'Hyunapeul' Edition 2 Membership Rewards Earning Rate Reduced After Renewal

"Customer Benefits Reduced Due to Excessive Fees Like Apple Pay"

As Hyundai Card renewed its flagship premium credit card, the 'Hyundai American Express Centurion,' consumer dissatisfaction is growing. Recently, most of Hyundai Card's revamped cards have followed the formula of 'renewal = benefit reduction,' leading to disappointment among users.

According to industry sources on the 16th, Hyundai Card discontinued three types of the Hyundai American Express Centurion Platinum, Gold, and Green cards the day before and launched upgraded Edition 2 versions of each. Among these, the 'Amex Platinum (HyunAPl),' with an annual fee of 1 million KRW, was the most popular card among consumers. Although the issuance conditions were strict, requiring a certain level of annual income, the benefits were so abundant that it was known as a 'value-packed card' that more than offset the annual fee. However, with this renewal, it is said that HyunAPl will no longer be able to maintain its former reputation.

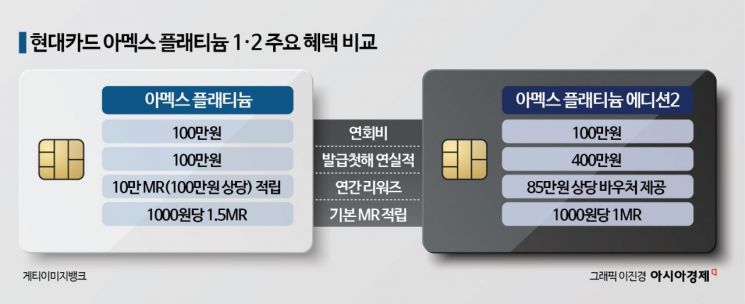

The original HyunAPl had a basic Membership Rewards (MR) accumulation rate of 1.5 MR per 1,000 KRW, but HyunAPl2 has been reduced by 33.3% to 1 MR. Membership Rewards is a global rewards program exclusive to American Express card members, operating since 1991. Each MR is worth about 10 KRW. Although the special MR accumulation rate slightly increased from 4.5 MR to 5 MR per 1,000 KRW, it only applies when using the card in five specific areas such as overseas merchants and domestic hotels.

What consumers find most disappointing is that while the original HyunAPl granted 100,000 MR (worth about 1 million KRW) upon issuance, HyunAPl2 offers vouchers worth 850,000 KRW instead. These include three travel vouchers worth 200,000 KRW each, one voucher worth 100,000 KRW, and three fashion and beauty vouchers worth 50,000 KRW each. The use of these vouchers is limited to certain domestic hotels, duty-free shops, travel agencies, and others. Additionally, the annual spending requirement in the first year after card issuance increased fourfold from 1 million KRW to 4 million KRW. From the second year onward, cardholders must spend over 36 million KRW to receive benefits such as vouchers.

Last month, Hyundai Card also upgraded its main fuel card, 'Energy Plus,' to Edition 3, tripling the annual fee and reducing benefits. In December last year, it discontinued the 'Costco Rewards' card and introduced Edition 2, raising the previous month's spending requirement and doubling the annual fee. Consumers who experienced consecutive benefit reductions rushed to apply for the soon-to-be-discontinued HyunAPl, causing a surge in applications.

The main reason Hyundai Card has repeatedly reduced card benefits is analyzed to be the deterioration of performance due to the credit card industry's downturn. According to preliminary results for last year, five card companies?Shinhan (-3.2%), Samsung (-2.1%), KB Kookmin (-7.3%), Hana (-10.9%), and Woori Card (-45.4%)?all saw decreases in net income compared to the previous year. This was influenced by increased funding costs due to high interest rates and a rise in customers unable to repay card payments or loans, leading to higher provisions for bad debts. Hyundai Card recorded a net income of 224.3 billion KRW cumulatively through the third quarter of last year.

Some criticize Hyundai Card for worsening profitability by securing contracts with famous overseas brands at excessively high fees and passing these costs onto consumers through reduced card benefits. American Express, a U.S. credit card company, was exclusively supplied by Samsung Card from 2008 but has been exclusively supplied by Hyundai Card since 2021 after Hyundai Card paid the fees. An industry insider said, "The reason Hyundai Card was the only one to offer Apple Pay service last year was that other card companies withdrew due to excessively high fees. This cost burden may be why cards with many consumer benefits are being restructured."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.