US Economy Surpasses Expectations with Strong Consumer Spending

South Korea Faces Concerns of Weak Consumption Amid High Interest Rates and Inflation

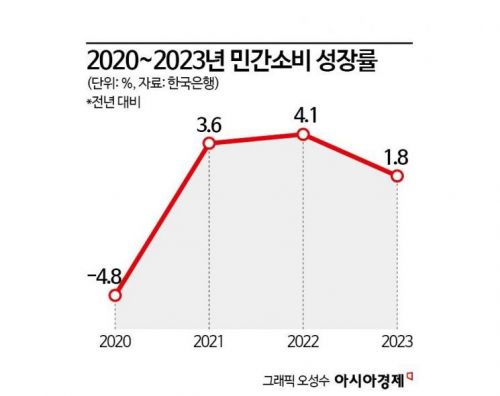

The U.S. economic growth rate has exceeded expectations, significantly reducing concerns about a recession. Despite high interest rates, consumer spending in the U.S. remains strong, and recently, with inflation stabilizing, there are even forecasts of a 'Goldilocks' economy (a growth rate that is neither too hot nor too cold). In contrast, South Korea is experiencing sluggish consumption, with economic growth rates declining for three consecutive years, fueling widespread concerns about low growth.

According to the U.S. Department of Commerce on the 29th, the U.S. GDP growth rate for the fourth quarter of last year was 3.3% annualized, far surpassing the market expectation of 2.0%. This figure also significantly exceeds the estimated potential growth rate of the high 1% range. Despite pressure from high interest rates, personal consumption increased by 2.8%, driving growth. The contribution of personal consumption to the fourth quarter GDP growth rate was as high as 1.91 percentage points.

The robustness of U.S. personal consumption is due to a strong labor market and continued favorable household financial conditions. Last month, the number of nonfarm payroll jobs in the U.S. increased by 216,000 compared to the previous month, greatly exceeding the expert forecast of 170,000. The unemployment rate was also 3.7%, below the expert estimate of 3.8%.

With a stable labor market, household financial conditions have improved. As of the third quarter of last year, the U.S. household debt delinquency rate was around 3%, significantly lower than the 5% recorded before the pandemic in 2020. Recently, with inflation stabilizing, there are evaluations locally that the U.S. economy has entered a 'Goldilocks' phase.

Jeong Yeji, a researcher at the International Finance Center, stated, "The favorable financial conditions of U.S. households drove the strong consumption trend last year," adding, "Although delinquency rates have recently risen, household debt remains at a healthy level, and financial conditions are good, limiting the potential for financial instability."

Unlike the favorable economic situation in the U.S., South Korea is facing difficulties. According to the Bank of Korea, South Korea's real GDP growth rate for the fourth quarter of last year was only 0.6%. For the entire year, it was 1.4%, continuously declining from 4.1% in 2021 to 2.6% in 2022.

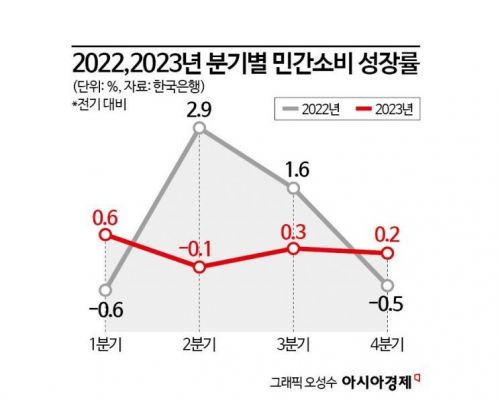

The sluggish consumption caused by high interest rates and high inflation had a significant impact. The private consumption growth rate in the fourth quarter of last year was 0.2%, continuing a low trend following 0.3% in the previous quarter. The contribution of private consumption to the fourth quarter GDP was also 0.2 percentage points, down from 0.4 percentage points in the previous quarter. The annual private consumption growth rate last year was 1.8%, the lowest since 2020.

Shin Seungcheol, Director of the Economic Statistics Bureau at the Bank of Korea, explained, "Looking at recent trends, the growth rate itself has declined, showing continued low growth, and private consumption is also growing below the growth rate," describing the situation as entering a low-growth phase.

The problem is that consumption trends are unlikely to improve significantly this year as well. Concerns are emerging that household income will decrease and consumption slowdown will continue due to the ongoing high interest rate and high inflation environment.

High interest rates and inflation particularly delay income improvement for low-income households, which have a high propensity to consume, thereby causing consumption slowdown. Due to last year's weak consumption, income for small business owners and temporary daily workers has continued to decline more than that of regular employees.

Baek Inseok, Head of the Macro-Finance Division at the Korea Capital Market Institute, explained, "We need to be cautious about the possibility of prolonged consumption weakness as income improvement for low-income households is delayed due to high inflation and high interest rates," adding, "If the consumption recovery weakens, the recovery of the perceived economy considering employment may be delayed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.