Banks to Issue First 'Interest Refund' from 5th to 8th

1.88 Million People to Receive Average of 730,000 Won Each

Guidance Provided from 1st Without Separate Application

Secondary Financial Borrowers to Apply from March

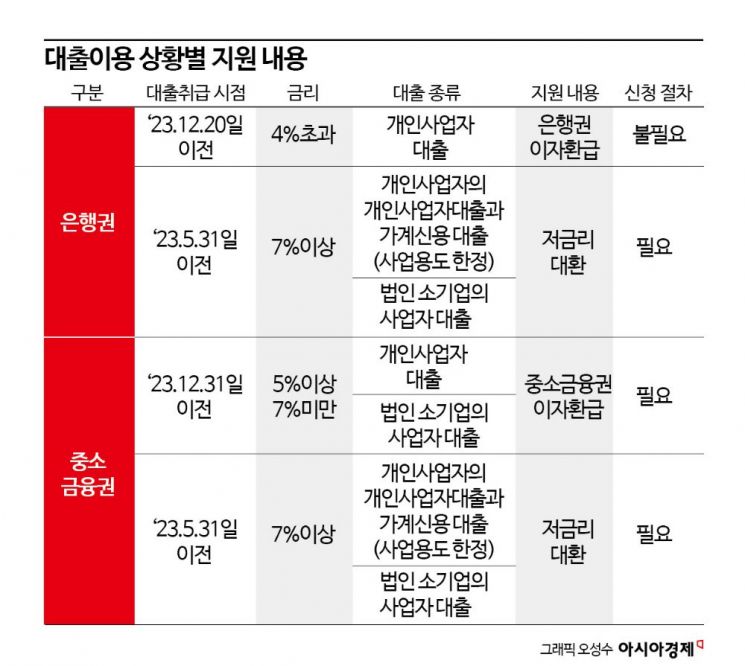

The government and financial sector's win-win financial support plan, aimed at reducing the interest burden on small business owners struggling with high interest rates and reduced consumption, has taken a concrete shape. Small business owners who borrowed money from banks at an interest rate exceeding 4% per annum can receive an average refund of 730,000 KRW for part of the interest paid over the past year as early as before the Lunar New Year holiday. Small business owners who took loans from secondary financial institutions at an annual interest rate between 5% and less than 7% will also receive a refund of up to 1.5 million KRW per person.

According to the 'Small Business Owners Interest Burden Reduction Plan' announced by the Financial Services Commission on the 31st of last month, the banking sector will provide approximately 1.5 trillion KRW to about 1.88 million small business owners starting from the 5th. Scheduled to be implemented in April, when combined with a tentative 600 billion KRW support amount for a voluntary program focusing on electricity bill support, the total is expected to reach around 2.1 trillion KRW. This is 100 billion KRW more than the initially announced 2 trillion KRW by the banking sector. Adding the 300 billion KRW budget for interest refunds in the secondary financial sector (to be implemented in March), the total scale is at least 2.4 trillion KRW.

First 'Interest Refund' for 1.87 Million Small Business Owners in Banking Sector Before Lunar New Year... Average 730,000 KRW Per Person

The first interest refund through the banking sector will take place from the 5th to the 8th. Banks will notify borrowers of the refund amount and schedule via text messages (SMS), app push notifications, etc., starting from the 1st, without requiring a separate application process, and plan to refund an average of 730,000 KRW per person. The refund standard is 90% of the portion exceeding a 4% interest rate, with a maximum loan balance of 200 million KRW and a maximum refund of 3 million KRW per borrower.

Small business owners eligible to receive the full refund through the initial refund process are those who have paid interest for more than one year as of the end of last year. Borrowers with less than one year of payment will receive a refund only for the interest paid last year through the initial refund process, and can receive refunds quarterly for up to one year for interest paid this year.

Lee Tae-hoon, Executive Director of the Korea Federation of Banks, stated, "Cashback will be made to deposit and withdrawal accounts without a separate application," and warned, "If anyone asks for personal information or recommends additional loans in exchange for applying for or receiving cashback, it is a voice phishing scam, so special caution is required."

Following the interest refund, the banking sector will implement a 'voluntary program' from April, investing 600 billion KRW to support electricity bills, rent, and other expenses. Banks plan to design the program in various ways, including contributions from guarantee institutions or community finance institutions, and announce the execution plan by the end of March.

Interest Support Benefits Also for Small Business Borrowers in Secondary Financial Sector Including Savings Banks... 300 Billion KRW Budget Allocated

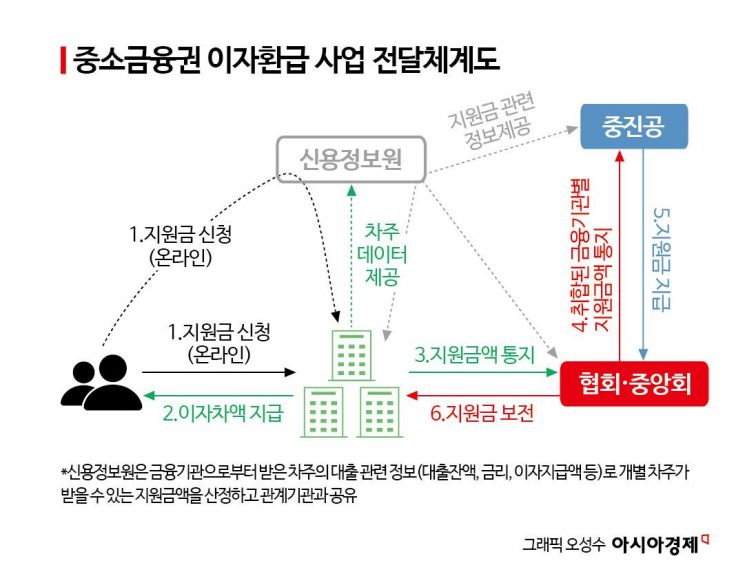

The Financial Services Commission has also detailed support measures for small business owners who borrowed money from the secondary financial sector, paying higher interest rates compared to bank loans, by allocating a budget of 300 billion KRW. The target includes small business owners who borrowed from small financial institutions such as savings banks, mutual finance (agricultural, fisheries, credit unions, forestry cooperatives, Saemaeul Geumgo), and specialized credit finance companies (card companies, capital companies). The support targets are individual business owners and small corporations with business loans at interest rates between 5% and less than 7% as of the end of last year. The target scale is about 400,000 people, with a maximum loan amount of 100 million KRW per person and a maximum refund amount of 1.5 million KRW.

The deduction amount varies by interest rate bracket to adjust the interest burden to 5%. Borrowers in the '5.0~5.5%' bracket receive a uniform deduction of 0.5 percentage points and interest support. Borrowers in the '5.5~6.5%' bracket receive support equal to the difference from 5%, and those in the '6.5~7%' bracket receive a uniform deduction of 1.5 percentage points, with interest refunded based on the result. For example, if the loan balance is 80 million KRW and the interest rate is 6%, the one-year interest difference is '80 million KRW x 1 percentage point (6% - 5%) = 800,000 KRW.'

Since public funds are involved, unlike the bank interest refund, a separate application process has been established. The Financial Services Commission plans to announce detailed procedures in early March, accept applications around mid-March, and start the first interest refund on March 29. Refunds will be paid at the end of each quarter (March 29, June 28, September 30, December 31), and borrowers who have paid interest for more than one year as of the quarter-end will receive one year's worth of refund at once.

Shin Jin-chang, Director of the Financial Industry Bureau at the Financial Services Commission, said, "If all eligible recipients apply, about 240,000 people are expected to receive an average of 750,000 KRW per person, totaling approximately 180 billion KRW in support during the first quarter of this year," adding, "We will continuously check preparation status to minimize inconvenience to borrowers and ensure smooth implementation in cooperation with the Ministry of SMEs and Startups."

High-Interest Loans Over 7% Reduced to 5.5% or Less... Low-Interest Refinancing Program Expanded

The Financial Services Commission plans to expand the target of the 'Low-Interest Refinancing Program,' operated jointly with the Korea Credit Guarantee Fund since September 2022. This is the third revision following March and August of last year. Since the program's implementation, about 23,000 small business loans with interest rates over 7% have been converted to low-interest loans at 5.5% or less. The average interest rate for beneficiaries dropped from 10.06% to 5.48%, a reduction of 4.58 percentage points.

With this third revision, small business owners who took loans by May 31 of last year, when the COVID-19 crisis level was still 'serious,' can also use the program. Additionally, after refinancing for one year, the loan interest rate will be capped at 5.0%, and the guarantee fee of 0.7% will be waived, further reducing the cost burden by up to 1.2%.

Director Shin said, "We plan to reflect the program target loans in the refinancing program's dedicated database and implement it within the first quarter of this year after the banking sector's contribution to the Korea Credit Guarantee Fund for guarantee fee reduction."

The 'Mortgage Refinancing' service through an online, one-stop refinancing infrastructure surpassed 10,000 applicants and nearly reached 1.8 trillion KRW in application amounts within 15 days of its launch. The photo shows an ATM of a commercial bank installed in Yongsan-gu, Seoul, on the 25th. Photo by Kang Jin-hyung aymsdream@

The 'Mortgage Refinancing' service through an online, one-stop refinancing infrastructure surpassed 10,000 applicants and nearly reached 1.8 trillion KRW in application amounts within 15 days of its launch. The photo shows an ATM of a commercial bank installed in Yongsan-gu, Seoul, on the 25th. Photo by Kang Jin-hyung aymsdream@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)