Last Year’s Investment Amount Growth Rate at 88%, Overwhelming 1st Place

"A Sure Growth Industry"... Government Support Also Boosts Investment Activity

First Pet Tech IPO Expected in 2025

Despite the 'investment winter,' venture capital (VC) investment in the pet industry has nearly doubled in one year. The 'Petconomy' craze has also swept through the VC sector. 'Petconomy' refers to the market or industry related to pets. It is a combination of 'pet' and 'economy.'

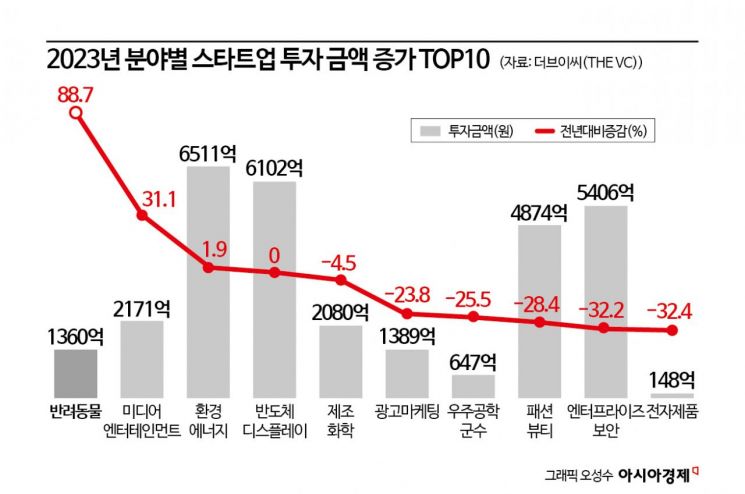

According to venture investment information firm The VC on the 12th, the pet sector saw the highest growth rate in startup investment last year. It attracted 136 billion KRW in investment, an 88.7% increase compared to 2022. Among 25 sectors, only three saw increased investment: pets, media & entertainment (31.1% increase), and environment & energy (1.9% increase). Among the remaining 22 sectors, semiconductors & displays remained flat, while 21 sectors experienced 'negative growth.' Amid the 'investment winter,' where total investment dropped 52.8% in one year (from 14.9 trillion KRW to 7 trillion KRW), the pet sector's indicators stood out remarkably.

Participation by Large Corporations... Still in 'Infancy' Compared to Advanced Countries

Among pet startups last year, the company that received the largest investment was BM Smile, which secured 28 billion KRW from SK Networks. BM Smile is recognized as the only company in Korea to have established a vertically integrated system related to the pet industry. It operates various businesses including pet litter, pet supplies, and pet tech. SK Networks decided to invest expecting synergy with its core subsidiaries such as SK Magic and Walkerhill. Water purifiers are a key item in the pet supplies market, and 'Petcations' (hotel vacations enjoyed with pets) have recently gained popularity. SK Magic, whose main business is water purifiers, and Walkerhill, a hotel operator, are seen as potential partners.

Pet healthcare company Onhill received 20 billion KRW in investment. Investors included KB Investment, HB Investment, Company K Partners, Comes Investment, Company K Partners, Quad Ventures, and Korea Development Bank Capital. Onhill operates the pet supplies brand 'Petoms' and the offline shop 'Onhill Pet.'

Premium pet food startup Poong attracted cumulative investments of 3 billion KRW until last year from Strong Ventures and Daekyo Investment, among others. The Poong application, which features self-developed products such as the natural food 'Saengsik Seonsaeng' and offers over 400 types of other brand pet foods, surpassed 100,000 subscribers last year. The annual sales of Saengsik Seonsaeng increased approximately 1000% compared to its launch year.

The absolute investment amount is still relatively small. The average investment in pet startups was 2.96 billion KRW, ranking ninth among the 25 sectors. The top sector in this regard was semiconductors & displays, with an average of 5.22 billion KRW. Compared to advanced countries, the domestic market still has a significant gap. For example, 53% of pet food purchases are imported products, indicating a strong preference for overseas brands. In overseas markets, investments of over 100 billion KRW are actively made, such as the UK pet tech startup Butternut Box, which raised 280 million pounds (about 470 billion KRW) last year.

A Future-Proven Growth Industry... 'IPO Companies' Are on the Horizon

Experts agree that the boom in pet company investments is because it is a 'growth industry' with a clear future. Yoon Geon-su, chairman of the Korea VC Association, said, "The foundation of the pet market is emotional bonding, so it is sometimes called an 'emotional industry.' We expect the emotional industry to continue growing." As of 2022, the number of pets in Korea was 7.99 million (5.45 million dogs and 2.54 million cats), a 43% increase over ten years. The related market size was 8 trillion KRW in 2022.

Kim Jae-yeop, director at Daekyo Investment, said, "Considering social indicators such as the increase in single-person households, aging population, declining birthrate, and Korea's income level, the number of pets will continue to rise." He added, "The amount spent per pet is also increasing." Since pets are considered family members, unlike general consumption, quality is prioritized over price. According to an analysis by Shinhan Card Big Data Research Institute of amounts spent by its customers at animal hospitals and other pet services, the average annual expenditure per person increased from 262,000 KRW in 2019 to 353,000 KRW in 2022.

The government's active intention to foster the pet industry is also fueling investment momentum. Last year, related ministries including the Ministry of Agriculture, Food and Rural Affairs and the Ministry of Economy and Finance announced plans to focus on developing the pet industry as a 'national strategic industry,' centering on four key areas: pet food, pet services, pet tech, and pet healthcare. The goal is to expand the related market to 15 trillion KRW by 2027.

Pet total healthcare company PitPet has signed an IPO underwriting contract with NH Investment & Securities and is aiming for a KOSDAQ listing in the second half of 2025. If successful, it will be the first domestic pet startup to go public. As the pet market continues to grow beyond early-stage investments, more startups are expected to pursue IPOs in the near future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)