Financial Supervisory Service and National Police Agency Special Investigation Results Expected Around April

Leading Room Regulations Strengthened Annually... July Legal Amendment to be Enforced

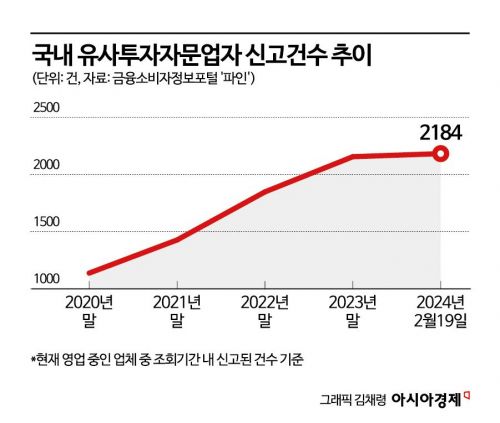

Similar Investment Advisory Firms Continue to Increase This Year... 27 More Locations

Following last year's SG Securities-induced stock price crash incident, the financial authorities and the National Police Agency, who declared war on 'illegal investment leading chat rooms,' are expected to announce the results of their joint crackdown around April. However, despite the authorities' strengthened regulatory stance, the number of quasi-investment advisory service providers, considered the main culprits behind these leading chat rooms, has been confirmed to continue increasing.

Financial Supervisory Service and Police Complete Special Investigation by End of March

According to financial authorities and the financial investment industry on the 20th, the Financial Supervisory Service (FSS) plans to complete the special inspection of illegal leading chat rooms, which has been conducted jointly with the National Police Agency's National Investigation Headquarters for six months since September last year, by April 24 and announce the related results. The main targets of the crackdown are fourfold: △providing false information to victims to extort money △embezzlement of victims' investment funds △unfair trading practices such as market manipulation and use of insider information △unregistered illegal business operations.

This special investigation was launched as last year's Ra Deok-yeon incident, along with large-scale crashes in about ten stocks, emerged as a social issue. Ra Deok-yeon, CEO of Hoan Investment Advisory, is known to have operated illegally without reporting to the financial authorities while providing investment consulting services through discretionary investment methods. He also repeatedly registered and closed multiple companies to evade financial authorities' surveillance. The authorities are also believed to have strengthened monitoring due to the possibility of increased volatility in so-called 'political theme stocks,' whose price movements are linked to the popularity of certain politicians ahead of the general elections in April this year.

The authorities' regulation of leading chat rooms has been strengthening annually. The FSS increased the budget for undercover inspections targeting illegal leading chat rooms to about 55 million KRW this year, roughly three times that of last year. In May last year, FSS Governor Lee Bok-hyun stated, "(Quasi-investment advisory service providers) continue to lure investors through social networking services (SNS) and YouTube with the bait of high returns and engage in unfair trading, causing ongoing harm," urging active response to illegal activities by quasi-investment advisory service providers. Subsequently, a dedicated team called the 'Illegal Activities Crackdown Team for Quasi-Investment Advisory Service Providers' was established under the Financial Investment Inspection Bureau.

With the enforcement of the amended 'Capital Markets and Financial Investment Business Act' in July this year, the criteria for expelling quasi-investment advisory service providers are expected to be strengthened. Currently, the FSS expels unqualified quasi-investment advisory firms from the market through a discretionary cancellation system. One-on-one stock leading chat rooms operating on a paid membership basis via online interactive channels such as SNS and open chat rooms are only permitted for officially registered investment advisory service providers subject to investor protection regulations. Violations result in becoming unregistered investment advisors and criminal penalties. Compensation for consumer losses or guaranteed profits is also prohibited, making it subject to criminal punishment. False or exaggerated advertisements presenting false or unrealized returns are subject to fines upon detection.

Number of Quasi-Investment Advisory Service Providers Continues to Increase This Year

Defying the authorities' regulations, the number of quasi-investment advisory service providers continues to rise this year. The number of quasi-investment advisory service reports registered on the FSS Financial Consumer Portal 'Fine' stands at 2,184, with 27 new cases filed this year alone. The number had already exceeded 2,100 by mid-last year. An FSS official stated, "The total number is increasing because the number of new entrants exceeds those being canceled by the authorities." With the number of individual investors surpassing 14 million, it is interpreted that operators using illegal advertising such as 'guaranteed high returns' are deceiving investors. As of the end of 2022, the number of individual investors in Korea was 14.24 million, more than double compared to five years before the COVID-19 pandemic.

Some voices call for the abolition of the quasi-investment advisory system itself, but from a practical standpoint, the prevailing opinion is to 'maintain the current system.' There are concerns that abolishing the quasi-investment advisory system could accelerate underground activities. The quasi-investment advisory system was introduced in 1997 to formalize private investment advisory service providers, known as 'boutiques,' as quasi-investment advisory service providers. If the system disappears, these providers would be completely excluded from regulatory oversight, and the system is also considered a minimal mechanism for the FSS to conduct undercover inspections and crackdowns.

Professor Cheon Chang-min of Seoul National University of Science and Technology said, "The quasi-investment advisory system exists only in Korea worldwide, so it is appropriate for it to disappear in the mid to long term," but added, "However, immediate abolition could send the wrong signal to the market, so it should be phased out gradually by expanding the scope of investment advisory services to absorb quasi-investment advisory services." Researcher Hwang Se-woon of the Korea Capital Market Institute said, "There is clearly a small demand for advisory services among stock investors," adding, "This demand is highly volatile over time, so there are areas that formally licensed firms such as asset management companies cannot cover."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.