2024 Joint Conference on Economics

Dr. Jeong Minhyun of KIEP Presents Paper at Korean Economic Association

There are concerns that the fiscal rules proposed in the National Finance Act amendment submitted by the current government and ruling party are insufficient to reduce South Korea's national debt. It has been suggested that alongside a prompt reform of fiscal management policies, an efficient debt management system must be established. Without proper management, the increasing debt could undermine capital formation and negatively impact the Gross Domestic Product (GDP).

According to the Korean Economic Association on the 31st, Dr. Jeong Min-hyun from the Korea Institute for International Economic Policy will present a paper titled "Fiscal Diagnosis of Korea through an Overlapping Generations Model" at the academic conference themed "Crisis Factors and Policy Directions of the Korean Economy," jointly hosted by the Korean Economic Association and the Korean Association of Public Finance as part of the "2024 Joint Economics Academic Conference" on the 1st.

Dr. Jeong conducted theoretical and empirical analyses using the overlapping generations model to examine the sustainability of South Korea's rapidly increasing national debt since 2019 and its impact on the economy.

According to Dr. Jeong, since 2019, South Korea's national debt relative to GDP has been steadily increasing. Forecasting over the next decade from 2023 to 2032, the national debt-to-GDP ratio is expected to rise rapidly from 51.1% to 59.4%. Even if fiscal measures are rigid and the national debt is passed on to future generations, the rapidly increasing debt is unsustainable.

The rapidly growing national debt hampers the accumulation of capital essential for productive activities, adversely affecting GDP. This holds true even if the national debt is maintained at a sustainable level. In particular, the increase in debt leads to higher interest rates and lower wage rates, resulting in a decline in the welfare of the working generation.

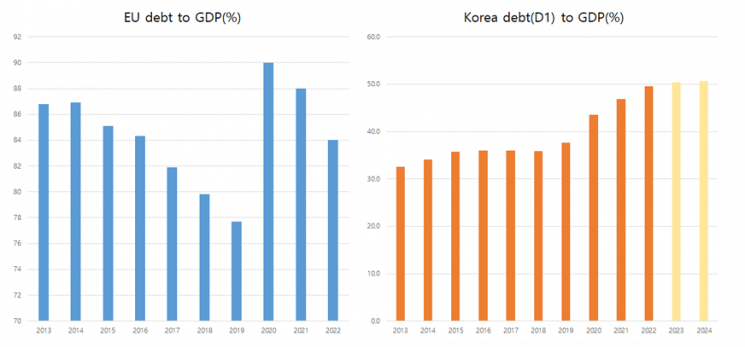

Compared to the European Union (EU), where the national debt-to-GDP ratio exceeds 80%, South Korea's ratio (49.4% as of 2022) remains relatively low. The problem is that while the EU's national debt ratio is rapidly declining, South Korea's debt ratio exhibits strong downward rigidity. The EU's national debt ratio, which hovered around 90% in 2020, dropped to about 84% in 2022. In contrast, South Korea's ratio has been increasing annually. Dr. Jeong pointed out, "Considering South Korea's low fiscal flexibility and low-growth trend, efforts to avoid chronic fiscal deficits are urgently needed."

From the perspective of public perception, the expansion of national debt is also undesirable. Dr. Jeong explained, "The recent rapid increase in South Korea's national debt may foster a misconception among the public that the surge in debt is not a serious problem or that future debt increases are inevitable." He added, "Such irrational beliefs could lead to a kind of 'fiscal illusion' or 'fiscal omnipotence,' making it difficult to reach social consensus on resolving debt issues. Therefore, it is necessary to raise awareness about the national debt problem."

Dr. Jeong also analyzed that the fiscal rules currently being discussed by the government and ruling party are unlikely to be of great help in this situation. While they may assist in adjusting the current deficit level, they cannot serve as binding constraints to reduce debt. He warned, "When negative shocks occur requiring significant fiscal spending, these constraints might act as barriers, potentially hindering the stimulative effects of fiscal policy."

He recommended, "Along with reforming fiscal management policies and establishing an efficient debt management system, flexible use of fiscal tools such as tax rates, pensions, public expenditures, and transfer payments is necessary to enhance debt sustainability and prevent rigidity in fiscal measures."

Comparison of National Debt-to-GDP Ratios between the European Union (left) and South Korea (based on D1). Figures for 2023 and 2024 are projections. / Source: Korean Economic Association

Comparison of National Debt-to-GDP Ratios between the European Union (left) and South Korea (based on D1). Figures for 2023 and 2024 are projections. / Source: Korean Economic Association

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.