Hyundai Motor and Kia with PBR below 1 strengthen shareholder returns

Improved investment sentiment in parts stocks amid surge in automakers

As the government announced the introduction of the 'Corporate Value-Up Program,' foreigners have been actively net buying Hyundai Motor and Kia stocks. The Yeouido securities market expects further gains, citing growing anticipation of a revaluation of the automobile sector.

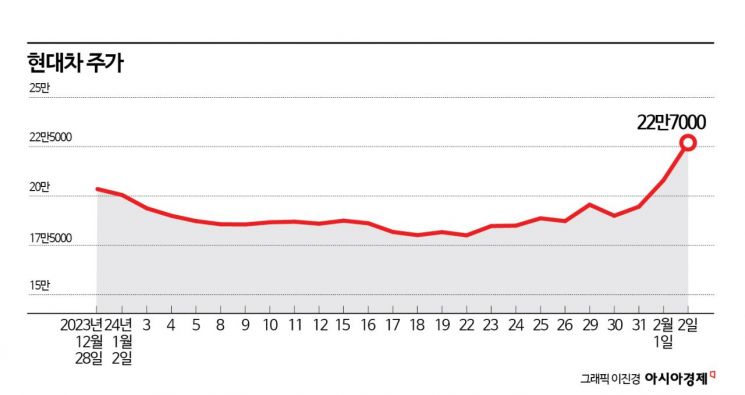

According to the financial investment industry on the 5th, foreigners net purchased Hyundai Motor and Kia stocks worth 707 billion KRW and 491 billion KRW respectively over five trading days from the 29th of last month to the 2nd. Supported by foreign buying, Hyundai Motor and Kia shares rose 21.2% and 26.6% respectively during the same period. Even considering the KOSPI's 5.5% increase over the week, the returns outperformed the market with double-digit gains.

Im Eun-young, a researcher at Samsung Securities, explained, "The recent sharp rise in Hyundai Motor Group's stock price is the result of improved return on equity (ROE) through last year's disposal of loss assets, strengthened shareholder returns, and expectations of undervaluation resolution due to the government's value-up policy."

To improve ROE last year, Hyundai Motor and Kia sold or converted their factories in Russia and China into export bases, reducing loss assets. The increasing sales of hybrid vehicles have also positively influenced the stock price rise. Choi Tae-yong, a researcher at DS Investment & Securities, said, "There were concerns that production capacity limitations would not sufficiently meet hybrid vehicle demand," adding, "However, recent affiliate earnings announcements mentioned expansion possibilities, so faster-than-expected sales growth can be anticipated." Hyundai Motor and Kia's hybrid sales in January increased by 41.8% and 92.2% respectively compared to the same period last year. Sales of major models such as Sorento, Carnival, and Sportage hybrid vehicles surged.

As the performance of major domestic automakers improves, the government's announcement of the value-up program to resolve the so-called 'Korea Discount' (undervaluation of the Korean stock market) has stimulated investment sentiment in the automobile sector. Hyundai Motor and Kia's price-to-book ratios (PBR) stand at only 0.54 and 0.70 respectively. Yoo Joo-woong, a researcher at Daol Investment & Securities, explained, "The automobile sector is generally traded at an average PBR of 0.6. Since the average ROE records profitability exceeding 10%, government guidelines are expected to act as a strong catalyst for stock price increases."

The trend of revaluation of Hyundai Motor and Kia's corporate value is expected to spread to parts suppliers. On the 2nd, Seoyon E-Hwa and Seoyon shares rose 24.7% and 15.9% respectively. Seoyon E-Hwa recorded consolidated sales of 3.581 trillion KRW, operating profit of 192 billion KRW, and net profit of 145 billion KRW last year. With a PBR below 1 and a relatively low price-to-earnings ratio (PER), the stock price surged alongside expectations of revaluation in the automobile sector.

Researcher Yoo analyzed, "SNT Motiv, PHA, and SL suggest that share buybacks and cancellations to improve PBR indicators are ongoing or that the scale of share repurchases may expand."

Jang Moon-soo, a researcher at Hyundai Motor Securities, also assessed, "Liquidity is abundant, and the profit-generating ability is relatively good, leading to increased investment preference for the automobile sector, which has high potential for additional shareholder-friendly policies and improvements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.