CP Balance Increases to Highest Level in One Year

Delayed Return to Bond Market Due to Decline in Construction and Tire Cord Performance

Short-Term Borrowing Ratio Rises Within Total Debt

Hyosung Group affiliates Hyosung Heavy Industries and Hyosung Advanced Materials have recently increased short-term borrowings such as commercial papers (CP). Despite rising funding needs due to loan maturities and facility investments, they have been unable to return to the corporate bond market as their performance and financial conditions have not significantly improved.

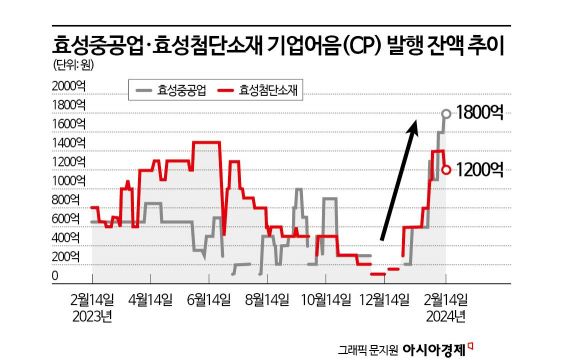

According to the short-term financial market on the 16th, Hyosung Heavy Industries issued CP worth 60 billion KRW on the 14th. They repaid 40 billion KRW of maturing CP and made a net issuance of 20 billion KRW. Earlier, on the 8th, they had also issued CP worth 50 billion KRW. The CP balance, which was zero until the end of last year, has gradually increased to 180 billion KRW this year.

The CP issuance balance of Hyosung Advanced Materials also rose from zero at the beginning of the year to 140 billion KRW recently. In January, they increased the CP balance to 100 billion KRW through multiple issuances, and in February, they made an additional net issuance of 40 billion KRW, continuing the upward trend. The CP balances of both Hyosung Heavy Industries and Hyosung Advanced Materials have reached their highest levels in a year.

The reason these Hyosung Group affiliates are increasing short-term borrowings through CP issuance is that funding needs continue due to loan maturities, capital expenditures (Capex), and operating funds, while issuing corporate bonds remains difficult.

Hyosung Heavy Industries has not issued corporate bonds since issuing private placement bonds with options in September 2022. At that time, they issued 3-year maturity option bonds supported by the Korea Credit Guarantee Fund, but the structure allowed early redemption rights (call options) to be exercised after six months, resulting in a high interest rate in the 6% range.

Hyosung Advanced Materials has not issued corporate bonds since issuing public bonds in March 2021. Due to poor performance and increased borrowings, their financial condition has not improved over the past two to three years, preventing them from entering the bond market.

This trend is expected to continue for the time being. Hyosung Heavy Industries is facing increased financial burdens due to recent deterioration in construction sector performance and lower sales rates at construction sites. Hyosung Advanced Materials also recorded an operating cash flow (OCF) deficit as of the end of September last year, with no improvement in financial conditions.

A credit rating agency official commented, "Since 2021, Hyosung Heavy Industries has seen increased borrowing burdens due to working capital needs from expanded orders in the heavy industry sector. Recently, although the heavy industry sector’s performance has improved, financial burdens have increased as cash flow in the construction sector has declined due to a downturn in the real estate market."

An investment banking industry official advised, "Hyosung Heavy Industries and Hyosung Advanced Materials continue to raise funds through CP as a way to bypass corporate bond issuance. As the proportion of short-term borrowings such as CP in total borrowings increases, the stability of loan maturities decreases, so it is necessary to convert CP into long-term borrowings such as corporate bonds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.