Ali and Temu, Rapid Growth in E-commerce

Naver's Transaction Growth Rate Hits Lowest in 2 Years

"Domestic E-commerce Crisis Just Beginning"

Naver Shopping's transaction growth rate recorded the lowest in two years. Excluding the North American consumer-to-consumer (C2C) platform acquired by Naver, the transaction volume in the fourth quarter of last year grew by only 5% compared to the same period the previous year. This is the lowest growth rate since Naver began disclosing commerce transaction growth rates in 2022. There is an assessment that the domestic platform crisis has become a reality due to the aggressive moves of Chinese direct purchase platforms such as AliExpress and Temu.

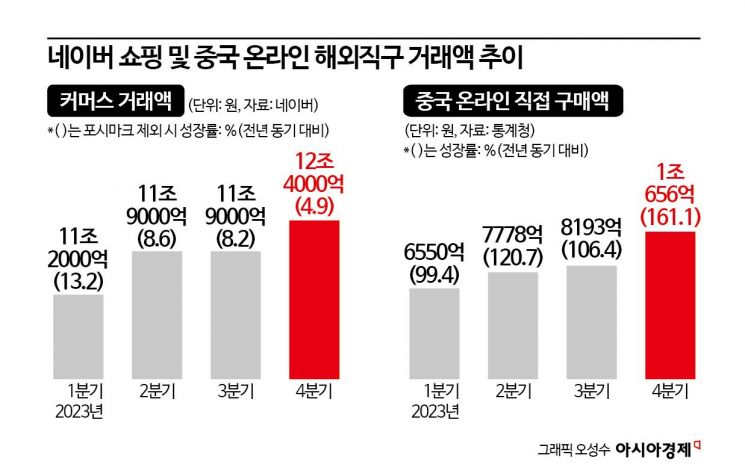

According to the IT industry on the 15th, the total transaction amount (GMV) of Naver's commerce division, excluding the North American C2C platform Poshmark, increased by 4.9% compared to the same period last year in the fourth quarter. The total transaction amount for Naver Commerce in the fourth quarter was 12.4 trillion KRW, and the transaction amount excluding Poshmark is estimated to be in the mid-to-high 11 trillion KRW range. In 2022, the transaction amount increased by an average of 18.1% each quarter, and even last year, when Poshmark's performance began to be reflected, it maintained double-digit growth (15.0%). However, the transaction growth rate excluding Poshmark has slowed down. After recording a single-digit 8.6% in the second quarter of last year, it fell below the 5% level in the fourth quarter.

The slowdown in Naver Shopping's growth is considered shocking given that the domestic online shopping market actually expanded last year. According to Statistics Korea data, online shopping transaction volume in the fourth quarter of last year was 61.1961 trillion KRW, a 10.6% increase compared to the same period last year. During this period, the amount of direct online purchases from China was 1.0656 trillion KRW, more than doubling. This suggests that the rise of Chinese direct purchase platforms has dealt a blow to Naver Shopping rather than domestic demand weakness.

The offensive of Chinese platforms is fierce. They are targeting domestic consumers in the era of high inflation by promoting ultra-low-priced Chinese products. They offer free shipping, free returns, and large-scale discount coupons. The number of users has also increased significantly. The top two applications with the highest user growth last year were AliExpress and Temu. As of last month, the monthly active users (MAU) of both companies exceeded 10 million.

Some in the securities industry have adjusted Naver's commerce sales forecast for this year. Mirae Asset Securities expects this year's commerce sales to increase by 7% from last year to 2.732 trillion KRW. This is a 10% downward revision from the previous forecast. Heeseok Lim, a researcher at Mirae Asset Securities, said, "If Chinese platforms grow as they did last year, the annual transaction volume will increase to around 4 trillion KRW," adding, "A significant portion of products sold in domestic open markets is likely to be replaced."

Some argue that it is still too early to judge the impact of Chinese direct purchase platforms. This is because Naver differs in product categories and consumer usage experience. Chinese platforms tend to have high consumer complaints due to delivery delays or missing items. On the other hand, Naver has been enhancing services such as 'Today Departure Products' and 'Arrival Guarantee Products' that arrive on the promised date.

On the contrary, from an advertising perspective, the growth of Chinese platforms is also positive. From Naver's point of view, AliExpress and Temu are advertisers. Sooyeon Choi, CEO of Naver, said during the fourth-quarter earnings conference call last year, "Naver Shopping's model is advertising-centered, so (Chinese platforms) are not only competitors but also strategic partners," adding, "AliExpress runs ads linked with Naver, and Temu is also expected to have a positive impact on advertising."

Naver plans to continuously monitor the trends and ripple effects of Chinese direct purchase platforms. Although it is difficult to quantitatively assess the immediate impact on the commerce business, it is judged that it will bring changes to the highly competitive online shopping market as a whole. Meanwhile, the domestic e-commerce industry reviewed the impact of government policies and overseas platform expansion. Coupang, 11st, Gmarket, and SSG.com attended a meeting hosted by the Ministry of Trade, Industry and Energy on the 14th to discuss these issues.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)