India-Related ETFs Average Return of 15.80% Over the Past 3 Months

India Stock Market Hits All-Time High... "Expectations as the World's Third Largest Economy"

As the Indian index hits an all-time high, funds are pouring into related exchange-traded funds (ETFs). With expectations that India will emerge as an economic powerhouse following the US and China, the index has risen, boosting ETF returns.

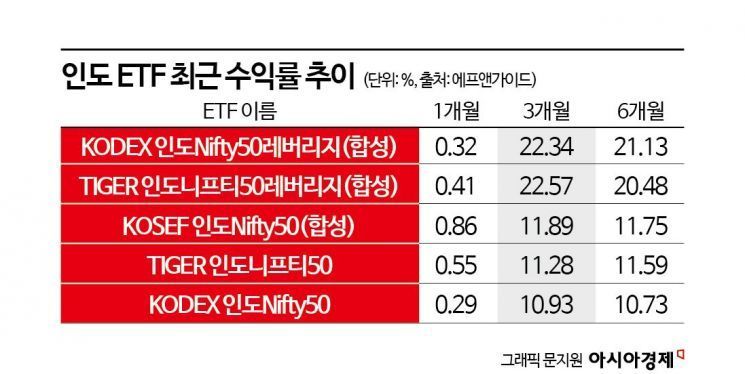

According to FnGuide on the 16th, as of the 14th, there are five India-related ETFs listed in the domestic stock market. Their average 3-month return was 15.80%. Mirae Asset Management's TIGER India Nifty 50 Leverage (synthetic) recorded the highest return at 22.57%. Following were Samsung Asset Management's KODEX India Nifty 50 Leverage (synthetic) at 22.34%, and Kiwoom Asset Management's KOSEF India Nifty 50 (synthetic) at 11.89%.

Along with the high returns, individual investors have been continuously injecting funds. In the past month, individuals purchased 24.7 billion KRW worth of Mirae Asset Management's TIGER India Nifty 50. KODEX India Nifty 50 also saw net purchases of 17.1 billion KRW. Thanks to these individual net purchases, the assets of these ETFs have grown. The net assets of KODEX India Nifty 50 ETF, KOSEF India Nifty 50 (synthetic), and TIGER India Nifty 50 recently surpassed 200 billion KRW.

These products track the 'Nifty 50 Index,' which consists of 50 major stocks listed on the National Stock Exchange (NSE) of India. The Nifty 50 has recently reached record highs. It rose from 18,197.45 on January 2 last year to the 21,800 level this month, approaching 22,000. This marks an increase of over 20% in one year.

The rapid rise in the Indian stock market is interpreted as reflecting expectations that India will become the world's third-largest economy. India surpassed China last year to become the most populous country globally. Especially with its abundant population and as a beneficiary of supply chain restructuring due to the US-China conflict, India is expected to gain significantly. According to the World Economic Outlook released by the International Monetary Fund (IMF) last month, India's economic growth forecast for 2024 is 6.5%. This exceeds the global average (3.1%), the average for emerging and developing countries (4.1%), and China's forecast (4.6%). It is also expected to rise to the world's third-largest economy by 2027, indicating rapid growth.

Song Min-gyu, head of the FICC ETF management team at Mirae Asset Management, said, "India is expected to emerge as a Big 3 country following the US and China due to its overwhelming working-age population, solid consumer market, and benefits from global supply chain restructuring."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)