Hyundai Department Store Group Establishes Mid-to-Long-Term Dividend Policy

NHN Announces Shareholder Return Policy Worth 66.6 Billion KRW

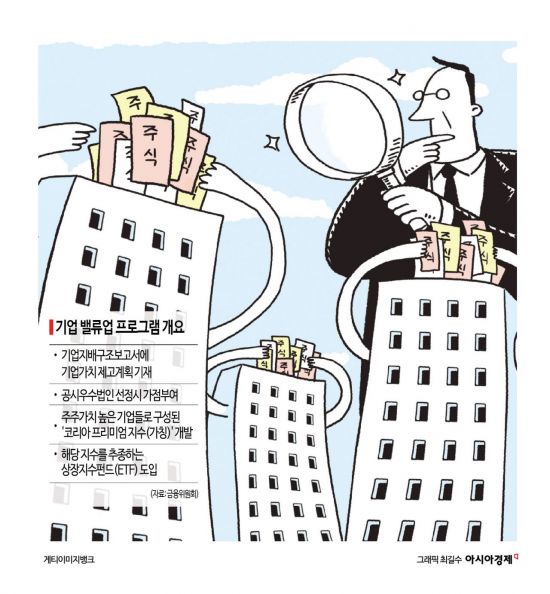

Companies are strengthening shareholder return policies to resolve the ‘Korea Discount’ (undervaluation of the Korean stock market). They are increasing dividends and repurchasing and retiring treasury shares ahead of the government’s announcement of a corporate value-up program.

According to the industry on the 15th, Hyundai Department Store Group’s holding company Hyundai G.F. Holdings and 10 listed companies within the group each held board meetings to establish mid- to long-term dividend policies from 2024 to 2026. Accordingly, Hyundai Department Store raised the minimum dividend from the previous 1,000 won to 1,300 won, and Hyundai Home Shopping guaranteed a dividend of at least 2,500 won per share.

In the case of Hyundai G.F. Holdings, the minimum dividend was set at 150 won per share, and it announced that last year’s dividend would be paid at 200 won per share. Hyundai Green Food also plans to pay a minimum dividend of at least 325 won per share over the next three years. Five affiliates?Hansome, Hyundai Livart, Hyundai Easywell, Daewon Kangup, and Hyundai Everdigm?plan to maintain a minimum dividend payout ratio of 10-20% for the first time over three years.

Hyundai Department Store Group will also carry out treasury share retirements worth a total of 25 billion won this year. Hansome plans to retire about 5% (12.4 billion won) of the total issued shares at the end of this month, including additional treasury shares it purchased, and Zinus will retire 475,944 treasury shares worth about 3.5 billion won by April.

NHN also announced a shareholder return policy totaling 66.6 billion won, including its first-ever cash dividend since its founding and treasury share repurchase and retirement. The dividend per share is 500 won, with a total dividend amount of about 16.9 billion won. It is scheduled to be paid in April after approval at the March shareholders’ meeting. Additionally, NHN plans to repurchase about 790,000 shares (worth 20 billion won) and retire 1.17 million shares (worth 26.3 billion won), which is 3.4% of the total issued shares, on the 26th.

SK Networks also resolved an agenda to increase dividends and manage treasury shares to enhance shareholder value. The regular dividend, which was previously 120 won per common share (145 won per preferred share), will be raised to 200 won (225 won per preferred share), and about 61% of total shares, or 14,503,630 shares (worth 77 billion won), will be retired in early March.

In addition, KT plans to retire treasury shares worth 27.1 billion won. Following a large-scale retirement of treasury shares worth 100 billion won for the first time in 14 years at the beginning of last year, KT is undertaking another large-scale treasury share retirement this year. KT also decided to pay a dividend of 1,960 won per share according to the shareholder return policy announced in October last year. The dividend yield is about 5.5%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.