Aggressive M&A Increases Debt but Cash Flow Worsens

Ssg.com and Shinsegae Construction Issues Burden Financing

Credit Rating Downgrade Possible in First Half of This Year

As tens of trillions of won in liquidity flood the corporate bond market this year, Emart, the largest distribution company in South Korea, has announced plans to issue corporate bonds. The project financing (PF) troubles of its subsidiary Shinsegae Construction and Emart's deteriorating performance are expected to act as negative factors in attracting investors.

According to the investment banking (IB) industry on the 25th, Emart will issue corporate bonds worth up to 400 billion won, with KB Securities, NH Investment & Securities, Korea Investment & Securities, and Shinhan Investment Corp. as lead managers. The bonds will be divided into 150 billion won of 3-year maturity bonds and 50 billion won of 5-year maturity bonds, with a demand forecast for institutional investors scheduled around the 31st. If sufficient investment funds are gathered, the issuance will be increased up to the maximum limit.

Recently, most large corporations have succeeded in issuing corporate bonds larger than the planned amount under relatively low interest rate conditions. The perception that interest rates have peaked and expectations of rate cuts in the second half of the year have simultaneously led institutional investment funds to flock to high-quality corporate bonds. However, concerns have arisen that Emart may differ somewhat from other large corporations. This is because the capital market's view of Emart and the Shinsegae Group is negative.

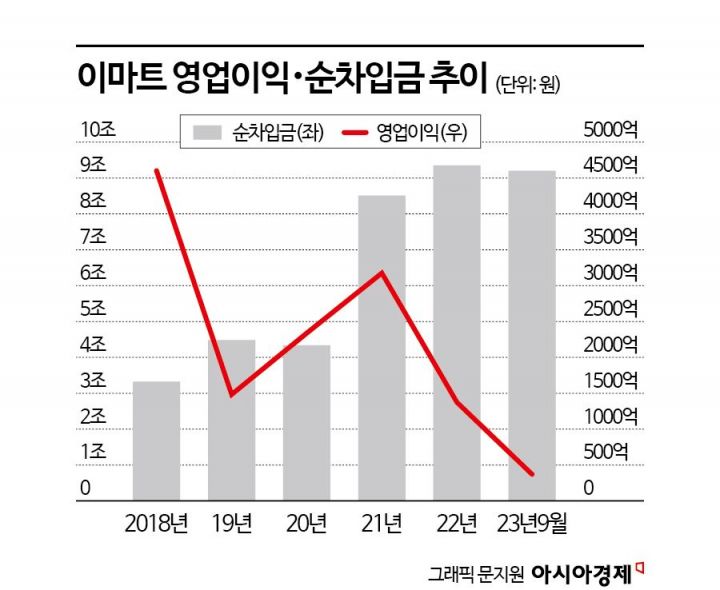

Emart's financial stability is increasingly deteriorating. Since 2021, it has aggressively pursued mergers and acquisitions (M&A), significantly increasing its borrowings. It has invested over 4 trillion won in acquiring or investing in SK baseball team, Gmarket, W Concept Korea, SKC Company (Starbucks Korea), and the U.S. winery Shafer Vineyard. In this process, borrowings increased from 6.18 trillion won at the end of 2020 to 11.64 trillion won at the end of the third quarter last year. Although it secured cash liquidity by selling subsidiaries such as Shinsegae Live Shopping and Emart's Gayang and Seongsu stores, it failed to control the pace of borrowing increase.

The burden of borrowings has grown while profitability and cash flow have worsened. Until 2022, Emart maintained an average annual operating profit of 200 to 300 billion won, but the deteriorating performance of affiliated companies in online distribution (SSG.com) and construction (Shinsegae Construction) has made it uncertain to guarantee profits. IBK Investment & Securities analyzed, "It is highly likely that Emart turned to an operating loss in the fourth quarter of last year," adding, "As long as the deficits of SSG.com and Shinsegae Construction continue, the consolidated operating profit of Emart is unlikely to improve quickly."

The possibility of financial support for the construction company is also a burden. Recently, the Shinsegae Group provided funds to resolve liquidity issues in Shinsegae Construction's PF. Shinsegae Construction issued 200 billion won in private bonds, which were purchased jointly by financial companies and Shinsegae I&C. Previously, to stabilize Shinsegae Construction's finances, it was decided to merge Shinsegae Yeongrangho Resort. An IB industry official said, "Shinsegae Construction's apartment projects are mainly concentrated in Daegu and Gyeongbuk, areas with many unsold units, and actual sales performance is poor, making the risk of insolvency high," adding, "Concerns about the construction sector will negatively affect the financing of group affiliates, including Emart."

Its credit rating (AA) is also at risk of downgrade. Credit rating agencies revised Emart's credit rating outlook from 'stable' to 'negative' last year. Excessive borrowing burden and deteriorating performance in e-commerce and construction sectors were cited as factors worsening creditworthiness. If financial improvements are not made, there is a possibility that the credit rating could fall to AA- in the first half of the year. However, the government's abolition of mandatory holiday closures for large marts could somewhat improve the distribution sector's performance, which is a positive factor.

A corporate bond market insider said, "Emart has signed a total underwriting agreement with lead managers and underwriters, so if there is no investment demand, securities firms will purchase all the bonds, meaning there is no possibility of failing to raise funds," but expressed concern, "If the demand forecast does not gather investment funds equal to the planned bond issuance amount, resulting in unallocated or unsold bonds, it will reflect a negative view of Emart, which could cause significant difficulties in future fund management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)