Sharp Decline in Operating Profit for Fashion Companies Except Samsung C&T

Market Winter Expected to Prolong... Struggling for Performance Rebound

Strengthening Imported Brands, Expanding into Global Markets

As prolonged high inflation and high interest rates spread recessionary consumption, the fashion industry received a disappointing performance report. The sluggish economy is expected to continue creating a challenging business environment this year as well. Major fashion companies are struggling to devise new strategies such as expanding overseas markets and imported brands to prepare for a rebound.

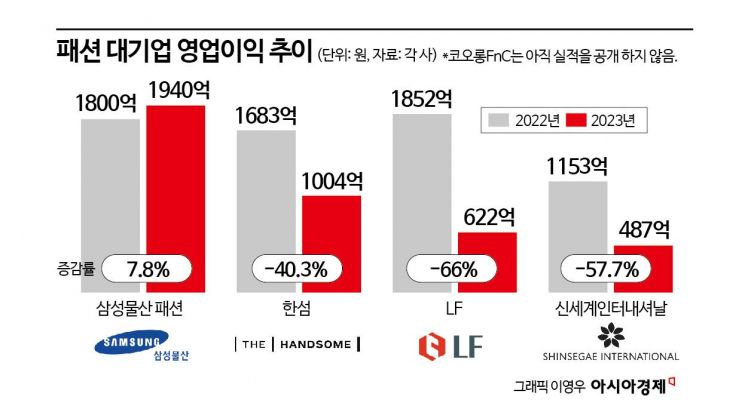

According to the fashion industry on the 7th, Hansome recorded an operating profit of 100.5 billion KRW last year, a sharp decline of 40.3% compared to 168.3 billion KRW the previous year. Sales remained at a similar level to the previous year at 1.5289 trillion KRW. The initial costs for launching new brands were high, and the introduction of global lines such as ‘Moose Knuckles,’ ‘Aspesi,’ and ‘Time’ negatively impacted profits.

Shinsegae International showed a similar trend. Last year, its consolidated operating profit was 48.7 billion KRW, a 58% plunge from the previous year, while sales also decreased by 12.8% to 1.3543 trillion KRW during the same period. This was anticipated as high-margin imported luxury brands exited the portfolio.

LF also recorded 62.2 billion KRW, with operating profit retreating by 66% during the same period. Kolon FnC has yet to announce its performance, but due to continued poor results such as a 9.9 billion KRW loss in the third quarter of last year, its annual performance is expected to decline. The prolonged recession has reduced consumption of fashion items such as clothing and bags, dragging down the performance of fashion companies across the board.

Among major fashion companies, Samsung C&T was the only one to show improved performance. Last year, Samsung C&T recorded an operating profit of 194 billion KRW, growing 7.8% during the same period. The demand for new luxury goods (high-end overseas fashion) centered on imported brands like Jacquemus, Studio Nicholson, and Ganni (collectively known as JASGA), which were discovered early, increased, benefiting existing lineups such as Ami, Maison Kitsun?, and Comme des Gar?ons.

The fashion industry expects harsh headwinds to continue this year following last year. For the weakened consumer sentiment to revive, economic recovery is necessary, but the outlook remains challenging. Therefore, fashion companies are revising survival strategies by expanding imported brands and portfolios and seeking overseas expansion.

Samsung C&T continues to discover and introduce imported brands mainly through select shops like ‘Beaker’ and ‘10 Corso Como (10CC)’ to consumers. In particular, it plans to exclusively bring in new luxury brands popular among women in their 20s and 30s, such as ‘JASGA’ launched last year, to attract consumers through its online channel, SSF Shop. A Samsung C&T official said, “As people in their 20s become the center of consumption, online competitiveness is becoming more important,” adding, “It is a crucial time to enhance brand competitiveness and experiential content.” Currently, the online sales ratio is in the 20% range, with growth stagnating since COVID-19.

Shinsegae International plans to expand its portfolio into the cosmetics (beauty) sector and aggressively grow potential imported brands. Last year, the company filled the gap left by ‘Celine’ with niche perfumes and cosmetics. It launched six cosmetics brands last year: Memo Paris, Kulte, Courr?ges, Suzanne Kauffmann, Dolce & Gabbana, and Hylamide. The luxury cosmetics brand ‘Swiss Perfection,’ acquired earlier, is planned to be promoted more aggressively this year. Swiss Perfection targets the premium skincare market, competing with brands like La Mer and Sisley. The company stated, “We aim to make Swiss Perfection a global brand with 100 billion KRW in retail sales within three years,” adding, “In the fashion sector, we will secure exclusive sales rights with high-margin structures.”

Overseas expansion is a self-help measure to overcome domestic sluggishness. Kolon FnC is the most proactive in this regard. It aims to enter the global market focusing on its outdoor brand ‘Kolon Sport’ and golf wear brand ‘Wak.’ Kolon Sport is preparing to enter the North American market centered on China, while Wak is expanding its footprint starting from Japan to China, the U.S., and Southeast Asia.

To target overseas markets, the company established a ‘China TF’ organization and created a ‘Global Design Center’ to support designs suitable for the global market. Hansome, which recently expanded its portfolio to include overseas fashion cosmetics brands, is also turning its attention to overseas expansion. It plans to target overseas markets through Paris Fashion Week with its two main brands, ‘System’ and ‘Time.’

Unlike other companies, LF focuses on stability. Its strategy is to nurture existing brands. After renewing ‘Daks’ and ‘Hazzys’ last year, LF will undertake detailed work this year to enhance customer brand satisfaction. While it has pursued aggressive marketing since taking over distribution of ‘Reebok’ two years ago, it plans to increase growth this year. Additionally, having secured a portfolio of imported brands such as ‘Patu,’ ‘Barbour,’ and ‘Kin,’ it intends to devise strategies to increase customer inflow.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)