3 Trillion Reserved in Q4 Amid Authorities' Pressure

Construction Industry Delinquency Rate Rises and Non-Performing Loans Increase

US January CPI Also Exceeds Expectations

It has been revealed that major financial holding companies have set aside nearly 9 trillion won in loan loss provisions in response to the financial authorities' determination to prevent the spread of insolvency in real estate project financing (PF).

In particular, influenced by the corporate restructuring (workout) of Taeyoung Construction, they accumulated 3 trillion won in provisions in the fourth quarter of last year alone, actively aligning with the authorities. However, with rising delinquency rates in the construction industry, an increase in non-performing loans, and the January U.S. Consumer Price Index (CPI) exceeding expectations?an indicator that could foreshadow future interest rate changes?a challenging environment is expected to persist.

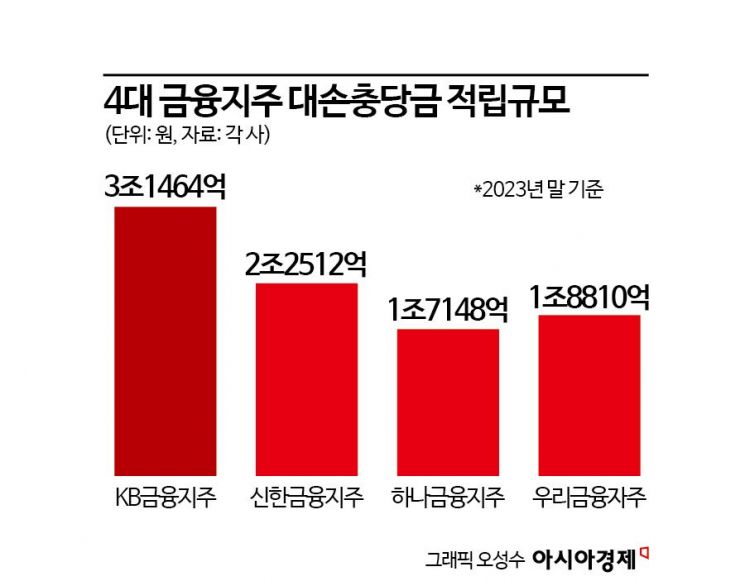

According to the financial sector on the 15th, the total amount of loan loss provisions accumulated by the four major financial holding companies?KB Financial, Shinhan Financial, Woori Financial, and Hana Financial?last year reached 8.9934 trillion won, marking an increase of over 71% compared to 5.2079 trillion won in 2022.

By financial holding company, KB Financial Group set aside the largest amount at 3.1464 trillion won, followed by Shinhan Financial Group with 2.2512 trillion won, Hana Financial Group with 1.7148 trillion won, and Woori Financial Group with 1.881 trillion won.

In particular, these financial holding companies accumulated 3.4463 trillion won in provisions in the fourth quarter alone, following the financial authorities' directive to block the spread of real estate PF insolvency triggered by the Taeyoung Construction workout. This amount represents 38% of the total provisions accumulated throughout the year.

The Financial Supervisory Service (FSS) is reviewing the appropriateness of these provisions based on the financial institutions' settlement data. As FSS Governor Lee Bok-hyun stated at the "2024 FSS Work Plan Press Conference," "We will not hesitate to expel financial companies that delay PF losses and evade responsibility," it is expected that the ability to absorb losses will be judged with a conservative standard.

Despite the nearly 9 trillion won in provisions set aside by major financial holding companies, concerns remain high regarding various indicators surrounding the financial market. This is due to the rising delinquency rates on construction loans and the size of non-performing loans (NPLs) exceeding 4 trillion won.

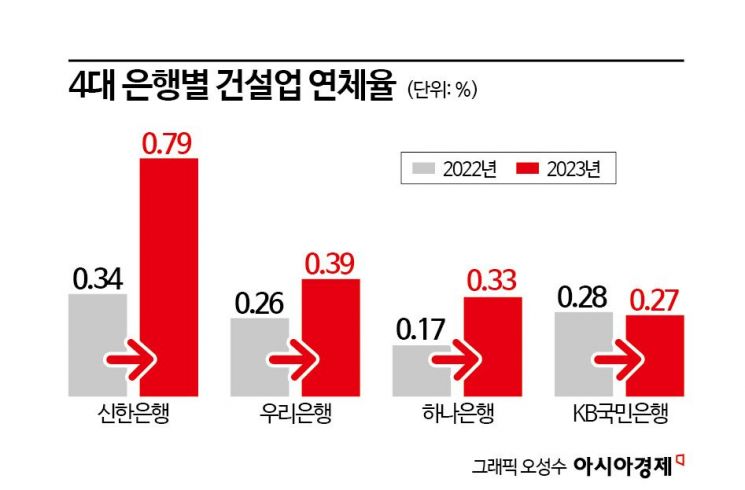

By bank, Shinhan Bank's delinquency rate on construction loans at the end of last year rose to 0.79%, more than double the previous year's 0.34%. Woori Bank's rate increased from 0.26% to 0.39%, and Hana Bank's from 0.17% to 0.33%. Only KB Kookmin Bank saw a slight decrease of 0.01 percentage points to 0.27% over the year.

The size of non-performing loans, referring to bad debts, was recorded at 4.2325 trillion won. This figure represents an increase of more than 24% compared to the previous year, with about 946.2 billion won added in the fourth quarter alone. This is interpreted as a result of weakened repayment capacity among small and medium-sized enterprises and vulnerable groups due to rapid interest rate hikes and the continuation of a high-interest rate environment. Accordingly, the coverage ratio of non-performing loans, an indicator of the four major financial holding companies' loss absorption capacity, averaged 187% last year, down 22 percentage points from the previous year.

The financial sector plans to undertake rigorous asset quality management this year through active sales of non-performing loans. With the U.S. CPI rising 3.1% year-on-year in January, surpassing market expectations, it has become even more difficult to predict when the high-interest rate trend will ease. Moreover, additional real estate PF insolvencies could emerge at any time, starting with Taeyoung Construction.

At an executive meeting the previous day, FSS Governor Lee emphasized, "We must manage so that the insolvency of financial companies' real estate PF is not deferred by riding on expectations of interest rate cuts," and added, "Financial companies should be cautious not to excessively leverage themselves due to excessive expectations of interest rate cuts." A financial sector official explained, "The financial authorities are closely scrutinizing the soundness of not only banks but the entire financial sector, and each financial institution is regularly reporting the situation. We plan to actively sell non-performing loans to reduce delinquency rates and the proportion of bad debts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.