Successful Turn to DRAM Profit in Q4 Last Year

High Bandwidth Memory (HBM) Sales Increased 3.5 Times Year-on-Year

DRAM Bit Growth in Mid-30% Range

Memory Profit Turnaround Expected in Q1 This Year

NAND Flash Inventory Expected to Normalize in First Half

Foundry Anticipates On-Device AI Demand

Samsung Electronics will respond to demand in the first half of the year by selectively adjusting production, focusing on high value-added products such as High Bandwidth Memory (HBM). HBM sales in the fourth quarter of last year increased 3.5 times compared to the same period the previous year, and by the second half of this year, advanced products including HBM3 are expected to account for 90% of total HBM sales.

On the 31st, Samsung Electronics shared these plans and forecasts during a conference call following the announcement of its fourth-quarter results. The explanation came in response to numerous questions about the semiconductor business (DS Division), which is showing signs of recovery in performance alongside the memory-centric semiconductor market recovery.

During the call, Samsung Electronics announced plans to improve memory profitability through a selective production cut strategy. Kim Jae-jun, Vice President of Samsung Electronics Memory Business Division, said that while DRAM inventory is rapidly decreasing, inventory levels vary by product, adding, "Considering future demand and inventory levels comprehensively, we plan to continue selective production adjustments within the first half of the year."

He also explained, "DRAM inventory will reach a normal range after the first quarter, and NAND normalization may vary depending on demand and market conditions, but it is expected to normalize by the first half at the latest. We will continuously monitor market demand and inventory levels to maintain flexible business strategies."

In the fourth quarter of last year, Samsung Electronics recorded bit growth rates for DRAM and NAND in the mid-30% range compared to the previous quarter, surpassing the market average. Additionally, the average selling price (ASP) during this period rose by low double digits for DRAM and high single digits for NAND. Furthermore, sales of advanced process products such as HBM, Double Data Rate (DDR)5, Low Power Double Data Rate (LPDDR)5X, and Universal Flash Storage (UFS) 4.0 increased, boosting performance.

As a result, Samsung Electronics succeeded in returning DRAM to profitability in the fourth quarter of last year after one year. It is expected that memory, including DRAM and NAND, will turn profitable in the first quarter of this year. Vice President Kim said, "We plan to actively respond to demand for HBM related to generative artificial intelligence (AI) and server solid-state drives (SSD), focusing on improving profitability. The memory business is expected to return to profitability in the first quarter."

Regarding HBM sales, which have recently increased due to AI memory demand, Samsung Electronics explained that "records are being broken every quarter." HBM sales in the fourth quarter of last year increased by more than 40% compared to the previous quarter and 3.5 times compared to the same period the previous year. Vice President Kim said, "The proportion of advanced products such as HBM3 is increasing, reaching half of total HBM sales in the first half of this year and 90% in the second half. We are also progressing with the commercialization of the latest product, HBM3E, and will complete mass production preparations in the first half."

The next product, HBM4, is scheduled for sampling in 2025 and mass production in 2026. Regarding the trend of increasing customized HBM demand by customers alongside generative AI, Vice President Kim said, "We are developing custom HBM that includes logic chips as well as standard products, and are discussing detailed specifications with major customers. We will lead the industry in the custom HBM market by leveraging synergies with foundry, system LSI, and advanced packaging."

This year, as the memory industry including Samsung Electronics increases production centered on HBM, supply of other products is expected to be limited. There is also a forecast that supply of advanced process products will fall short of demand. Vice President Kim predicted, "The industry's bit growth will be limited this year." He added, "Capital expenditures (CAPEX) within the industry are expected to partially recover this year but will be largely focused on HBM. Bit growth for products other than HBM may be limited."

Although the foundry division, which set a record for maximum orders last year, showed relatively weak performance, it is focusing on on-device AI opportunities this year. On-device AI refers to AI implemented on devices without network connection. Jung Ki-bong, Vice President of Samsung Electronics Foundry Division, said, "Many on-device AI products will be released. As AI performance improves, the neural processing unit (NPU) block size increases and SRAM capacity grows, which will significantly contribute to foundry demand in the future."

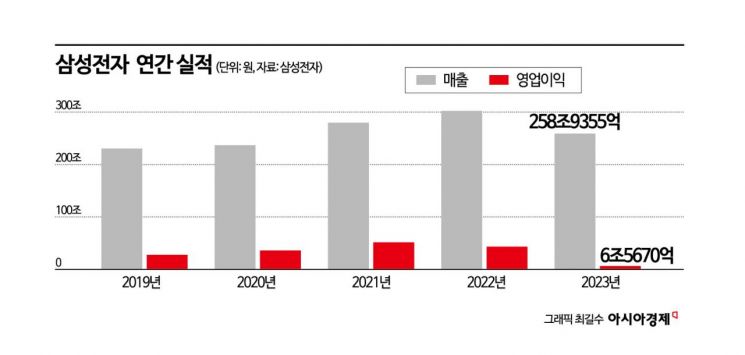

Samsung Electronics recorded sales of KRW 67.7799 trillion and operating profit of KRW 2.8247 trillion in the fourth quarter of last year. Sales decreased by 3.81% and operating profit by 34.4% compared to the same period the previous year. Annual sales last year were KRW 258.9355 trillion, down 14.33% year-on-year, and operating profit was KRW 6.567 trillion, down 84.86%. This is the first time in 15 years since the global financial crisis in 2008 (KRW 631.9 billion) that Samsung Electronics' annual operating profit fell below KRW 10 trillion.

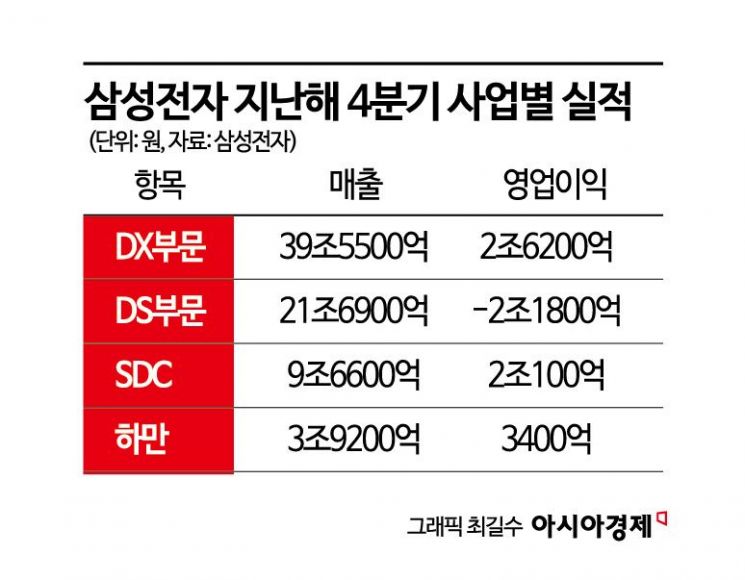

By business division, the DS Division recorded sales of KRW 21.69 trillion and an operating loss of KRW 2.18 trillion in the fourth quarter of last year. The cumulative annual deficit was KRW 14.87 trillion. The DX Division, which handles home appliances and mobile businesses, recorded sales of KRW 39.55 trillion and operating profit of KRW 2.62 trillion in the fourth quarter. The Display (SDC) Division posted an operating profit of KRW 2.01 trillion during the same period. Harman, an automotive electronics affiliate, recorded an operating profit of KRW 340 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.