Rising WTI Prices Amid Middle East Instability and US Inventory Decline

International oil prices have reached their highest level in two months, raising concerns that they could stimulate domestic consumer prices. The rise in oil prices is seen as leading to increased inflationary pressure and potentially influencing the Bank of Korea's monetary policy.

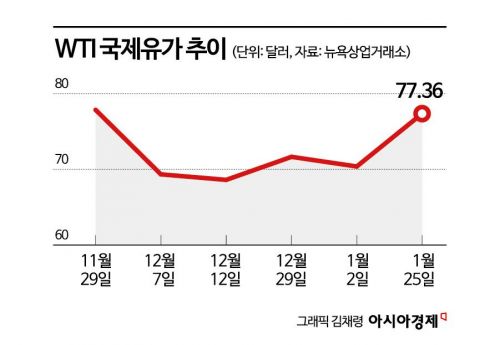

On the 25th (local time), the March delivery price of West Texas Intermediate (WTI) crude oil closed at $77.36 per barrel on the New York Mercantile Exchange, up $2.27 from the previous trading day. WTI had stabilized after reaching $77.86 on November 29 last year but has now hit its highest point in about two months.

International oil prices rose to the $90 range in October last year due to production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and Middle East tensions, but then retreated to the $60 range in December amid concerns of oversupply.

Geopolitical Concerns in the Middle East Heighten, Driving Oil Prices

The recent upward trend in oil prices is driven by ongoing geopolitical concerns in the Middle East and a complex mix of factors including a cold snap that has reduced U.S. crude oil inventories.

In the Red Sea, Yemen's Houthi rebels have been attacking civilian vessels under the pretext of supporting Hamas, the Palestinian armed faction currently at war with Israel. In response, the U.S. and the U.K. have been conducting airstrikes on Houthi bases.

The world's second-largest shipping company, Maersk, announced that one of its commercial vessels was struck by a missile attack from the Houthi rebels while passing through the Bab el-Mandeb Strait, the gateway connecting the Red Sea to the Gulf of Aden. The spread of instability in the Middle East is thus impacting international oil prices.

Hwang Yuseon, a senior researcher at the International Finance Center, stated, "The recent large-scale airstrikes by the U.S. and the U.K. in response to Houthi attacks on civilian vessels in the Red Sea have further escalated tensions in the Middle East," adding, "The uncertainty surrounding the Middle East situation could cause the risk premium on international oil prices to rise again." However, Hwang noted, "If the conflict is contained and no actual supply disruptions occur, the rise in oil prices will be limited."

The cold wave in the U.S. has also contributed to a decrease in oil production and inventories. According to the U.S. Energy Information Administration (EIA), U.S. crude oil production dropped by 1 million barrels per day last week due to temporary shutdowns of some oil facilities caused by the Arctic cold snap. U.S. crude oil inventories fell by 9.23 million barrels compared to the previous week.

Expectations of global economic improvement have also influenced the rise in oil prices. The U.S. real GDP growth rate for the fourth quarter of last year, announced on the 25th, was 3.3% annualized, significantly exceeding the market forecast of 2%. The stronger-than-expected U.S. economy and growing hopes for a soft landing without recession have pushed international oil prices higher. Additionally, expectations for China's government stimulus policies are also playing a role.

Rising Oil Prices Forecast to Push Domestic Inflation Up

The rise in oil prices has sparked concerns about increasing domestic consumer prices. International oil prices are considered the most significant factor affecting domestic consumer inflation. If consumer prices exceed expectations, market expectations for the Bank of Korea's interest rate cuts could weaken. Recently, the rise in the won-dollar exchange rate has further heightened inflationary pressures.

A Bank of Korea official said, "Both rising oil prices and a stronger dollar increase the cost of imported raw materials, which stimulates our domestic inflation," adding, "So far, the impact of rising oil prices on inflation is not significant, but if prices continue to rise, inflation could be affected."

There are also views that continued oil price increases could be a persistent inflationary burden throughout the year. Lee Buhyung, head of the Trend Analysis Team at Hyundai Research Institute's Economic Research Office, said, "International oil prices are expected to maintain upward pressure on supply-side prices due to intensified geopolitical risks in the Middle East, including strengthened OPEC production cuts and ongoing conflicts in the Red Sea," forecasting, "Oil prices will remain at a high level around $80 per barrel this year." Lee added, "With oil prices trending upward, inflation levels this year could be higher than expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.