park Cheol-wan to enter the management rights dispute. In 2021, he dissolved the special joint holding relationship with his uncle, Chairman Park Chan-gu, and began a full-scale dispute. Although the dispute lasted for two years, it did not yield results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.