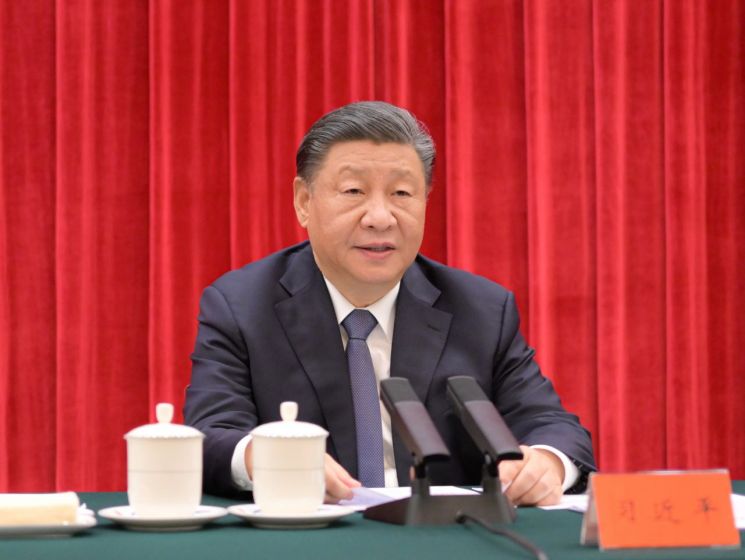

China's stock market stimulus policies are expected to accelerate. Chinese President Xi Jinping is scheduled to receive a report on the stock market, and financial authorities are set to begin discussions on stock market-related policies, according to reports.

On the 5th (local time), Bloomberg News cited sources reporting that President Xi plans to receive a recent report on the stock market from financial authorities. As early as that day, officials from regulatory bodies such as the China Securities Regulatory Commission are expected to explain the recent stock market situation to the top leadership and discuss related policies.

The meeting will be held behind closed doors, and the timing may also change. Bloomberg explained that it remains to be seen whether any new support policies will be introduced. There have been no related reports from within China so far.

Chinese financial authorities have begun preparing policies to prevent a stock market crash. Bloomberg previously reported, citing knowledgeable sources, that Chinese authorities have imposed limits on the total return swap (TRS) transaction amounts for some securities firms starting this week. This is intended to prevent mainland institutional investors from short selling Hong Kong-listed stocks through TRS contracts.

TRS refers to an over-the-counter derivative transaction involving the exchange of total returns generated from underlying asset trades. From the perspective of institutional investors, it effectively allows them to increase their investment capital by borrowing from securities firms, thus enjoying a leverage effect.

According to sources, authorities have also instructed that if offshore subsidiaries or branches of domestic institutional investors purchase mainland Chinese stocks through TRS contracts, they should not reduce those stock positions. Additionally, some quant hedge funds that execute trades algorithmically have been completely banned from placing sell orders since the 5th, and hedge funds employing market-neutral strategies such as long-short funds have faced restrictions on reducing their long positions. These hedge funds' trading methods have been identified as the main cause of the recent sharp decline in small-cap stocks in China. Although there have been reports about establishing a 370 trillion won stock market stabilization fund, no official announcements or implementations have been made to date.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)