Efficient reform of social insurance is being discussed as a solution to the population crisis caused by low birth rates and aging. It is argued that social insurance premiums such as health insurance and national pension have more than doubled in the past decade, increasing the burden on the public and even eroding the growth potential of our economy.

On the 7th, the Korea Employers Federation (KEF) released a report titled "Current Status of the Burden of the Five Major Social Insurances and Policy Improvement Tasks." KEF pointed out that the increase in social insurance burdens in Korea is too rapid, criticizing that expanding social insurance coverage while the population is declining leads to a heavier burden on the public.

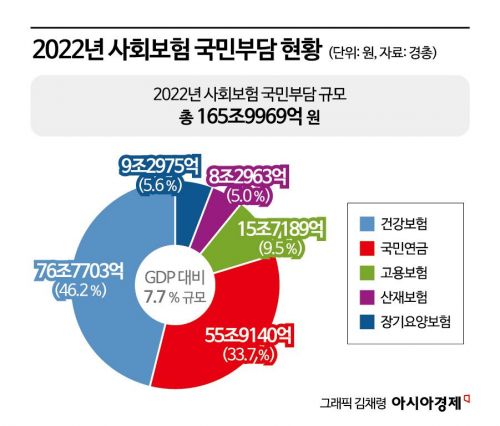

Social insurance refers to government-guaranteed insurances such as health insurance, national pension, employment insurance, industrial accident insurance, and long-term care insurance. In 2022, the total amount of the five major social insurance premiums borne by the Korean public was 165.997 trillion won. Compared to 80.7028 trillion won in 2012, this has more than doubled in 10 years.

Looking at the growth rate alone, it increased by an average of 7.5% annually. This is 4.7 times higher than the average annual inflation rate (1.6%) during the same period and 1.8 times higher than the average annual nominal GDP growth rate (4.1%). As a result, the ratio of social insurance premiums to nominal GDP rose significantly from 5.6% in 2012 to 7.7% in 2022.

Korea’s social insurance burden relative to GDP has also increased at the fastest rate among OECD countries. Over the past 10 years, Korea’s social insurance burden as a percentage of GDP rose from 5.9% in 2012 to 8.2% in 2022, recording the highest growth rate (39.5%) among OECD member countries. This is 2.7 times higher than Japan (14.8%), the world’s most aged country. This contrasts with the OECD average, which decreased by -0.9% during the same period.

A KEF official said, "The problem is that the increase in Korea’s social insurance burden is too rapid," adding, "This negatively affects corporate employment and investment beyond household burdens and reduces growth potential." He continued, "Facing the demographic cliff, it is urgent to improve expenditure efficiency by system rather than expanding quantitative coverage," and added, "Health insurance, which has the largest public burden, should be used as a catalyst for pension reform by shifting to a policy of freezing premium rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.