Jungjingong, Proactive Response to Export Difficulties of 1,600 Companies Related to CBAM

Promotion Targeting 100 Companies This Year

The small and medium-sized enterprise (SME) sector is accelerating efforts to prepare countermeasures against the EU's Carbon Border Adjustment Mechanism (CBAM). Although CBAM will be fully implemented from January 1, 2026, carbon emission reports must be submitted quarterly even during the ‘transition period’ that began last October. The first carbon emission report was submitted by the 31st of last month, making it impossible to postpone preparations for two years later. Accordingly, SME support organizations have begun establishing measures to proactively address export difficulties faced by related companies. The industry is also exploring support plans to help companies prepare independently.

On the 2nd, the Small and Medium Business Corporation (SBC) announced that it will launch a new ‘CBAM Response Infrastructure Construction Project’ this year. This is to support responses during the transition period until December 2025, before CBAM is fully enforced in 2026. CBAM is a system where the EU imposes a ‘carbon border tax’ on the carbon emissions generated during the production and manufacturing processes of imported products. It serves as a kind of tariff barrier to prevent disadvantages to EU companies subject to strict carbon emission regulations. The carbon border tax will be imposed from 2026 and targets domestic companies exporting six major items: steel, aluminum, cement, fertilizer, electricity, and hydrogen.

The SBC estimates that about 1,600 SMEs involved in these six major items will be affected and plans to support more than 100 companies this year. First, consulting on calculating carbon emissions by product will be provided, and support will be given to ensure emission verification through EU Emissions Trading System (ETS) accredited institutions. The consulting includes everything from emission calculation to data aggregation for verification and submission to verification bodies, along with reduction consulting. Verification certificates meeting the requirements of CBAM-introducing countries will also be issued. Kang Seok-jin, Director of SBC, said, "We aim to proactively address the difficulties of export companies through carbon emission calculation consulting and emission verification using accredited institutions," adding, "We will prioritize export companies to help them prepare for carbon neutrality."

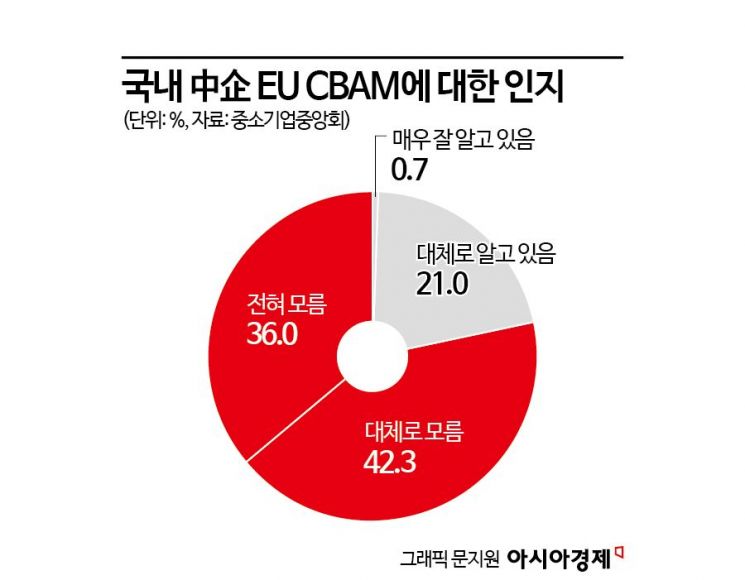

The reason SBC is accelerating related responses is that the implementation is approaching with the transition period already started, but our SMEs are still not properly prepared. Director Kang said, "Our country's SMEs do not have the capacity to focus on carbon neutrality as they lack funds, personnel, and environmental infrastructure," adding, "We must thoroughly prepare as trade tariffs could be imposed later." In fact, a survey conducted last year by the Korea Federation of SMEs targeting 300 SMEs found that 78.3% of respondents were unaware of CBAM. Among companies directly affected by EU exports or planning to enter the EU market, 54.9% said they have ‘no special response plan.’

The industry also views enhancing SMEs' capabilities to manage and report greenhouse gas emissions independently as an urgent task. This is why the Korea Federation of SMEs recently partnered with the Korea Environment Corporation to support SMEs in establishing CBAM emission calculation and reporting management systems. Since the transition period began last October, the Korea Environment Corporation has been operating a ‘CBAM Corporate Support Help Desk’ and provides one-on-one customized consultations to EU-exporting companies. Yang Chan-hoe, Head of the Innovation Growth Division at the Korea Federation of SMEs, said, "We will continuously monitor so that SMEs can prepare independently and support the emission calculation and reporting system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.