CEO Score Survey... 8 out of 57 Companies Have Over Half of Their Shares as Collateral

Stock-Backed Loans Total 7.2 Trillion Won at End of January... Samsung Family Borrowed 1.5 Trillion Won

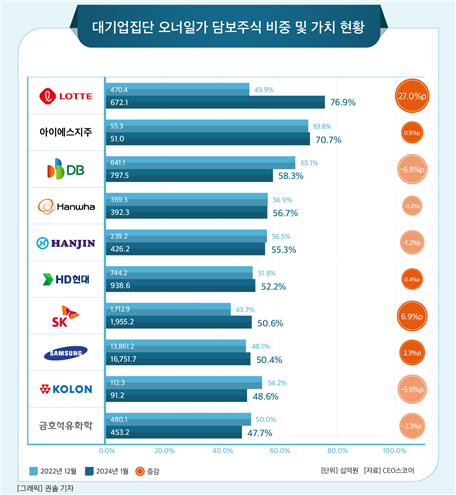

The proportion of stock collateral held by the families of conglomerate owners was found to be about 32%. There were 8 groups where the stock collateral ratio exceeded half. Among the owners, Chairman Shin Dong-bin and the Lotte Group owner family had the highest stock collateral ratio.

On the 7th, CEO Score, a corporate data research institute, released the results of a survey conducted on 57 out of 72 large business groups designated by the Fair Trade Commission that hold stocks in listed affiliates. As of the end of last month, stocks provided as collateral for loans amounted to approximately KRW 28.9905 trillion. This corresponds to 32.1% of the total stock holdings worth KRW 90.372 trillion. The higher the collateral ratio, the greater the risk of forced sale due to collateral maintenance ratio regulations.

By conglomerate group, the Lotte owner family’s stock collateral ratio rose from 49.9% at the end of 2022 to 76.9% as of the end of last month. This was the highest ratio among the owner families. During this period, the Lotte owner family additionally borrowed about KRW 100.2 billion.

IS Group (70.7%) ranked second. Although the IS Group owner family repaid about KRW 7 billion in loans over the past year, the proportion of stocks held as collateral increased by 0.9 percentage points (p) within their total stock holdings.

The DB owner family (58.3%) followed. Although DB’s ratio decreased by 6.8 percentage points from 65.1% at the end of 2022, it still maintained a high level. DB repaid KRW 3.3 billion in stock collateral loans during this period.

Hanwha (56.7%), Hanjin (55.3%), HD Hyundai (52.2%), SK (50.6%), Samsung (50.4%), Kolon (48.6%), and Kumho Petrochemical (47.7%) followed.

The largest increase in stock collateral ratio was seen in HL. HL had zero stock collateral loans at the end of 2022 but borrowed about KRW 20 billion as of last month. Compared to the end of 2022, HL’s stock collateral ratio expanded by 39.6 percentage points as of the end of January. Lotte (27.0%p) and Hansol (21.5%p) followed.

On the 20th, the city center viewed from Ttukseom Hangang Park in Gwangjin-gu, Seoul, is shrouded in fine dust as the fine dust concentration in Seoul reaches the 'Bad' level. Photo by Jinhyung Kang aymsdream@

On the 20th, the city center viewed from Ttukseom Hangang Park in Gwangjin-gu, Seoul, is shrouded in fine dust as the fine dust concentration in Seoul reaches the 'Bad' level. Photo by Jinhyung Kang aymsdream@

As of the end of last month, the total stock collateral loan amount for all conglomerate owner families was KRW 7.1908 trillion, an increase of KRW 2.0227 trillion (39.1%) compared to KRW 5.1681 trillion at the end of 2022.

The group that increased its stock collateral loan amount the most was the Samsung family. As of January, Hong Ra-hee, former director of the Leeum Museum and mother of Samsung Electronics Chairman Lee Jae-yong, had stock collateral loans amounting to KRW 1.75 trillion, an increase of KRW 900 billion compared to KRW 850 billion at the end of 2022. Hotel Shilla President Lee Boo-jin and Samsung Welfare Foundation Director Lee Seo-hyun, who increased their loans by KRW 387 billion and KRW 201.7 billion respectively, followed. As of the end of last month, their loan amounts were KRW 1.037 trillion and KRW 572.8 billion, respectively.

The total stock collateral loan amount for the Samsung owner family increased by KRW 1.4887 trillion from KRW 1.8711 trillion at the end of 2022 to KRW 3.3598 trillion at the end of January.

LG Chairman Koo Kwang-mo also ranked fourth in terms of personal loan amount increase among owner families, having borrowed KRW 149 billion in stock collateral loans over the past year. Accordingly, his loan amount increased from KRW 188 billion at the end of 2022 to KRW 337 billion as of last January.

The increase in stock collateral loans among owner families is interpreted as due to inheritance tax burdens. Since the passing of the late Koo Bon-moo, former LG Chairman, in 2018, and the late Lee Kun-hee, former Samsung Chairman, in 2020, installment payments of inheritance taxes have been ongoing.

The Lotte owner family also took out additional loans of KRW 90.5 billion and KRW 9.7 billion, respectively, by Shin Young-ja, former director of the Lotte Welfare Foundation, and Shin Dong-bin, Chairman of Lotte, to pay inheritance taxes following the death of Chairman Shin Kyuk-ho in 2020.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)