Impact of Offline Movement Post-Endemic

Failure to Provide Customized Content

Initial Market Settlement Failure as Reason

Queenit and Posty Continue Steady Growth

Musinsa and Brandy Face Bitter Taste

Recently, the fortunes of fashion platforms that have expanded their categories targeting women in their 40s and 50s have sharply diverged. While some platforms recorded triple-digit growth annually, others have either shut down their businesses or effectively ceased operations. Although the shift of middle-aged women to offline shopping after the COVID-19 endemic transition played a role, the main reason cited is the failure to provide customized content for the 4050 customer segment, which prevented them from establishing a foothold in the early market.

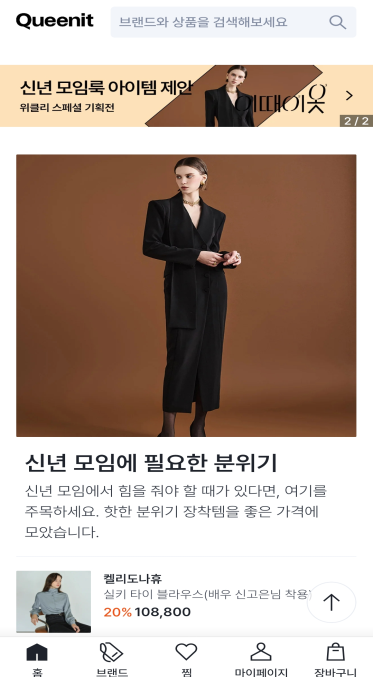

According to the fashion platform 'Queenit' on the 25th, the company’s sales last year reached around 40 billion KRW, more than doubling compared to the previous year. Transaction volume also nearly doubled. Although the company did not achieve an annual operating profit turnaround due to large-scale TV advertising at the end of last year, it has maintained steady growth since launching its application (app) in 2020. ‘Posty,’ operated by KakaoStyle (Zigzag), also saw a 150% increase in transaction volume last year, marking two consecutive years of triple-digit growth following a 120% increase in 2022.

Queenit and Posty are fashion platforms targeting middle-aged women in their 40s and 50s. They have firmly maintained their positions among the many fashion platforms that emerged rapidly targeting middle-aged women who found offline shopping difficult due to COVID-19. Queenit’s app has accumulated 6.4 million downloads, while Posty has 5.7 million downloads. The number of partner stores is over 1,600 and 2,000 respectively, with major brands including Mozo Espin, She’s Miss, Olivia Lauren, Esquire, Nepa, and K2. According to app and retail analysis service WiseApp, Queenit ranked first among specialty mall apps most used by women in their 50s.

However, 'Musinsa' and 'Brandy,' which experienced explosive growth based on the 10s and 30s age groups, faced setbacks. Musinsa launched ‘Lazynight’ targeting women in their 40s, and Brandy introduced ‘Flare.’ At the time these platforms debuted, there were many fashion platforms targeting teenagers to those in their 30s, but few targeted Generation X (born 1970?1980), women aged 40 and above.

Middle-aged women had previous online shopping experience but tended to prioritize quality and fit over low prices when purchasing products, resulting in a higher proportion of offline consumption. However, during the COVID-19 period, as face-to-face shopping became difficult, the number of middle-aged women purchasing clothing online increased exponentially.

Since their economic power was higher than that of teenagers and those in their 20s, their purchase amounts and quantities were also larger.

However, Musinsa did not attract as many customers as expected and ultimately ceased Lazynight operations at the end of last year. Instead, it plans to focus on 29CM, a women’s fashion platform targeting the 20s and 30s age group. Brandy also ended Flare operations in June last year and rebranded its app as ‘Selfy.’ Selfy has transformed into an app used by wholesale traders between Korea and China. 'W Concept,' which two years ago recorded double-digit growth in 4050 middle-aged female membership, now reports that middle-aged female membership growth is not as high as before, with more women in their 20s and 30s increasing.

An industry insider said, "Platforms that adopted a strategy of segmenting fashion platforms specialized by age group have started to wind down businesses that were judged unsuccessful over time," adding, "Along with the consumption characteristics of middle-aged women who shop based on experience, many consumers have returned to offline shopping as COVID-19 ended."

The industry analyzes that the success or failure of these fashion platforms was determined by how quickly they provided customized services that attracted consumers. Queenit reduced the number of products displayed on one mobile screen from about eight to three or four, eliminating inconvenience in app usage. It also used machine learning (ML) techniques to offer personalized recommendations for each buyer, with the conversion rate from this service reaching nearly 30?40% of monthly active users.

Posty followed a similar approach. Focusing on the tendency of middle-aged women to purchase fashion brands from home shopping, Posty actively developed a 'live broadcast' service. It also introduced a high-quality private brand (PB) called 'Itfine,' which increased purchase satisfaction. A Posty representative said, "Middle-aged women rarely have a clearly defined style but tend to shop mainly from brands they have purchased before," adding, "Providing personalized services to accurately understand their needs and naturally guide them to new brands is important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)